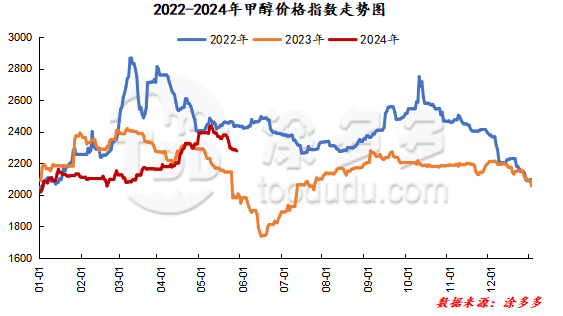

Methanol: Futures returns to the 2600 yuan mark and the spot market is weak and difficult to change

On May 27th, the methanol market price index was 2277.76, down 7.21 from the previous working day, and 0.32% lower than the previous working day.

Outer disk dynamics:

Methanol closed on May 24:

China's CFR ranges from US $305 to US $311 per ton, up US $6 per ton.

Us FOB 97-98 cents per gallon, flat

Southeast Asia CFR 365.5-US $366.5 / ton, Ping

European FOB 302.5-303.5 euros / ton, up 2.50 euros / ton.

Summary of today's prices:

Guanzhong: 2330-2350 (- 20), North Route: 2160-2200 (- 10), Lunan: 2470-2500 (- 30), Henan: 2420-2440 (0), Shanxi: 2350-2430 (0), Port: 27102760 (5)

Freight:

North Route-North Shandong 250-320 (20ppm 40), North Route-South Shandong 280-310 (0amp 0), South Line-North Shandong 270-300 (0max 0), Guanzhong-Southwest Shandong 160-240 (- 20Compare 10)

Spot market: today, the Chinese methanol market has a regional trend, the port spot quotation continues to be arranged at a high level, and the Chinese market continues to fall. At present, some units in China are stopped as scheduled, but with the restart of the previous maintenance equipment, the overall supply of the market does not change much, and the follow-up of the downstream market demand is limited, the overall shipping situation of manufacturers is limited, and the market transaction atmosphere is poor. Specifically, the market price in the main producing areas fell in a narrow range, with the quotation on the south line around 2180 yuan / ton, maintaining the last working day, the price on the north line was around 2160-2200 yuan / ton, the lower end was reduced by 10 yuan / ton, and some devices in the region were parked for home maintenance, and the start-up work in the region fell somewhat, but the downstream demand follow-up was limited, and some bidding manufacturers had more storage and streaming auction and other operations. Market prices in Shandong, the main consumer area, fluctuated down, with southern Shandong 2470-2500 yuan / ton, low-end down 30 yuan / ton, and northern Shandong 2460-2480 yuan / ton. the strong trend of futures has a certain boost to the market mentality, but the downstream replenishment enthusiasm is not high, rigid demand is the main. The market quotation in North China is running stably for the time being. Hebei quoted price 2410-2430 yuan / ton today, which maintained yesterday, but the downstream demand did not improve significantly in the short term, and the downstream mostly maintained rigid demand for procurement, so it was difficult to sell goods. Shanxi quoted 2350-2430 yuan / ton today, and the early Zhou businessmen mostly had a wait-and-see mentality.

Port market: today, methanol futures shock consolidation. Early morning near-end rigid demand to buy, far month a small number of high shipments. Afternoon buying continued, arbitrage buying price to follow up, the basis is slightly stronger. The overall transaction throughout the day is not bad. Taicang main port transaction price: spot transaction: 2750-2755, basis 09: 130pm: 135bot: 2730-2735, basis: 09: 105Universe: 120x, transaction: 2675-2685, basis: 09x60: 70X: 6: 2655-2670, basis: 09x40amp: 50x: 2650, basis: 0930pm: 35.

|

Area |

2024/5/27 |

2024/5/24 |

Rise and fall |

|

The whole country |

2277.76 |

2284.96 |

-7.20 |

|

Northwest |

2160-2350 |

2170-2350 |

-10/0 |

|

North China |

2350-2430 |

2350-2430 |

0/0 |

|

East China |

2725-2830 |

2710-2840 |

15/-10 |

|

South China |

2680-2760 |

2670-2760 |

10/0 |

|

Southwest |

2350-2650 |

2350-2650 |

0/0 |

|

Northeast China |

2550-2650 |

2550-2650 |

0/0 |

|

Shandong |

2460-2600 |

2480-2600 |

-20/0 |

|

Central China |

2420-2750 |

2420-2750 |

0/0 |

Future forecast: recently, there will be equipment overhaul and restart in the Chinese market. Yulin Yankuang plant has been inspected in two phases since May 26, and the expected time is not less than 30 days. The Huating device in Gansu has stopped now, and the start-up of the local market has declined somewhat. However, with the restarting of the early maintenance equipment and mutual hedging, the overall market supply has not been significantly reduced, coupled with the poor shipment of some manufacturers in the early stage. The inventory of manufacturers has increased compared with the previous period, and it is difficult for the supply side to have obvious support to the market in the short term, coupled with the fact that it is difficult to have a significant improvement in downstream demand at present. Under the influence of the contradiction between supply and demand, the enthusiasm of operators to enter the market to replenish stock is not high. At present, it is expected that the price of methanol in the Chinese market will continue to be weak in the short term, and the spot quotation of the port may maintain a high shock, but in the later stage, attention should be paid to coal prices, the operation of on-site equipment and the follow-up of downstream demand.

Recent operation of the plant

|

Name of production enterprise |

Annual capacity; ten thousand tons |

Raw material |

Starting date of maintenance |

Maintenance end date |

Operation of the device |

|

Shaanxi Runzhong |

60 |

Coal |

2024/5/20 |

2024/7/20 |

Parking maintenance |

|

Inner Mongolia black cat |

30 |

Coke oven gas |

2024/5/16 |

To be determined |

Parking maintenance |

|

Prolong the second phase of Yueneng |

180 |

Coal |

2024/5/9 |

2024/6/9 |

Parking maintenance |

|

Inner Mongolia Rongxin Phase I |

90 |

Coal |

2024/5/6 |

2024/5/21 |

Returned to normal operation |

|

Shenhua Baotou |

230 |

Coal |

2024/4/15 |

2024/5/19 |

Returned to normal operation |

|

Datang Duolun |

168 |

Coal |

2024/5/10 |

2024/6/5 |

Parking maintenance for 25 days |

|

Inner Mongolia Yigao |

30 |

Coal |

2024/4/19 |

2024/5/24 |

Returned to normal operation |

|

Northwest energy |

30 |

Coal |

2023/10/8 |

2024 / May |

Stop production and overhaul |

|

Xinjiang new industry |

50 |

Coal |

2024/5/10 |

2024/5/28 |

Parking maintenance |

|

Gansu Huating |

60 |

Coal |

2024/5/26 |

To be determined |

Parking maintenance |

|

Qinghai Salt Lake |

133 |

Coal |

2024/5/19 |

To be determined |

Methanol and olefins are stopped for maintenance. |

|

Shandong Yanzhou Mining Guohong |

64.5 |

Coal |

2024/5/22 |

To be determined |

Reduced to double furnace operation |

|

Guangxi Huayi |

180 |

Coal |

2024/5/15 |

2024/5/22 |

A set of equipment is being stopped for overhaul and is being restored one after another. |

|

Jiangyou Wanli |

15 |

Natural gas |

2023/12/1 |

2024 / May |

Parking maintenance |

|

Shanxi coking |

35 |

Coke oven gas |

2024/5/10 |

2024 / early June |

A set of devices for parking and maintenance |

|

Anhui Linyi Coking |

40 |

Coke oven gas |

2024/5/6 |

2024/6/6 |

The two sets of devices are overhauled in turn |