Methanol: The methanol period is now undergoing a simultaneous correction. The market transaction atmosphere is limited

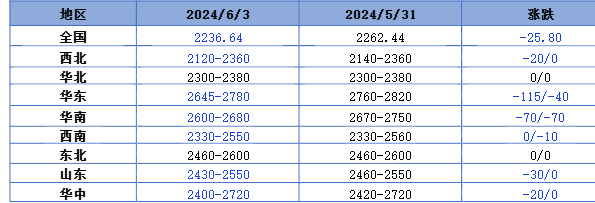

On June 3, the methanol market price index was 2236.64, which was 25.81 lower than that of the previous working day and 1.14% lower than the previous working day.

Outer disk dynamics:

Methanol closed on May 31:

China's CFR ranges from US $312 to US $315 per ton, down US $3 per ton

Us FOB 98-99 cents per gallon, flat

Southeast Asian CFR 363.5-364.5 US dollars / ton, down 2 US dollars / ton

European FOB 308.5-309.5 euros / ton, up 0.75 euros / ton.

Summary of today's prices:

Guanzhong: 2340-2360 (0), North Route: 2120-2160 (- 20), Lunan: 2430-2450 (- 50), Henan: 2400-2405 (- 20), Shanxi: 2300-2350 (0), Port: 26452695 (- 115)

Freight:

North Route-North Shandong 270-330 (0ax 0), North Line-South Shandong 290-310 (0max 0), South Line-North Shandong 260-290 (0max 0), Guanzhong-Southwest Shandong 160-230 (0max 0)

Spot market: today, the price of methanol in China has fluctuated, the futures market has fallen high, and the spot market price has been adjusted in a narrow range. at present, the performance of demand in the downstream of the Chinese terminal is poor, and some of the traditional downstream has entered the off-season of consumption. the performance of methanol demand is mediocre, coupled with the recent continuous decline in methanol prices, industry fear of falling sentiment breeds, market operation is mainly cautious and rigid demand. Specifically, the market price in the main producing areas fell in a narrow range, with the quotation on the south line around 2180 yuan / ton, stable, the price on the north line around 2120-2160 yuan / ton, the lower end reduced by 10 yuan / ton, and the futures market dropped sharply. Most operators in the market are cautious to wait and see. Today, there are few new prices issued by enterprises in the northwest region. The market price in Shandong, the main consumer area, is weak, with 2430-2450 yuan / ton in southern Shandong and 2480-2510 yuan / ton in northern Shandong. The futures trend is downward, and the industry has a strong wait-and-see mood. The market quotation in North China is running stably for the time being. Hebei quotation is 2360-2380 yuan / ton today, which is stable. At present, the wait-and-see mood of Hebei methanol market is strong, and most methanol manufacturers have not bid yet. Shanxi quotes 2300-2350 yuan / ton today. At present, the inventory of most methanol enterprises in the market is uncontrollable, and the manufacturers have no demand for destocking for the time being, but the performance of downstream demand is poor, and some manufacturers reduce the price slightly in order to guarantee shipment or stock.

Port market: methanol futures fell today. Spot purchase on demand. In the morning, the pick-up atmosphere of paper goods is better, the price is right, and the basis is strong; in the afternoon, with the increase in selling, the delivery is cautious, and the basis falls slightly. The overall deal is OK. Taicang main port transaction price: spot transaction: 2675-2695, base difference 09: 100: 6, basis: 2645-2660, basis: 09: 60, spread: 75: 6, transaction: 2620-2640, basis: 09: 45: 50: 6: 2615-2630, basis: 09: 35: 45: 45: 7: 2600-2625, basis: 09: 20: 28.

Future forecast: as part of the traditional downstream market enters the off-season of demand, the contradiction between supply and demand in the Chinese market appears slightly, coupled with the slight decline in the price of raw materials, the cost is also weakened in the face of methanol support, and the bearish sentiment in the market is more obvious. the enthusiasm of on-site traders and terminal tourists to enter the market is not high, the market trading atmosphere is light, and the futures market is high, which aggravates the wait-and-see mood of the market. At present, the overall performance of methanol fundamentals is empty, and the enthusiasm of operators to enter the market and replenish stocks is limited. It is expected that methanol market prices may continue to be weak in the short term, but in the later stage, we should pay attention to coal prices, plant operation and downstream demand follow-up.

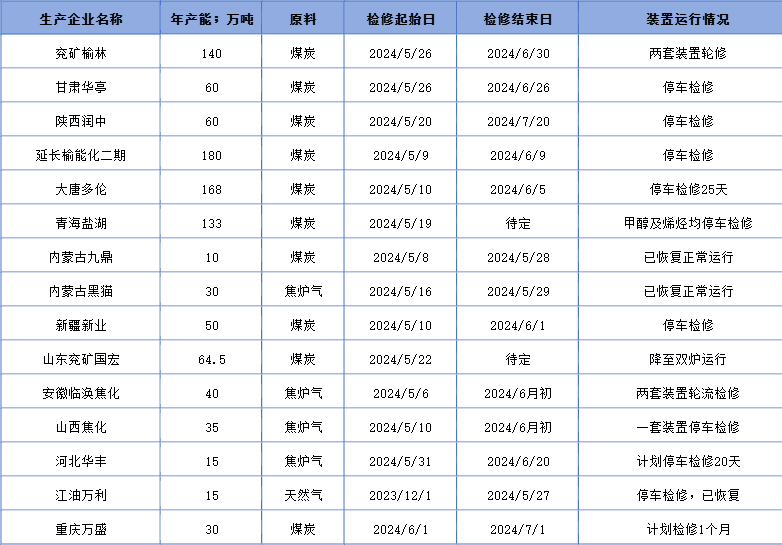

Recent operation of the plant