PVC: Low futures prices and insufficient participation in sideways trading, technical closing lines continue, and spot goods are slow

PVC futures analysis: June 12 V2409 contract opening price: 6230, highest price: 6256, lowest price: 6183, position: 835249, settlement price: 6225, yesterday settlement: 6266, down: 41, daily trading volume: 1101814 lots, precipitated capital: 3.65 billion, capital outflow: 31.07 million.

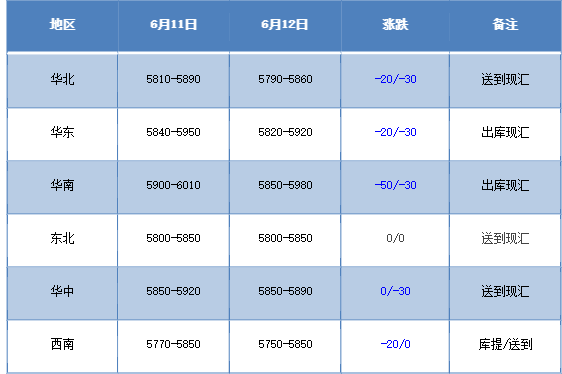

List of comprehensive prices by region: yuan / ton

PVC spot market: & the mainstream transaction price of China's PVC market in nbsp; countries weakens slightly and the spot market moves slowly. Compared with the valuation, it fell by 20-30 yuan / ton in North China, 20-30 yuan / ton in East China, 30-50 yuan / ton in South China, stable in Northeast China, 30 yuan / ton in Central China and 20 yuan / ton in Southwest China. The ex-factory prices of upstream PVC production enterprises mostly remained stable, and individual production enterprises slightly lowered their ex-factory quotations in exchange for better transactions. Futures low continues to be arranged in a narrow range, traders in various regions of the spot market do not change much in early trading, afternoon offers drop steadily in the afternoon, and higher offers are more difficult to close, and the spot price and one-bite price coexist, and the basis changes little. Among them, East China basis offer 09 contract-(300-350-380), South China 09 contract-(250-300-350), North 09 contract-(600-630-660) Southwest 09 contract-(430-470). Feedback from all regions is not good, downstream products enterprises wait and see the willingness to replenish goods is light, hanging order price is on the low side.

Futures point of view: PVC2409 contract price night opening price volatility, intraday slight decline followed by V-shaped rise. Since the beginning of morning trading, the futures price has been fluctuating in a small range, and the direction of the afternoon price has not changed significantly. 2409 contracts fluctuated from 6183 to 6256 throughout the day, with a spread of 73 and 09 contracts reducing positions by 8734 positions, with 835249 positions so far, 2501 contracts closing at 6401 and 127607 positions.

PVC Future Forecast:

In terms of futures: & nbsp As we expected yesterday, the operating low range of the PVC2409 contract futures is approaching the 6180 line, but the market shows a trend of reducing positions, and the fluctuation range of the futures price is narrowing, and the long-short direction is inadequate. the technical level shows that there is also a turning trend in the Bollinger belt (13, 13, 2). The daily MACD line and KD line tend to expand, and the futures price shows a positive pillar with a longer lead throughout the day. There is a certain amount of more power in trading, with 23.7% more opening than empty opening 22.6%. After the policy impact weakened, PVC returned to the low position, and the overall plasticizing plate returned to the air position. Today's increase is not enough compared with polyolefins. In the short term, we still maintain the previous point of view and observe the performance of the low range of 6180-6350.

Spot aspect: first of all from the overall macro rhythm, driven by the continuous efforts of a number of previous policies, the overall commodity showed a certain upward trend, but with the gradual weakening of the impact of the policy, the fermentation ended, the market began to return to sort out. The two cities of PVC are more sensitive to this feedback, with a considerable increase in policy guidance, but the corresponding decline is also larger. From the perspective of supply and demand, although the supply is expected to increase with the maintenance and storage, the demand has not been released for a long time, and the high inventory in the game between supply and demand still becomes a constraint. On the outer disk, the minutes of the Federal Reserve meeting will be released soon, the international oil price of crude oil has risen slightly, the US Energy Information Administration (EIA) has raised its forecast for global oil demand growth this year, and the Organization of Petroleum Exporting countries (OPEC) has stuck to its forecast for relatively strong growth in 2024. On the whole, the spot market of PVC may still face the pattern of arrangement in the short term.