Methanol: Futures continue to operate at high levels, methanol spot trends are mixed

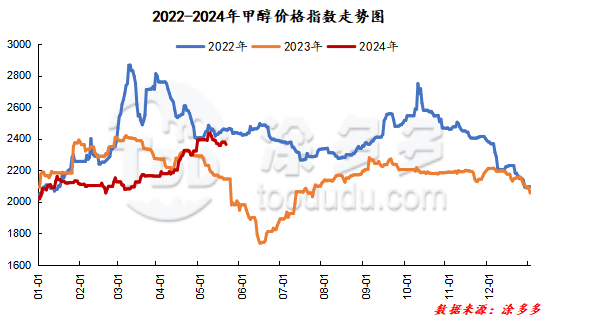

On May 20, the methanol market price index was 2363.42, down 14.35 from the previous working day and 0.6 per cent lower than the previous working day.

Outer disk dynamics:

Methanol closed on May 17:

China's CFR ranges from US $316 to US $320 per ton, up US $2 per ton.

Us FOB 92-93 cents per gallon, flat

Southeast Asian CFR 369-US $370 / ton, up US $1 / ton

European FOB 300.75-301.75 euros / ton, down 1.75 euros / ton.

Summary of today's prices:

Guanzhong: 2390 (20), North Route: 2320-2330 (- 20), Lunan: 2580-2600 (20), Henan: 2510-2520 (10), Shanxi: 2380-2480 (0), Port: 2780-2310 (- 60)

Freight:

North-Shandong 200-260 (0ax 0), north-south Shandong 280-310 (0max 0), south-north Shandong 280-310 (10max 0), Guanzhong-southwest Shandong 220-280 (0max 0)

Spot market: today, the price of methanol market is arranged in a narrow range, the futures market continues to fluctuate at a high level, the price of the port spot market goes up along with it, the price of China's spot market falls somewhat, and the enthusiasm of the downstream market to enter the market is general. The main enterprises' bidding is accompanied by failed auctions. Specifically, the market price in the main producing areas is adjusted narrowly, and the quotation on the southern line revolves around 2310 yuan / ton, maintaining yesterday, while the quotation on the northern line revolves around 2320-2330 yuan / ton, and the lower end is reduced by 20 yuan / ton. although the methanol futures market trend is still strong, but the boost effect on the spot market is general, at present, there is obvious resistance to high-priced methanol downstream, poor enthusiasm for receiving goods, and part of the main enterprises are accompanied by failed auctions. The market prices in Shandong, the main consumer area, are adjusted in a narrow range, with 2580-2600 yuan / ton in southern Shandong and 2580-2620 yuan / ton in northern Shandong. Some downstream operators hold certain resistance to the current high prices, and the market transaction atmosphere is general. The market quotation in North China is running stably for the time being. Hebei quotation is 2510-2520 yuan / ton today. The downstream market demand performance is general, and the overall transaction atmosphere of the market is general. Shanxi quotes 2380-2480 yuan / ton today, and the downstream manufacturers are more cautious in following up. Rigid demand replenishment is the main, the overall market transaction atmosphere is general.

Port market: today, methanol futures shock consolidation. The spot offer is few, the rigid demand purchase, the basis is strong. Long-term morning shipments are active, the basis is obviously weak; afternoon shipments decreased, the basis rebounded slightly. The overall transaction throughout the day is not bad. Taicang main port transaction price: spot / small order: 2950-3010, basis 09: 300, margin: 340, basis: 2780-2815, basis: 09: 130, margin: 160, transaction 6: 2765-2800, basis: 09: 105, margin: 130: 6: 2715-2745, basis: 09: 60, basis: 8010: 2685-2720, basis: 09: 40.

|

Area |

2024/5/20 |

2024/5/17 |

Rise and fall |

|

The whole country |

2363.42 |

2377.77 |

-14.35 |

|

Northwest |

2260-2310 |

2280-2380 |

-20/-70 |

|

North China |

2380-2520 |

2380-2520 |

0/0 |

|

East China |

2780-3030 |

2895-2930 |

-115/100 |

|

South China |

2760-2860 |

2730-2850 |

30/10 |

|

Southwest |

2350-2650 |

2350-2650 |

0/0 |

|

Northeast China |

2650-2760 |

2550-2780 |

100/-20 |

|

Shandong |

2580-2700 |

2560-2700 |

20/0 |

|

Central China |

2510-2750 |

2500-2750 |

10/0 |

Forecast in the future: recently, the high operation of methanol futures has led to an increase in the spot market price of the port, coupled with the tight circulation of spot goods in the port area at present, which to a certain extent supports the false mood of the holders. at present, the arbitrage space between the port and China continues to open, and the possibility of Chinese goods flowing back to the port can not be ruled out in the later stage. However, the quotation in the Chinese market fluctuates under the influence of poor demand and the increased supply pressure of manufacturers in some regions, but the overall enthusiasm of the downstream market to enter the market and replenish the stock is not high, and the market price has fallen under the transaction of rigid demand. At present, the contradiction between supply and demand in the Chinese market has been highlighted. It is expected that the price in the Chinese market will fall in a narrow range in the short term, and the port spot may remain high, but in the later stage, we need to pay attention to the coal price and the operation of the plant in the field.