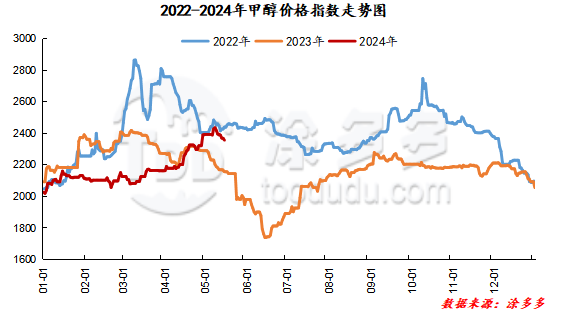

Methanol: Futures market hits new high, spot market stops falling and stabilizes

On May 17, the methanol market price index was 2377.77, up 14.98 from yesterday and 0.63 per cent from the previous month.

Outer disk dynamics:

Methanol closed on May 16:

China CFR 310-315USD / ton, Ping

Us FOB 92-93 cents per gallon, down 1 cent per gallon

Southeast Asian CFR 368-369 US dollars / ton, up 5 US dollars / ton

European FOB 302.5-303.5 euros / ton, flat.

Summary of today's prices:

Guanzhong: 2370-2380 (0), North Route: 2340-2370 (20), Lunan: 2560-2580 (20), Henan: 2500-2530 (10), Shanxi: 2380-2450 (0), Port: 28402865 (0)

Freight:

North-Shandong 200-260 (5thumb 0), North-South Shandong 280-310 (0max 0), South-North Shandong 270-310 (0max 0), Guanzhong-Southwest Shandong 220-280 (- 20 Compal 10)

Spot market: today, methanol market prices are arranged in a narrow range, and the futures market has risen sharply, boosting the mentality of operators to a certain extent, the port spot quotation has been adjusted with the market, and the trading atmosphere in the Chinese market has improved compared with the previous period. Bidding by manufacturers in the region is relatively smooth. Specifically, the market prices in the main producing areas are adjusted in a narrow range, and the quotation on the southern line revolves around 2310 yuan / ton, maintaining yesterday, while the quotation on the northern line revolves around 2340-2370 yuan / ton, the futures market fluctuates at a high level, the mentality of market operators has improved, and the bidding of manufacturers is relatively smooth. Market prices in Shandong, the main consumer area, have been raised in a narrow range, with 2560-2580 yuan / ton in southern Shandong and 2580-2620 yuan / ton in northern Shandong. Some downstream operators hold certain resistance to the current high prices, and the market transaction atmosphere is general. North China market quotation narrow adjustment, Hebei quotation 2510-2520 yuan / ton today, maintain yesterday, the downstream market demand performance is general, the overall market transaction atmosphere is general; Shanxi quotation today 2380-2450 yuan / ton, downstream manufacturers follow up mood is more cautious, rigid demand replenishment-based, the overall market transaction atmosphere is general.

Port market: methanol futures are higher today. Few near-end offers, rigid demand to follow up; in the morning forward a small number of high shipments, arbitrage delivery, the basis stabilized; afternoon buying active, the basis further strengthened. The overall transaction throughout the day is not bad. Taicang main Port transaction Price: spot / 5: 2895-2920, deal: 2775-2810, basis 09: 140Universe, basis: 2750-2780, basis: 09125Universe: 140Trache6, basis: 2710-2750, basis: 09,85Universe: 95Trache7, basis: 2680-2700, basis: 0950Universe 60.

|

Area |

2024/5/17 |

2024/5/16 |

Rise and fall |

|

The whole country |

2377.77 |

2362.79 |

14.98 |

|

Northwest |

2280-2380 |

2260-2380 |

20/0 |

|

North China |

2380-2520 |

2380-2520 |

0/0 |

|

East China |

2895-2930 |

2840-2880 |

55/50 |

|

South China |

2730-2850 |

2710-2820 |

20/30 |

|

Southwest |

2350-2650 |

2350-2620 |

0/30 |

|

Northeast China |

2550-2780 |

2550-2780 |

0/0 |

|

Shandong |

2560-2700 |

2540-2700 |

20/0 |

|

Central China |

2500-2750 |

2490-2750 |

10/0 |

Future forecast: in the near future, the overall profit situation of coal-to-methanol enterprises is good, and there are delays in equipment maintenance in some Chinese manufacturers, and with the restart of some parking devices in the early stage, the supply side of the market will be well supported or weakened in the later stage. in addition, with the recent unplanned parking of international devices, the arrival of imported shipments has decreased compared with the previous period, and the port market inventory continues to go to storage. At present, the port arbitrage space is opened again. The volume of domestic trade may increase narrowly next week. However, the follow-up of the terminal downstream market demand is limited, with the continuous increase of methanol prices in the previous period, the profits of the downstream industry have been compressed more obviously. at present, some olefin units have been stopped, Datang Duolun extended the second phase of Yulin of China Coal, Xingxing and other devices are parking, the demand side of methanol support continues to reduce, the traditional downstream market still gives priority to the rigid demand for methanol, the demand side of methanol support is difficult to improve significantly in the short term. Generally speaking, under the influence of the supply and demand game, the methanol market price is expected to continue to be weak next week, but we should pay attention to the coal price and the operation of the plant in the later stage.