PVC: The futures price was strong first and then weak and short, and the technology of hot money entry turned, and the spot price was mainly adjusted slightly

PVC futures analysis: June 11 V2409 contract opening price: 6270, highest price: 6330, lowest price: 6221, position: 843983, settlement price: 6266, yesterday settlement: 6295, down: 29, daily trading volume: 1063656 lots, precipitated capital: 3.691 billion, capital inflow: 112 million.

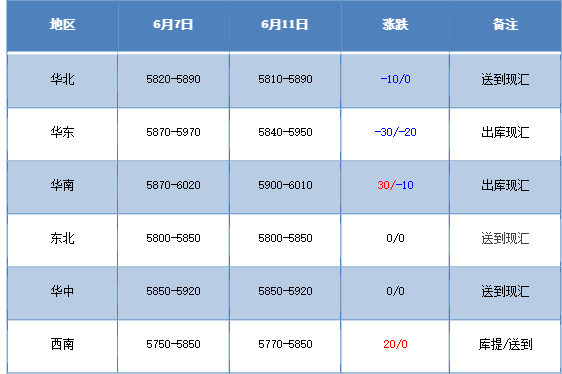

List of comprehensive prices by region: yuan / ton

PVC spot market: the mainstream transaction price in China's PVC market is mainly adjusted in a narrow range, and the price is relatively flexible. Compared with the valuation, it fell 10 yuan / ton in North China, 20-30 yuan / ton in East China, 10 yuan / ton in the high end of South China, 30 yuan / ton in the low end of South China, stable in Northeast China, stable in Central China, and 20 yuan / ton in Southwest China. The ex-factory prices of upstream PVC production enterprises basically remained stable, and there was no obvious trace of adjustment after returning from the Dragon Boat Festival, including basically stable price shipments in remote warehouses. The performance of the futures market is still poor. The price offered by traders in various regions is slightly lower than that of last Friday, and the supply of high-priced goods is difficult to close. The futures prices in the late morning and afternoon are lower, and the price advantage of the basis offer is gradually emerging. The basis enlarges and adjusts slightly, including East China basis offer 09 contract-(300-350-380), South China 09 contract-(250-300), North 09 contract-(600-630-660). Southwest 09 contract-(430-470). On the whole, the turnover rhythm of today's spot market is still light, and there is no obvious improvement in volume.

From a futures point of view: PVC2409 contract prices rose slightly at the start of trading, but the high of only 6330 did not break further upward, that is, it turned weaker and downward, and afternoon prices continued to settle to the end. 2409 contracts fluctuated in the range of 6221-6330 throughout the day, with a spread of 109. 09. The contract increased its position by 32991 lots, with 843983 positions so far, 2501 contracts closing at 6387 and 126328 positions.

PVC Future Forecast:

In terms of futures: & nbsp The futures price trend of PVC2409 contract rose slightly and then weakened, and it was slightly weak from the perspective of futures price trend. In terms of transaction, the gap opened 26.9% compared with 24.6% more. The technical level showed that the middle and lower tracks of the Bollinger belt (13, 13, 2) turned down obviously, and the overall trend of futures prices continued the trend of low horizontal consolidation, but the recent low shock caused the lower rail position to decline slightly. Daily-level MACD lines and KD lines continue to show a dead-end trend. At present, due to the lack of guidance from the news side of the policy, we will continue to observe the performance of the low range of 6180-6350 in the short term when the two markets return to weak consolidation after the end of the policy effort.

Spot aspect: & nbsp At present, the logic of the supply and demand level is still an early factor, the supply port is under maintenance, and the start-up load of the PVC plant is less than 80%. Although it is insufficient, the start-up of the corresponding downstream is still at a high level. Since the beginning of May, the rising period of the two cities has come to an end, returning to the market dominated by supply and demand factors, and returning to the low horizontal market, the spot market has once again appeared a situation of light trading, and rigid demand procurement is lukewarm. Production enterprises are also faced with certain inventory digestion pressure. In the outer disk, international oil prices closed higher as the market expected an increase in fuel demand in the summer, but the stronger dollar limited the rise in oil prices. However, the strength of the dollar put pressure on the market as strong US jobs data on Friday boosted expectations that the Fed would suspend interest rate cuts. On the whole, if there are policy expectations in the current two cities, prices will strengthen, and prices will continue to be weak and slightly sorted out after returning to the fundamentals.