PVC: If you look closely at the futures price, the fluctuations are narrowing, and the spot is slightly fine-tuned

PVC futures analysis: June 5th V2409 contract opening price: 6289, highest price: 6324, lowest price: 6298, position: 849539, settlement price: 6298, yesterday settlement: 6296, up: 2, daily trading volume: 1197378 lots, precipitated capital: 3.735 billion, capital outflow: 28.08 million.

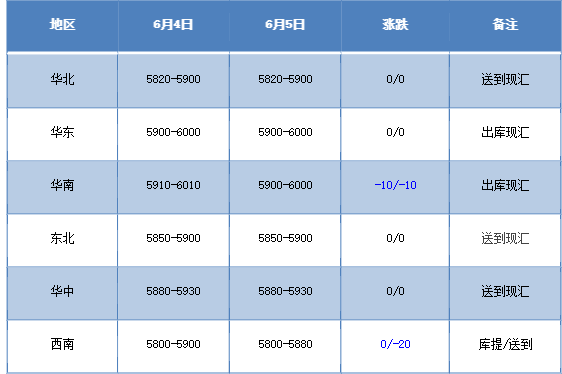

List of comprehensive prices by region: yuan / ton

PVC spot market: the mainstream transaction price in China's PVC market continues to be adjusted in a narrow range, with each region according to its own shipments. The comparison of valuation shows that North China is stable, East China is stable, South China is down 10 yuan / ton, Northeast China is stable, Central China is stable, and Southwest China is down 20 yuan / ton. Upstream PVC production enterprises factory prices remain stable, individual enterprises tentatively slightly increase the price of 3-8 materials 50 yuan / ton. Futures continued to fluctuate in a narrow range, and the comparison of one-mouth price offers among traders in the spot market remained basically unchanged yesterday, individually adjusted slightly according to the shipment situation, and the spot price and one-mouth price coexisted. The relative advantage of the base difference offer of low futures price is obvious, but the downstream hanging order point is generally low, of which the base difference offer 09 contract in East China (300-350-380) and 09 contract in South China-(250-300) 09 contract in the North-(600-640), 09 in the Southwest-(400-450). On the whole, it is difficult to close a deal at a high price in today's spot market, and it is mainly done at a low price. Downstream purchasing enthusiasm is on the low side.

Futures point of view: PVC2409 contract night futures prices rose slightly after the decline, after the V-shaped trend. Prices fell again after the start of morning trading, rising in the afternoon but not overnight highs, and then weakened. 2409 contracts fluctuated from 6268 to 6324 throughout the day, with a spread of 56. 09 contracts reduced positions by 566 lots, with 849539 positions so far, 2501 contracts closing at 6440 and 122423 positions.

PVC Future Forecast:

In terms of futures: & the volatility of nbsp;PVC2409 contract futures in the recent performance, basically belongs to a very narrow range of only 56 points within the adjustment, and the trend of long and short is insufficient, the change in position volume is also small, in terms of trading, the short opening is 23.1% compared with 23.7% more. The technical level shows that the opening of the three tracks of the Bollinger belt (13, 13, 2) tends to open, the future price is arranged in a small range above the lower track, and the MACD line and KD line of the daily line continue to show a dead-forked trend. At present, the overall technical closing line is slightly empty, and now the two cities have begun a certain callback arrangement after the fermentation policy guidance. We still maintain the previous point of view and continue to observe the performance of the low range of 6250-6410.

Spot aspect: first from the policy port, after fermenting the policy stimulus, the overall commodity sentiment is slightly reduced and sorted out, PVC is also difficult to get out of the separate market in the general environment, the current trend of the two cities is insufficient, on the one hand, the lack of capital participation, on the other hand, the industrial chain in the face of the current market also has a certain shipping pressure. There is still no obvious variable guidance on the supply and demand side. There may be an impression of delay in PVC July shipping quotation in Asia, but the market is expected to rise mostly, up at US $50 / tonne. On the outer disk, oil prices continued to fall as OPEC + decided to cancel some voluntary additional production cuts after September. At the capacity meeting on June 2, OPEC + agreed to extend all production restrictions until next year, but left room for the eight member states to phase out voluntary production cuts from October. On the whole, the PVC spot market may still be low and narrow in the short term, waiting for a turnaround.