Daily Review of Urea: Market prices continue to decline, demand follow-up appears regional (June 12)

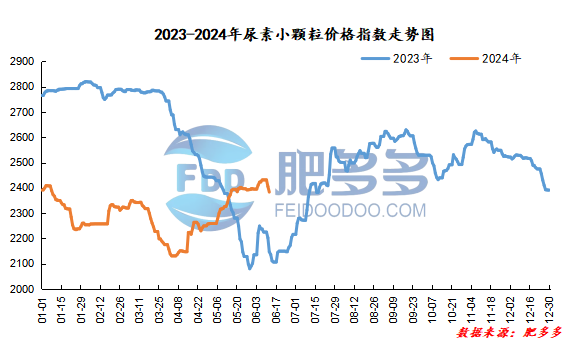

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on June 12 was 2,383.00, a decrease of 22.27 from yesterday, a month-on-month decrease of 0.93% and a year-on-year increase of 11.01%.

Urea futures market:

Today, the opening price of the urea UR409 contract is 2065, the highest price is 2079, the lowest price is 2058, the settlement price is 2068, the closing price is 30% lower than the settlement price of the previous trading day, down 1.44% month-on-month, and the fluctuation range throughout the day is 2058-2079; the basis of the 09 contract in Shandong is 2058; the 09 contract has increased its position by 5785 lots today, and so far, it has held 235010 lots.

Today, urea futures prices continue to open low and go low. Expectations of weakening their own fundamentals are gradually being realized. The simultaneous downward adjustment of the spot market has gradually moved down the support for disk prices. Coupled with the fact that there is no new driver in the current market macro environment, short-term urea may Maintain weak shocks, but we need to guard against new speculative sentiments in the market after overseas data and subsequent trading logic are determined today and tomorrow.

Spot market analysis:

Today, China's urea market prices continued to decline. After the company's quotation was lowered, downstream followed up appropriately.

Specifically, prices in Northeast China have stabilized at 2,440 - 2,460 yuan/ton. Prices in East China fell to 2,270 - 2,310 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,270 - 2,460 yuan/ton, and the price of large particles fell to 2,260 - 2,330 yuan/ton. Prices in North China fell to 2,200 - 2,460 yuan/ton. Prices in South China fell to 2,410 - 2,460 yuan/ton. Prices in the northwest region are stable at 2,400 - 2,410 yuan/ton. Prices in Southwest China are stable at 2,300 - 2,700 yuan/ton.

Market outlook forecast:

In terms of factories, the transaction volume of new orders has been low after manufacturers cut prices. Quotes have continued to be lowered under pressure on shipments. Currently, there are fewer waiting orders. Quotes in Northeast China and Inner Mongolia have remained stable, and prices in other peripheral areas have been lowered. In terms of the market, there is a strong wait-and-see atmosphere in the market. After the price cut, although downstream inquiries increased, the actual transactions were still dominated by caution, and the market continued to be weak. On the supply side, the supply of equipment in the industry is recovering, and Nissan is slowly improving, and supply is expected to be abundant. On the demand side, there is still a certain amount of topdressing demand in some areas in the north, so the quotations of some companies are firm and stable in the short term; downstream industrial factories follow up with a limited amount, which is weaker than the previous period. Purchasing on the overall demand side is cautious, and the sentiment of the industry is weak. Downward.

Overall, the current urea market demand is mixed. After the factory cut prices, a small amount of downstream purchases will follow up. It is expected that the urea market price will continue to decrease steadily in a short period of time.