PVC: Futures gave up some of the gains, both long and short sides left the market, and the spot was adjusted back.

PVC futures analysis: may 21 V2409 contract opening price: 6368, highest price: 6407, lowest price: 6246, position: 922745, settlement price: 6331, yesterday settlement: 6354, down: 23, daily trading volume: 1588408 lots, precipitated capital: 4.083 billion, capital outflow: 201 million.

List of comprehensive prices by region: yuan / ton

|

Area |

May 20th |

May 21 |

Rise and fall |

Remarks |

|

North China |

5830-5930 |

5810-5860 |

-20/-70 |

Send to cash remittance |

|

East China |

5980-6050 |

5880-6000 |

-100/-50 |

Cash out of the warehouse |

|

South China |

6000-6100 |

5930-6050 |

-70/-50 |

Cash out of the warehouse |

|

Northeast China |

5700-5850 |

5700-5850 |

0/0 |

Send to cash remittance |

|

Central China |

5850-5910 |

5850-5910 |

0/0 |

Send to cash remittance |

|

Southwest |

5750-5850 |

5730-5800 |

-20/-50 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction prices fell slightly, giving up some of the gains. Compared with the valuation, it fell by 20-70 yuan / ton in North China, 50-100 yuan / ton in East China, 50-70 yuan / ton in South China, stable in Northeast China, stable in Central China, and 20-50 yuan / ton in Southwest China. Upstream PVC production enterprise factory price part of the reduction of 50-80-100 yuan / ton, mainly to active shipments, coinciding with the contract on Tuesday to the basic volume, there is no obvious volume signing. Futures slightly down to give up some of the gains, the spot market merchants offer a small decline, some real single prices have room for negotiation, with the downward price, the basis offer advantage, and the basis slightly expanded, including East China basis offer 09 contract-(300-350-400), South China 09 contract-(250-300), North 09 contract-(600-650), Southwest 09 contract-(400-450). Although the two quotations coexist, but the downstream procurement intention is still low, most continue to wait and see, the overall spot trading atmosphere is light.

From the perspective of futures: & the volatility of the night market price of the nbsp; PVC2409 contract opens low and moves high, and the volatility range of the overall night market price narrows. After the start of morning trading, futures prices fell slightly, falling below the 6300 mark as low as 6246, and afternoon prices were fluctuated. 2409 contracts fluctuated in the range of 6246-6407 throughout the day, with a shortfall of 161009 contracts by 36028 positions, with 922745 positions so far, 2501 contracts closing at 6487 and 94305 positions.

PVC Future Forecast:

Futures: PVC2409 contract futures slightly pullback, giving up some of the previous gains, the high point of the futures price is also slightly lower than yesterday's peak, and the market continues to show a state of withdrawal, of which the air level 25.4% is almost the same as Duoping 25.5%, long and short both sides have left the market performance. The technical level shows that the opening of the three tracks of the Bolin belt (13, 13, 2) is still expanding, the KD line at the daily level crosses, and the trend of golden fork disappears. Although the futures price gives back part of the increase, but the futures price is still high, and can not determine the disappearance of the strong trend, but with the end of the policy fermentation, the market pullback slightly. In the short term, the operation of futures prices continues to observe the persistence of the high range of 6230-6450.

Spot aspect: & the correction of the nbsp; futures price makes the two-day point price offer return to the market, and the base offer expands slightly. Although there are offers for both the one-off price and the point price, the downstream products enterprises relatively resist the high price, and the supply of goods transferred between traders during the previous period of big price rise disappears today. First of all, the fundamentals of PVC have not changed greatly in the short term, and the start-up load of PVC plant is stable, but some PVC production enterprises began to overhaul in the middle and late ten days, and the material supply may be reduced, but the demand has always been lukewarm. In the outer disk, international oil prices closed lower, ending three consecutive gains, and recent WTI crude oil futures failed even to hold above $80 a barrel hit on Friday, as Fed officials said they were waiting for more signs of falling inflation before starting to cut interest rates. On the whole, in the short and short term, the spot price of PVC is mainly sorted out at a high level.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

May 20th |

May 21 |

Rate of change |

|

V2409 collection |

6383 |

6321 |

-62 |

|

|

Average spot price in East China |

6015 |

5940 |

-75 |

|

|

Average spot price in South China |

6050 |

5990 |

-60 |

|

|

PVC2409 basis difference |

-368 |

-381 |

-13 |

|

|

V2501 collection |

6544 |

6487 |

-57 |

|

|

V2409-2501 close |

-161 |

-166 |

-5 |

|

|

PP2409 collection |

7837 |

7794 |

-43 |

|

|

Plastic L2409 |

8649 |

8579 |

-70 |

|

|

V--PP basis difference |

-1454 |

-1473 |

-19 |

|

|

Vmure-L basis difference of plastics |

-2266 |

-2258 |

8 |

|

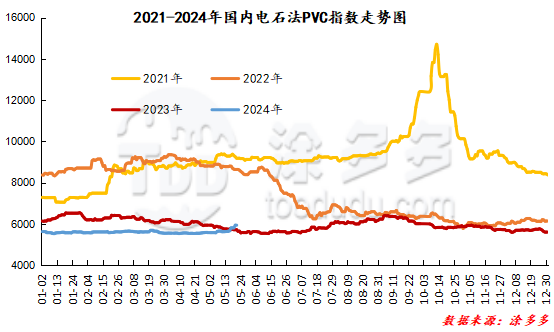

China PVC Index: according to Tuduoduo data, the Chinese calcium carbide PVC spot index fell 48.07 or 0.809% to 5896.10 on May 21. The ethylene PVC spot index was 6171.19, down 77.26, or 1.236%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 275.09.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

Yesterday's warehouse order quantity |

Today's warehouse order volume |

Increase or decrease |

|

Polyvinyl chloride |

China Reserve shares |

4,241 |

4,241 |

0 |

|

|

Large-scale reserve |

240 |

240 |

0 |

|

|

Guangzhou materials |

2,053 |

2,053 |

0 |

|

|

The central reserve is near the port |

905 |

905 |

0 |

|

|

China Central Reserve Nanjing |

1,043 |

1,043 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

3,433 |

3,433 |

0 |

|

|

Zhenjiang Middle and far Sea |

1,353 |

1,353 |

0 |

|

|

Shanghai Zhongyuan Sea |

614 |

614 |

0 |

|

|

Middle and far sea in Jiangyin |

1,466 |

1,466 |

0 |

|

Polyvinyl chloride |

Zhejiang 837 |

120 |

120 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

3,189 |

3,189 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,699 |

1,699 |

0 |

|

Polyvinyl chloride |

Shanghai-Hong Kong logistics |

691 |

691 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

5,890 |

5,890 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

15,017 |

15,017 |

0 |

|

Polyvinyl chloride |

Pinghu Huarui |

3,157 |

3,157 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

2,097 |

2,097 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

5,415 |

5,415 |

0 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

1,014 |

1,014 |

0 |

|

Polyvinyl chloride |

Chuanhua mandarin |

631 |

631 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

900 |

900 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

600 |

600 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

900 |

900 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,000 |

1,000 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

3,060 |

3,060 |

0 |

|

Polyvinyl chloride |

Zhejiang Jiahua |

300 |

300 |

0 |

|

PVC subtotal |

|

55,538 |

55,538 |

0 |

|

Total |

|

55,538 |

55,538 |

0 |

PVC long bears hold the list of bulls:

|

Ranking of daily trading positions in Dalian Commodity Exchange (Table 1) |

|||

|

Ranking |

Member abbreviation |

Trading volume |

Increase or decrease |

|

1 |

Guotai Junan (valet) |

400,538 |

-86,429 |

|

2 |

Eastern Stock Exchange Futures (valet) |

289,707 |

-2,210 |

|

3 |

Citic Futures (valet) |

281,135 |

-22,733 |

|

4 |

Huawen Futures (valet) |

212,818 |

-122,321 |

|

5 |

Huizhou Merchants Futures (valet) |

93,957 |

-16,640 |

|

6 |

Haitong Futures (valet) |

89,341 |

-18,704 |

|

7 |

Galaxy Futures (valet) |

79,968 |

-52,851 |

|

8 |

Huatai Futures (valet) |

72,876 |

-10,885 |

|

9 |

Middle period of founder (valet) |

72,074 |

-8,602 |

|

10 |

League of Nations Futures (valet) |

67,521 |

12,966 |

|

11 |

Shenyin Wanguo (valet) |

66,337 |

-20,801 |

|

12 |

Guangfa Futures (valet) |

61,888 |

-12,366 |

|

13 |

Soochow Futures (valet) |

59,453 |

-23,434 |

|

14 |

Zhongcai Futures (valet) |

55,749 |

-23,782 |

|

15 |

Hua'an Futures (valet) |

48,919 |

12,797 |

|

16 |

Citic Construction Investment (valet) |

46,174 |

-16,684 |

|

17 |

Ruida Futures (valet) |

33,937 |

-2,037 |

|

18 |

Huaxi Futures (valet) |

33,557 |

-14,200 |

|

19 |

Xingzheng Futures (valet) |

33,543 |

19,042 |

|

20 |

Oriental Wealth (valet) |

33,389 |

-5,985 |

|

Total |

|

2,132,881 |

-415,859 |

|

Ranking of daily trading positions in Dalian Commodity Exchange (Table 2) |

|||||||

|

Ranking |

Member abbreviation |

Hold the purchase order quantity |

Increase or decrease |

Ranking |

Member abbreviation |

Hold sales order quantity |

Increase or decrease |

|

1 |

Zhongcai Futures (valet) |

116,981 |

714 |

1 |

Guotai Junan (valet) |

124,836 |

-3,564 |

|

2 |

Guotai Junan (valet) |

53,158 |

4,770 |

2 |

Yongan Futures (valet) |

63,434 |

1,921 |

|

3 |

Citic Futures (valet) |

34,934 |

4,384 |

3 |

Citic Futures (valet) |

55,413 |

453 |

|

4 |

Huatai Futures (valet) |

32,206 |

-595 |

4 |

Galaxy Futures (valet) |

45,371 |

-4,286 |

|

5 |

Eastern Stock Exchange Futures (valet) |

26,519 |

2,737 |

5 |

Shenyin Wanguo (valet) |

40,053 |

-2,547 |

|

6 |

Yongan Futures (valet) |

24,220 |

224 |

6 |

Guotou Anxin (valet) |

33,991 |

1,145 |

|

7 |

Citic Construction Investment (valet) |

24,128 |

-1,321 |

7 |

Zhejiang Merchants Futures (valet) |

33,778 |

-197 |

|

8 |

Galaxy Futures (valet) |

23,630 |

-180 |

8 |

Eastern Stock Exchange Futures (valet) |

31,901 |

-9,510 |

|

9 |

Huizhou Merchants Futures (valet) |

23,620 |

-2,503 |

9 |

Huatai Futures (valet) |

27,342 |

-4,253 |

|

10 |

Middle period of founder (valet) |

19,837 |

-874 |

10 |

CICC Wealth (valet) |

20,661 |

1,142 |

|

11 |

Haitong Futures (valet) |

18,319 |

-5,847 |

11 |

Citic Construction Investment (valet) |

19,336 |

29 |

|

12 |

South China Futures (valet) |

16,818 |

1,825 |

12 |

Zhongcai Futures (valet) |

19,163 |

-2,961 |

|

13 |

Cofco Futures (valet) |

14,534 |

610 |

13 |

Everbright Futures (valet) |

16,070 |

-103 |

|

14 |

Sino-Thai Futures (valet) |

14,518 |

-539 |

14 |

South China Futures (valet) |

15,170 |

-1,458 |

|

15 |

Baocheng Futures (valet) |

14,474 |

647 |

15 |

Donghai Futures (valet) |

14,645 |

539 |

|

16 |

Zhejiang Merchants Futures (valet) |

14,398 |

412 |

16 |

Medium-sized products (valet) |

13,975 |

721 |

|

17 |

Hua'an Futures (valet) |

14,346 |

21 |

17 |

Guangfa Futures (valet) |

13,865 |

181 |

|

18 |

Guangfa Futures (valet) |

13,486 |

107 |

18 |

ITC Futures (valet) |

11,969 |

142 |

|

19 |

Zhonghui Futures (valet) |

12,841 |

125 |

19 |

Hongye Futures (valet) |

11,477 |

-180 |

|

20 |

Everbright Futures (valet) |

12,064 |

-89 |

20 |

Middle period of founder (valet) |

10,533 |

-520 |

|

Total |

|

525,031 |

4,628 |

Total |

|

622,983 |

-23,306 |

The information provided in this report is for reference only.