After the holiday, market demand followed up and the urea industry continued to improve

Introduction: the urea market demand in May Day is better, the new order increment of the enterprise, the support of the enterprise to be issued after the festival, the follow-up of the market demand side is better, and under the influence of the expected reduction of supply, the manufacturers give priority to the price, and the quotation continues to be arranged steadily and upward.

Section I & Analysis of nbsp; Urea Price trend

The trend of Urea small Particle Price Index in 2024 from 1.1to nbsp;

The urea market rose steadily in April, with the implementation of the maintenance plans of some enterprises, the supply shrank, while the demand gradually improved, manufacturers shipped more pre-received orders, continued to go out of the warehouse, enterprises went to the warehouse obviously. Since then, although the transaction of the new order has gradually shrunk, most enterprises ship goods without pressure, the quotation is still relatively strong, and the quotations of some manufacturers are slightly loosened, and the market is stable.

As of April 30, 2024, China's urea small particle price index was 2258.77, down 7.51 per cent from the same period last year.

After the May Day holiday, agricultural rice fertilizer is replenished in stages, the demand is relatively limited, the replenishment mood is more wait-and-see, maintain a small amount of on-demand procurement; industrial compound fertilizer is in the peak season of high nitrogen fertilizer production, factory start-up is rising month-on-month, the procurement demand for raw materials is higher, the overall demand side support is strong, coupled with some devices are planned to enter the maintenance period, industry start-up is expected to decline, the formation of positive, to a certain extent, promote the price up.

As of May 13, 2024, China's urea small particle price index was 2340.45, down 1.56% from the same period last year.

Market price trend of 1.3 2024.4.1-2024.5.13

Looking at the trend chart of urea small particle price index from April 1 to May 13 this year, near the holiday, urea prices began to rise gradually; after the festival, urea prices continued to rise, rising continuously, and the overall high operation was maintained; after the festival, the market demand side continued to follow up, coupled with plant supply reduction, the formation of positive, market trading continued to improve, so that the overall focus of trading continued to move up.

Section II & Analysis of the supply situation of nbsp; Industry

2.1Nissan situation of nbsp;

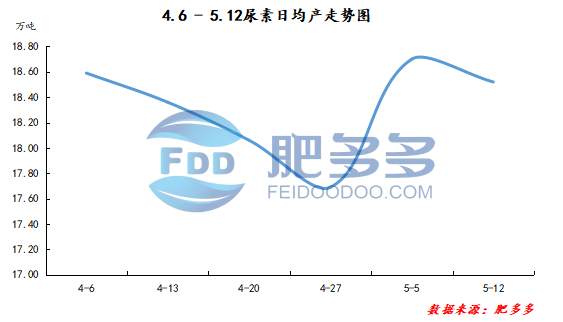

As of May 12 this year, China's daily urea output was about 185200 tons this year, up 1.57% from the same period in 2023. Nissan in the industry continued to decline before the festival, the plant was stopped and overhauled in April, and the average daily output of the industry showed a downward trend and resumed at the end of many months. The start-up of the plant in the festival has resumed, but the maintenance plan of the follow-up plant still exists, and Nissan may continue to show a downward trend.

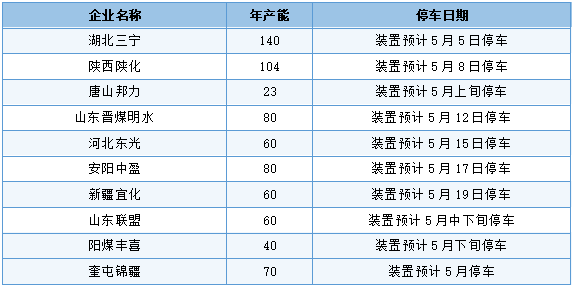

2.2 & maintenance of nbsp; equipment

This month, the equipment maintenance is not in a small amount, the maintenance devices are started one after another, Nissan shows a downward trend, the industry starts to decline, the short-term spot supply is tight, and the supply side is good for the price to rise within the month.

As of April 28, 2024, the operating rate of China's urea industry was about 81.70%, down 1.56% from the same period last year.

As of May 12, 2024, the operating rate of China's urea industry was about 85.52%, up 4.44% from the same period last year.

Section III & Analysis of nbsp; inventory

3. 1 enterprise inventory situation

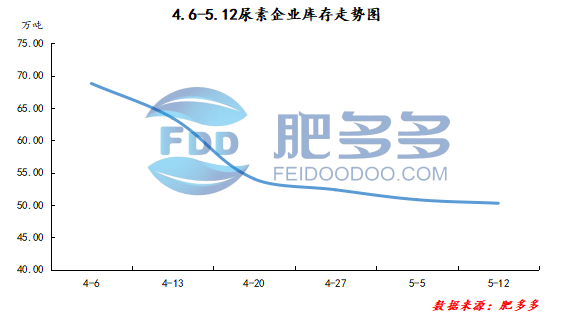

Before the festival, urea enterprises receive sufficient orders in advance, and enterprise inventory decreases one after another, coupled with the influence of plant production reduction, inventory goes down; after the festival, the demand is good, the downstream takes goods actively, the new order continues to follow up, and the enterprise inventory continues to go to the warehouse. Under the influence of demand reduction and increase, the current enterprise inventory is running at a low level.

As of May 12, 2024, the inventory of enterprises in China's urea industry was 502800 tons, 534600 tons less than the same period last year, and 51.53% lower than the same period last year.

3.2 Port inventory situation

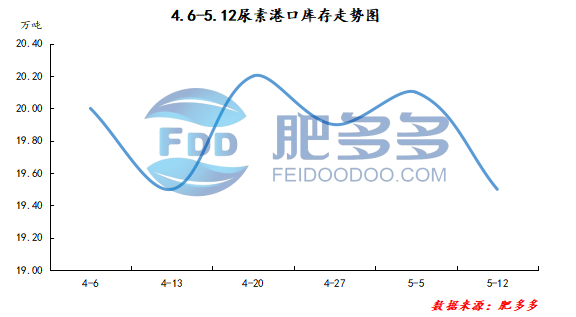

Export policy control still exists, the current international prices are low, the profit space of Chinese goods export is small, the willingness of enterprises to collect ports is small, and the port goods are arranged in a stable and small range.

As of May 12, 2024, the port inventory of China's urea industry was 195000 tons, an increase of 69000 tons over the same period last year, an increase of 54.76 percent over the same period last year. Among them, the inventory of large granular ports was 124000 tons, an increase of 99000 tons over the same period last year; the inventory of small granular ports was 71000 tons, a decrease of 30000 tons over the same period last year.

Section IV & Future Forecast of nbsp; Urea Market

Factory: the new order transaction volume of manufacturers is gradually reduced, and it is being carried out one after another, the sales pressure is not protruding temporarily, the quotation is stable and firm, and the spot supply of manufacturers in some mainstream areas is tight, giving priority to the current mentality.

Market: the transaction of new orders in the market is slowing down, the pursuit of highs is limited, the sentiment of trading is weakening, and the market is temporarily deadlocked.

Supply: the enterprise maintenance plan is approaching this month, the spot supply in the market is tight, the trend of industry start is declining, and Nissan is declining.

Demand: agricultural demand maintains rigid demand follow-up, a small amount of procurement is limited; industrial compound fertilizer plant is still in the summer high nitrogen fertilizer production period, procurement rigid demand follow up.