Methanol: Low inventories, strong basis support futures close at 2601, the Chinese market adjusts within a narrow range

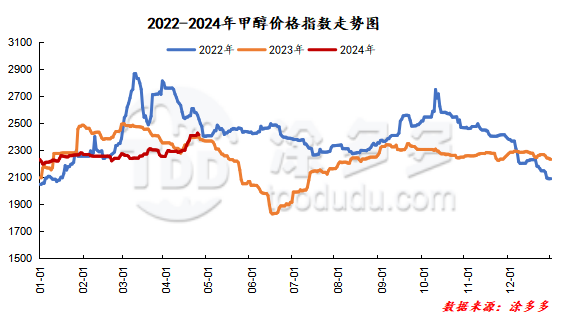

On May 13, the methanol market price index was 2467.67, 16.16 lower than the previous working day, and 0.65% lower than the previous working day.

Outer disk dynamics:

Methanol closed on May 10:

China's CFR ranges from US $350 to US $3100 per ton, up by US $1 per ton.

Us FOB 94-95 cents per gallon, flat

CFR in Southeast Asia: us $363,364 per ton, Ping

European FOB 301-302 euros / ton, up 0.25 euros / ton.

Summary of today's prices:

Guanzhong: 2380-2400 (- 20), North Route: 2370-2410 (20), Lunan: 2530-2550 (0), Henan: 2470-2510 (20), Shanxi: 2450-2530 (0), Port: 26802780 (0)

Freight:

North Line-210-250 North Shandong (0ax 0), North Line-South Shandong 280-310 (0max 0), South Line-North Shandong 260-300 (0max 10), Guanzhong-Southwest Shandong 220-290 (0max 0)

Spot market: today, the methanol market price shows a regional trend, the Chinese market adjusts narrowly, and the futures market is strong. Recently, the main producing areas of the Chinese market and some parking devices in Northeast China have returned to production, and the supply has increased narrowly compared with the previous period, but at present, the overall increment is limited, and some enterprises still have pre-order execution, the supply of negotiable goods in the market is still not much, and there is still support for the mentality of operators. Coupled with the substantial increase in the futures market, the basis remains relatively high. Specifically, the market price in the main producing areas is weak, with the southern quotation around 2380 yuan / ton, maintaining the last working day, and the northern quotation around 2370-2410 yuan / ton, and the Jiutai 2 million-ton plant is restarted. at present, the load is gradually increasing, and the supply in the field increases narrowly, but at present, the inventory level of enterprises is not high, some manufacturers still have pre-orders to be executed, and spot available resources are still tight, which has a certain support for the mentality of operators. Market prices in Shandong, the main consumer area, fell in a narrow range, with 2530 yuan / ton in southern Shandong and 2600-2630 yuan / ton in northern Shandong. At present, the downstream market is under serious pressure, there is a psychological resistance to high-priced supply, and the enthusiasm of entering the market to replenish goods is not high. The market quotation in North China is adjusted in a narrow range. Hebei quotation is 2560-2600 yuan / ton today, the downstream demand is depressed and weak, the market transaction atmosphere is weakening, some methanol enterprises operate at profit and delivery, and the market price is stable; Shanxi quotes 2450-2530 yuan / ton today, the new order trading volume of manufacturers is less, and the wait-and-see mood of operators is stronger.

Port market: methanol futures higher. Near-end cherish sales, long-term arbitrage shipments, the basis of the whole line to catch up; a small amount of high shipments in the afternoon, paper goods basis slightly down, near-end firm. The price difference in exchange has widened. The overall transaction is active. Taicang main port transaction price:; 5 deal: 2680-2750, basis 09: 145 160: 5 transaction: 2640-2720, base difference: 09: 100amp, 130x: 6, transaction: 2600-2660, basis difference: 0960max: 70

|

Area |

2024/5/13 |

2024/5/11 |

Rise and fall |

|

The whole country |

2467.67 |

2483.83 |

-16.16 |

|

Northwest |

2280-2410 |

2280-2410 |

0/0 |

|

North China |

2450-2600 |

2450-2600 |

0/0 |

|

East China |

2680-2760 |

2680-2760 |

0/0 |

|

South China |

2650-2750 |

2610-2750 |

40/0 |

|

Southwest |

2350-2620 |

2380-2620 |

-30/0 |

|

Northeast China |

2550-2780 |

2550-2800 |

0/-20 |

|

Shandong |

2530-2700 |

2530-2700 |

0/0 |

|

Central China |

2470-2780 |

2450-2780 |

20/0 |

Future forecast: in the near future, the overall inventory pressure in the Chinese market is not great, all the early parking devices have returned one after another, and the supply has increased narrowly compared with the previous period, but at present, the overall increment is limited, and some enterprises still have pre-order executions. the supply of negotiable goods in the market is still not much, and there is still support for the mentality of operators, but as methanol prices remain high, profits in downstream industries are further compressed. Some downstream operators hold certain resistance to the current high prices, and the overall enthusiasm for entering the market is limited. From the point of view of the port market, at present, the spot circulation in the port area is tight, and the futures market operates at a high level, but the spot market price forms a certain support. At present, the market supply and demand game or continued stalemate, methanol prices into a dilemma, methanol market trends are expected to be different in the short term, but in the later stage we should pay attention to coal prices and the operation of the plant.