Daily Review of Urea: The fundamentals are relatively loose as industry supply continues to pick up (June 13)

China Urea Price Index:

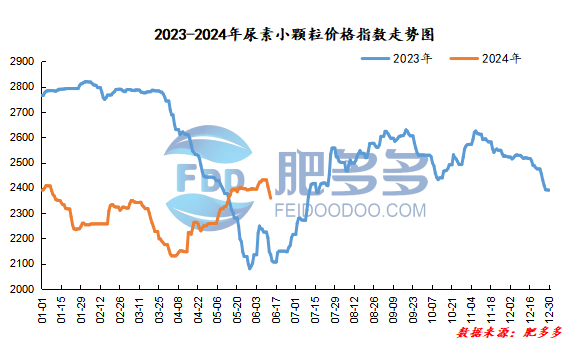

According to Feiduo data, the urea small pellet price index on June 13 was 2,358.77, a decrease of 24.23 from yesterday, a month-on-month decrease of 1.02% and a year-on-year increase of 10.42%.

Urea futures market:

Today, the opening price of the urea UR409 contract is 2048, the highest price is 2059, the lowest price is 2035, the settlement price is 2048, and the closing price is 2044. The closing price is 24 lower than the settlement price of the previous trading day, down 1.16% month-on-month. The fluctuation range of the whole day is 2035-2059; the basis of the 09 contract in Shandong is 196; the 09 contract has reduced its position by 2683 lots today, and so far, the position is 232327 lots.

Today, the urea futures market continued to gap short and open low. The main reason was still due to the negative impact of night market macro sentiment on the commodity market. Recently, the fundamentals of urea have shown a weakening trend. The resonance between the recovery of the supply side and the weakening of the demand side has affected the cooling of urea market sentiment. In the short term, urea itself lacks new drivers or remains mainly weak, but it is necessary to guard against the digestion of macro emotions. Compensation.

Spot market analysis:

Today, the price of urea in China continues to decline, and manufacturers are in a poor position in acquiring new orders. They reduce prices and collect orders, and the actual follow-up is limited.

Specifically, prices in Northeast China fell to 2,430 - 2,460 yuan/ton. Prices in East China fell to 2,230 - 2,290 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,240 - 2,460 yuan/ton, and the price of large particles fell to 2,230 - 2,330 yuan/ton. Prices in North China fell to 2,200 - 2,450 yuan/ton. Prices in South China fell to 2,370 - 2,460 yuan/ton. Prices in Northwest China fell to 2,380 - 2,400 yuan/ton. Prices in Southwest China fell to 2,270 - 2,650 yuan/ton.

Market outlook forecast:

In terms of factories, manufacturers have a poor acceptance of new orders. Under the pressure of shipments, quotations have continued to be lowered and consolidated, but the actual situation of manufacturers is still average. In terms of the market, the market has weakened and declined, and there has been no sign of improvement. Trading continues to be weak. Trading sentiment has dropped, sentiment has turned short, and most of the market transactions have been sold at low prices. In terms of supply, the current industry supply continues to improve, with daily production exceeding 180,000 tons. Enterprise inventories have also begun to increase, and the supply side is relatively loose. On the demand side, due to the current impact of climate drought, the time for agricultural replenishment has been delayed, and agricultural demand has entered a gap period, which has weakened; industrial compound fertilizers are in the final stage, and the demand has just dropped, and a small amount of replenishment is mainly needed. The overall follow-up efforts are poor., industrial support is relatively limited.

On the whole, the fundamentals of the urea market are currently in a loose trend. There is no positive support for the upward trend of prices. Many weaknesses are being consolidated downward. It is expected that the urea market price will continue to stabilize and consolidate downward in a short period of time.