Daily Review of Urea: Companies 'willingness to chase higher weakens market price downward consolidation (May 20)

China Urea Price Index:

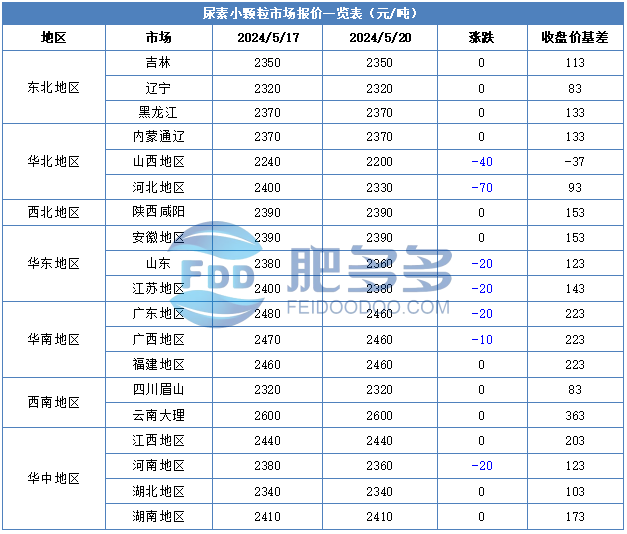

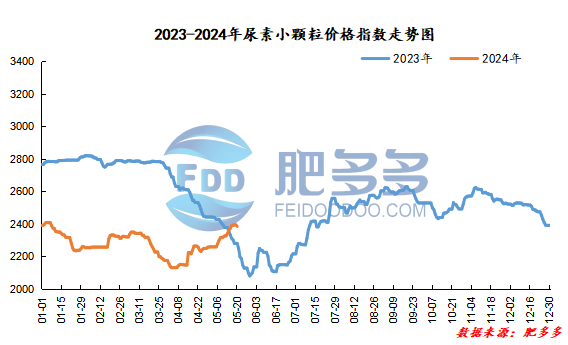

According to Feiduo data, the urea small pellet price index on May 20 was 2,384.41, a decrease of 9.55 from last Friday, a month-on-month decrease of 0.40% and a year-on-year increase of 4.58%.

Urea futures market:

Today, the opening price of the Urea UR409 contract: 2138, the highest price: 2238, the lowest price: 2091, the settlement price: 2162, and the closing price: 2237. The closing price increased by 91 compared with the settlement price of the previous trading day, up 4.24% month-on-month. The fluctuation range of the whole day is 2091-2238; the basis of the 09 contract in Shandong is 123; the 09 contract has increased its position by 13295 lots today, and so far, it has held 254399 lots.

Today, urea futures prices opened lower and moved higher. The fundamentals have not yet changed significantly. In the afternoon, they were mainly driven by geopolitical risks. Due to the continued high prices in the spot market, downstream willingness to receive goods has gradually decreased, and manufacturers 'quotations have been lowered slightly. However, there is still support from their own positive factors. In the short term, it is recommended to wait and see whether the spot market that has just cooled down can reignite positive feedback. It is also necessary to note that the futures price may come under pressure from the regulatory authorities again after it breaks and rises.

Spot market analysis:

Today, China's urea market price has been loosened and lowered. The market price has reached a high level. The willingness of operators to continue to chase higher prices has weakened, and companies have lowered their quotations and closed orders.

Specifically, prices in Northeast China have stabilized at 2,300 - 2,380 yuan/ton. Prices in East China fell to 2,350 - 2,400 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,340 - 2,450 yuan/ton, and the price of large particles fell to 2,300 - 2,370 yuan/ton. Prices in North China fell to 2,200 - 2,380 yuan/ton. Prices in South China fell to 2,440 - 2,490 yuan/ton. Prices in the northwest region are stable at 2,390 - 2,400 yuan/ton. Prices in Southwest China are stable at 2,300 - 2,750 yuan/ton.

Market outlook forecast:

In terms of factories, the transaction volume of new orders from manufacturers has slowed down after the increase in quotation prices. Currently, based on the support of pending orders, the quotation is firm and stable. Some companies have lowered prices to collect orders. Although there are a small number of transactions in the market, the overall follow-up situation is average, and the company's offers are large and stable. Move. In terms of the market, market prices have reached a high level, and downstream are temporarily stabilizing and waiting. Most of the positive factors have been released. The sentiment of industry operators to chase high has basically cooled down, and follow-up has slowed down significantly. The mood is cautious and waiting. The market has adjusted within a narrow range, and the market operation is clearly deadlocked. In terms of supply, there are still plans for equipment storage and maintenance this week. The market spot supply is still tight, and the market supply is limited. On the demand side, the downstream compound fertilizer factory is still in operation, but there is still just need. However, it is cautious about the current high purchase price in the market, and the sentiment of continuing to chase the price has slowed down. It has a wait-and-see attitude, and demand support is relatively limited.

On the whole, the current urea market price is at a high level, and the downstream market is not willing to continue to buy and increase. The market is deadlocked and has limited fluctuations. It is expected that the urea price will gradually decrease steadily in a short period of time. However, under the influence of tight supply, the price will be reduced. Limited.