Methanol: Futures market highs fell back and spot prices adjusted within a narrow range

Methanol: futures disk high drop spot quotation narrow range adjustment

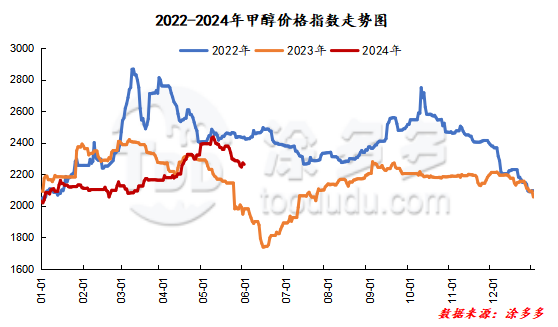

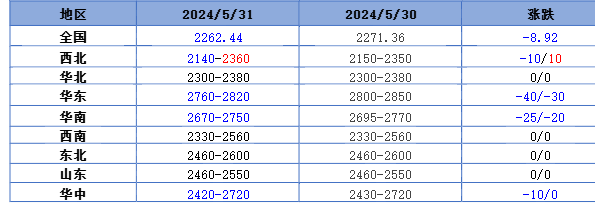

On May 31, the methanol market price index was 2262.44, down 8.91 from yesterday and 0.39 per cent from the previous month.

Outer disk dynamics:

Methanol closed on May 30:

China's CFR is US $315,320 per ton, up US $3 per ton.

Us FOB 98-99 cents per gallon, flat

Southeast Asia CFR 365.5-366.5 US dollars / ton, Ping

European FOB 307.75-308.75 euros / ton, up 1.25 euros / ton.

Summary of today's prices:

Guanzhong: 2340-2360 (0), North Route: 2140-2190 (- 10), Lunan: 2480-2500 (0), Henan: 2420 (- 10), Shanxi: 2300-2380 (0), Port: 2760-2770 (- 40)

Freight:

North Route-North Shandong 270-330 (0ax 0), North Line-South Shandong 290-310 (10max 0), South Line-North Shandong 260-290 (0max 0), Guanzhong-Southwest Shandong 160-230 (0max 0)

Spot market: today, the price of methanol in China is weak and volatile, the futures market is high, the spot market price is adjusted in a narrow range, and the overall trading atmosphere of the market is limited. at present, the overall demand performance of the downstream market is poor, most of the operators in the market are more obvious about the wait-and-see mood in the future. Specifically, the market price in the main producing areas fell narrowly, with the quotation on the south line around 2180 yuan / ton, 20 yuan / ton higher than yesterday, and the price on the north line around 2140-2190 yuan / ton, which was lowered by 10 yuan / ton at the low end. at present, the downstream market demand performance is poor, the shipments of manufacturers in the region are poor, and some manufacturers' inventory has increased slightly, so it is difficult to have obvious support for regional market prices in the short term. The market price in Shandong, the main consumer area, is weak, with 2440-2450 yuan / ton in southern Shandong and 2440-2470 yuan / ton in northern Shandong. The overall transaction atmosphere in the downstream market is poor, and the prices of some manufacturers are reduced to ensure shipment. The market quotation in North China is running stably for the time being. Hebei quotes 2360-2380 yuan / ton today. Yesterday, the downstream demand for methanol in the region is weak and difficult to change, and the downstream manufacturers have strong price pressure, and the market price continues to be weak. Shanxi quotes 2300-2350 yuan / ton today, the market terminal demand is weak, some manufacturers in the market mainly reduce prices for shipments, but the follow-up of downstream market demand is limited, and the trading atmosphere is general.

Port market: methanol futures fell today. Spot demand for a small number of small orders. Near-end contract negotiation is the main, a small number of unilateral shipments. Far month arbitrage shipments, buying cautious, the basis weakens rapidly. The overall transaction throughout the day is mediocre. Taicang main Port transaction Price: spot / small order: 2760-2770 position 6 deal: 2695-2715, basis difference 09: 50, margin: 65, transaction 6: 2675-2705, basis: 09, 40, 40, 45, transaction 6: 2660-2700, basis difference: 09, 30, 35, deal 7 : 2655-2675, the basis difference is 09 / 20 / 20 / 20 / 15 / 07 / 20.

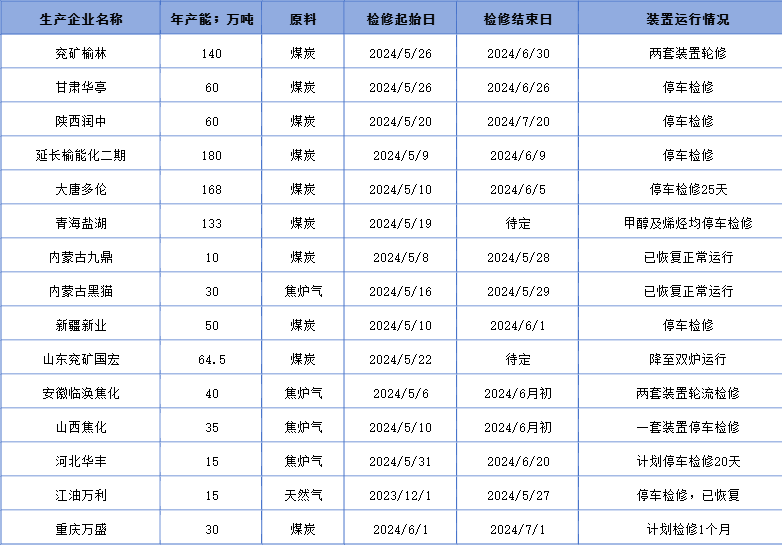

Future forecast: recently, with the parking maintenance of some devices in the Chinese market, the local market supply has been reduced, but with the restart of the previous parking devices, the overall market supply has not changed much, and it is difficult to significantly improve the supply in the Chinese market in the short term. At present, part of the traditional downstream has entered the off-season demand, in which formaldehyde plants have more follow-up or negative storage and parking operations, and the demand for methanol is expected to decrease. At present, the contradiction between supply and demand in the Chinese market still exists, and short-term prices may continue, such as weak operation, but next week is approaching the Dragon Boat Festival holiday, the downstream market may store a small amount of rigid demand for stock, and the market turnover may increase narrowly, but considering that the holiday is relatively short, the overall trading volume of the market may be relatively limited. It is expected that the short-term methanol market price will continue to differentiate, the methanol market price in China will continue to be weak, and the port spot quotation will fluctuate at a high level, but in the later stage, we should pay attention to the coal price, the operation of the plant in the field and the follow-up of downstream demand.

Recent operation of the plant