PVC: Futures once again stepped on the prefix 6, running strong in the late session, and the spot market rose slightly at the beginning of the week

PVC futures analysis: may 13th V2409 contract opening price: 5989, highest price: 6052, lowest price: 5987, position: 914157, settlement price: 6019, yesterday settlement: 5997, down: 22, daily trading volume: 905916 lots, precipitated capital: 3.867 billion, capital inflow: 60.74 million.

List of comprehensive prices by region: yuan / ton

|

Area |

May eleventh |

May 13th |

Rise and fall |

Remarks |

|

North China |

5500-5580 |

5520-5580 |

20/0 |

Send to cash remittance |

|

East China |

5610-5730 |

5630-5730 |

20/0 |

Cash out of the warehouse |

|

South China |

5660-5750 |

5670-5770 |

10/20 |

Cash out of the warehouse |

|

Northeast China |

5450-5650 |

5410-5620 |

-40/-30 |

Send to cash remittance |

|

Central China |

5600-5670 |

5620-5670 |

20/0 |

Send to cash remittance |

|

Southwest |

5530-5640 |

5510-5640 |

-20/0 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction prices rose slightly, the spot market began to be OK at the beginning of the week. Compared with the valuation, it rose 20 yuan / ton in North China, 20 yuan / ton in East China, 10-20 yuan / ton in South China, 30-40 yuan / ton in Northeast China, 20 yuan / ton in Central China and 20 yuan / ton in Southwest China. The ex-factory prices of upstream PVC production enterprises tentatively rose by 20-50 yuan / ton, the prices of remote warehouses in some northwest regions rose synchronously, and the export quotations of some enterprises increased by 9 US dollars / ton. Futures are running strongly, and the spot market quotation is slightly higher than that of Saturday, and coexists with the spot price, but the basis of the spot price does not change much and has no advantage for the time being, including 09 contract in East China (350-380), 09 contract in South China-(250-280), 09 contract in North China-(550-600), and 09 contract in Southwest China-(400). Although spot market prices have risen slightly since the beginning of the week, merchants have expanded their profits. In order to strive for better transactions and inventory digestion, downstream upstream feedback on market prices is relatively flat.

From the perspective of futures: & the night price of the nbsp; PVC2409 contract rose slightly at the start of trading, and the price was pushed back to the prefix 6. After the start of the morning trading on Monday, the futures price was sorted out in a narrow range, and the afternoon price rose for the second time. 2409 contracts fluctuated in the range of 5987-6052 throughout the day, with a shortfall of 65. 09 contracts with an increase of 5790 positions, with 914157 positions so far, 2501 contracts closing at 6210 and 87843 positions.

PVC Future Forecast:

Futures: The futures price of PVC2409 contract once again stepped on the prefix of 6, especially the late trading price showed a trend of strong operation, and the price of increasing positions rose slightly. In terms of transaction, some bullish sentiment appeared again in terms of trading, which was 24.8% higher than that of short opening. The technical level showed that the three-track openings of Bollinger Belt (13, 13, 2) were all upward, which ended last week's three consecutive declines. The high point of the futures price is beginning to approach the upper track position again. The KD line at the daily line level shows a slight golden fork trend, while the MACD line shows an obvious golden fork trend. From the current time node, we still believe that the operation of futures prices is expected to be good, and observe the stability of the high range of 5970-6080 in the short term.

Spot: first of all, the overall cultural index of commodities strengthened today, and the main Chinese futures contracts closed up and down at midday. The container transportation index (European line) rose by more than 14%, manganese and silicon by more than 6%, and iron ore, vegetable oil, methanol and No. 20 glue (NR) by more than 2%. In terms of decline, lithium carbonate fell by more than 2%, and fuel oil and coking coal fell by more than 1%. But the overall plasticizing plate performance is strong today, PVC prices in the two cities rose slightly, PVC fundamentals, the cost of port calcium carbide prices rose 50-100 yuan / ton, calcium carbide cost support is obvious. There is no obvious change in supply and demand, the start-up load of PVC plant is stable, the feedback from the upstream and downstream of the price on the demand side is mediocre, and the follow-up mood is insufficient, and although there are expectations in the two cities of PVC over time, the pace of spot procurement has not improved, and social inventory remains high. Although the fundamentals of PVC have become a weak consensus, the two cities are still out of certain expectations after testing low levels for a long time, so the spot market of PVC may be slightly stronger in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

May 10th |

May 13th |

Rate of change |

|

V2409 collection |

5986 |

6043 |

57 |

|

|

Average spot price in East China |

5660 |

5680 |

20 |

|

|

Average spot price in South China |

5695 |

5720 |

25 |

|

|

PVC2409 basis difference |

-326 |

-363 |

-37 |

|

|

V2501 collection |

6151 |

6201 |

50 |

|

|

V2409-2501 close |

-165 |

-158 |

7 |

|

|

PP2409 collection |

7540 |

7584 |

44 |

|

|

Plastic L2409 |

8441 |

8480 |

39 |

|

|

V--PP basis difference |

-1554 |

-1541 |

13 |

|

|

Vmure-L basis difference of plastics |

-2455 |

-2437 |

18 |

|

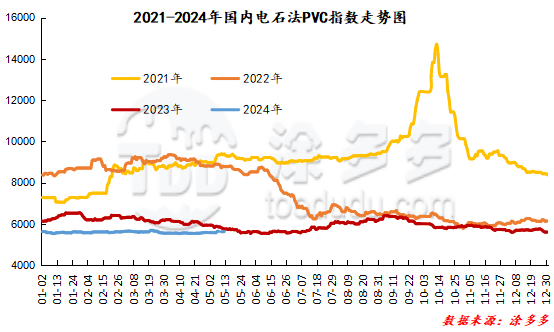

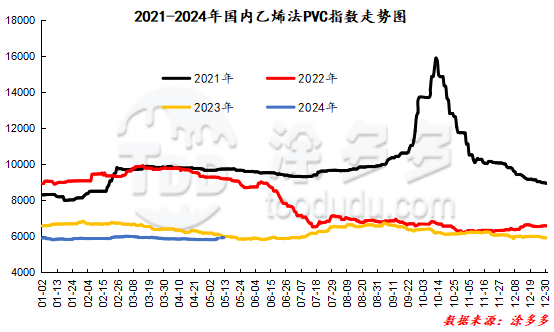

China PVC Index: according to Tudou data, the Chinese calcium carbide PVC spot index rose 6.54, or 0.116%, to 5638.06 on May 13. The ethylene PVC spot index was 5915.64, down 15, with a range of 0.253%. The calcium carbide index rose, the ethylene index fell, and the ethylene-calcium carbide index spread was 277.58.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

Yesterday's warehouse order quantity |

Today's warehouse order volume |

Increase or decrease |

|

Polyvinyl chloride |

China Reserve shares |

2,569 |

2,845 |

276 |

|

|

Large-scale reserve |

240 |

240 |

0 |

|

|

Guangzhou materials |

1,259 |

1,535 |

276 |

|

|

The central reserve is near the port |

255 |

255 |

0 |

|

|

China Central Reserve Nanjing |

815 |

815 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

2,571 |

2,571 |

0 |

|

|

Zhenjiang Middle and far Sea |

919 |

919 |

0 |

|

|

Shanghai Zhongyuan Sea |

601 |

601 |

0 |

|

|

Middle and far sea in Jiangyin |

1,051 |

1,051 |

0 |

|

Polyvinyl chloride |

Zhejiang 837 |

60 |

60 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

1,760 |

1,760 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,004 |

1,004 |

0 |

|

Polyvinyl chloride |

Shanghai-Hong Kong logistics |

615 |

615 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

5,285 |

5,285 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

10,260 |

10,888 |

628 |

|

Polyvinyl chloride |

Pinghu Huarui |

1,972 |

2,230 |

258 |

|

Polyvinyl chloride |

Hangzhou port logistics |

783 |

783 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

5,035 |

5,035 |

0 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

850 |

850 |

0 |

|

Polyvinyl chloride |

Chuanhua mandarin |

379 |

379 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

900 |

900 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

600 |

600 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

900 |

900 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

600 |

600 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

0 |

1,000 |

1,000 |

|

Polyvinyl chloride |

Sinotrans East China |

1,560 |

1,560 |

0 |

|

Polyvinyl chloride |

Zhejiang Jiahua |

300 |

300 |

0 |

|

PVC subtotal |

|

39,887 |

42,049 |

2,162 |

|

Total |

|

39,887 |

42,049 |

2,162 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.