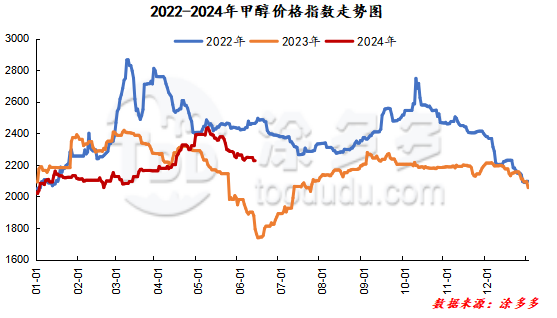

Methanol: Futures market fluctuates and the spot market continues to be weak

On June 12, the methanol market price index was 2221.19, which was 5.28 lower than that of the previous working day and 0.24% lower than the previous working day.

Outer disk dynamics:

Methanol closed on June 11:

China CFR 304,313 US dollars / ton, down 1 US dollar / ton

Us FOB 103104 cents per gallon, flat

Southeast Asia CFR 363.5-364.5 US dollars / ton, Ping

European FOB 324.75-325.75 euros / ton, down 1 euro / ton.

Summary of today's prices:

Guanzhong: 2310-2330 (0), North Route: 2120-2160 (0), Lunan: 2480 (0), Henan: 2400-2410 (- 10), Shanxi: 2270-2350 (0), Port: 2580-2595 (- 10)

Freight:

North Route-Northern Shandong 240-290 (- 10amp 0), Northern Route-Southern Shandong 290-310 (0amp 0), Southern Route-Northern Shandong 260-290 (0qamp Mueller 5), Guanzhong-Southwest Shandong 140-200 (0max 0)

Spot market: today, methanol market prices are arranged in a narrow range, the overall trading atmosphere in the Chinese market is slightly better than in the previous period, the bidding situation of various manufacturers in the region is OK, the futures market is mainly volatile, and the quotation of the port spot market is adjusted with the market. Specifically, the market price in the main producing areas is arranged in a narrow range, the quotation on the south line is around 2200 yuan / ton, stable, and the price on the north line is around 2120-2160 yuan / ton, and the bidding situation of manufacturers in the region is better. Kaiyue methanol starting price is quoted at 2140 yuan / ton factory cash exchange, the quantity is 6000 tons, and the final transaction is 2155-2160 yuan / ton; Shenmu starting bidding price is quoted at 2160 yuan / ton factory cash exchange, the quantity is 4000 tons, and the final transaction is 2175 yuan / ton Yulin Yanzhou Mining starting price quoted 2150 yuan / ton factory cash exchange, the quantity of 7000 tons, the final 2160 yuan / ton all transactions. The market price in Shandong, the main consumer area, is weak, with 2480 yuan / ton in southern Shandong and 2430-2450 yuan / ton in northern Shandong. At present, the market demand in the lower reaches of the region is general, and the overall trading atmosphere is limited. The market quotation in North China is adjusted in a narrow range. Hebei quotation is 2400 yuan / ton today, and the follow-up in the lower reaches of the region is limited. Some operators in the market hold a certain wait-and-see mood towards the future, and the manufacturers' quotation fluctuates little. Shanxi quotes 2270-2350 yuan / ton today. Although some methanol plants in the region are stopped and overhauled, the overall replenishment mood in the lower reaches after the festival is general, and the market transaction atmosphere weakens.

Port market: methanol futures fluctuated in a narrow range today. Spot trading is light. During the month, the offer is positive, arbitrage buying is the main, the basis is significantly weaker, the long-term fluctuation is small, and the price difference between months is narrowing. The overall deal is OK. Taicang main port transaction price: 6, transaction price: 2580-2595, base difference 09: 20 pound, base difference: 2580-2595, base difference: 2575-2580, base difference: 09: 15, market price: 20, basis difference: 2575-2580, basis difference: 09: 15: 20.

Future forecast: in the near future, the overall supply performance of the Chinese market is abundant, methanol from some olefin plants in the main producing areas continues to be exported, the supply of negotiable goods in the market is still abundant, and some manufacturers in the region still have a certain depot demand, there is no obvious favorable support at the supply end in the short term, and the current terminal downstream market demand performance is poor, under the influence of the contradiction between supply and demand, the Chinese market price may continue to be weak in the short term. From the point of view of the port market, the port inventory continues to accumulate slightly this week, the current terminal downstream market demand performance is poor, and affected by the Dragon Boat Festival holiday, some port areas are limited to pick up goods, resulting in an increase in port market inventory. Overall, it is expected that the short-term methanol market price will continue to fluctuate, but in the later stage, we should pay attention to the coal price, the operation of the plant in the field and the downstream demand follow-up.

Recent operation of the plant