PVC: Futures continued to rise at high levels and broke through again. Technical breaks twice, and the spot market continues to improve

PVC futures analysis: may 8th V2409 contract opening price: 6035, highest price: 6078, lowest price: 6013, position: 936544, settlement price: 6044, yesterday settlement: 5997, up: 47, daily trading volume: 1062169 lots, precipitated capital: 3.947 billion, capital outflow: 752.8 billion.

List of comprehensive prices by region: yuan / ton

|

Area |

May 7th |

May 8th |

Rise and fall |

Remarks |

|

North China |

5490-5550 |

5550-5610 |

60/60 |

Send to cash remittance |

|

East China |

5600-5760 |

5650-5760 |

50/0 |

Cash out of the warehouse |

|

South China |

5650-5750 |

5680-5780 |

30/30 |

Cash out of the warehouse |

|

Northeast China |

5450-5650 |

5480-5680 |

30/30 |

Send to cash remittance |

|

Central China |

5600-5670 |

5640-5710 |

40/40 |

Send to cash remittance |

|

Southwest |

5530-5650 |

5580-5670 |

50/20 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction prices continue to rise, the market atmosphere is good. Compared with the valuation, it rose by 60 yuan / ton in North China, 50-70 yuan / ton in East China, 30 yuan / ton in South China, 30 yuan / ton in Northeast China, 40 yuan / ton in Central China and 20-50 yuan / ton in Southwest China. Upstream PVC production enterprises factory prices yesterday did not rise today, the range is concentrated in 30-50-70 yuan / ton, production enterprises offer actively, there is a certain amount of contract signing, but a generation of businessmen still have a wait-and-see mentality. The high point of futures has broken through again, the spot market has warmed up, and the price offers of merchants in various regions have been raised again. After the operation of high futures prices, the supply of point prices has no price advantage, but the two quotation methods coexist and the basis is maintained in the early stage. Among them, East China basis offer 09 contract-(350-370), South China 09 contract-(250-270), North 09 contract-(550-600), Southwest 09 contract-(400). On the whole, although the quotation continues to rise, there is little support for high-price offers in the market, some of which are negotiated in a small way, and the purchasing enthusiasm in the lower reaches is not high.

From the perspective of futures: & the night price of the nbsp; PVC2409 contract continues to fluctuate in a narrow range, and the direction of the price is not clear. After the beginning of morning trading, futures prices continued to show upward performance on the basis of night trading, and afternoon prices weakened from their highs and gave up some of their gains. 2409 contracts fluctuated in the range of 6013-6078 throughout the day, with a shortfall of 65. 09 contracts by 16117 positions, with 936548 positions so far, 2501 contracts closing at 6179 and 936548 positions.

PVC Future Forecast:

Futures: The high point of the PVC2409 contract futures price once again showed the performance before the breakthrough, and the overall fluctuation range was within the high range, but the market showed a certain trend of position reduction compared with yesterday. In terms of transaction, more than 23.4% of which was more than 21.6% of the short opening, which was also the main reason for the upside of the early trading price, but some positions were closed in the afternoon. Caused the futures price to give up some of the increase. The technical level shows that the opening of the third track of the Bolin belt (13, 13, 2) diverges, and the price breaks through the upper track for the second time, but there is a negative column with a long shadow line throughout the day, and a certain empty force appears on the disk. In the short term, the operation of futures prices continues to observe the stability and persistence of the high range of 5970-6100.

Spot aspect: & the high point of the price operation of the two cities in the nbsp; period also continues to show a high-level rising situation. Merchants in various regions of the spot market are more enthusiastic in quotation, but the downstream reception of high prices in Chengdu is not good, a small number of transactions and there is a certain profit margin, downstream products enterprises are mainly procurement. Looking at the current two cities, from the time node, although the upward price of the two cities is more inclined to the property market policy, the macro policy in the third quarter belongs to the stage of strength according to experience. therefore, the overall market has certain expectations in this period of time in a comprehensive rhythm. In the outer disk, oil prices fell as the US Energy Information Administration (EIA) raised its global oil production forecast for this year and lowered its demand forecast, suggesting that the market is well supplied and market merchants are focused on the latest US inventory data. On the whole, we believe that the PVC spot market can fluctuate narrowly at a new level in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

May 7th |

May 8th |

Rate of change |

|

V2409 collection |

6032 |

6021 |

-11 |

|

|

Average spot price in East China |

5680 |

5705 |

25 |

|

|

Average spot price in South China |

5700 |

5730 |

30 |

|

|

PVC2409 basis difference |

-352 |

-316 |

36 |

|

|

V2501 collection |

6185 |

6179 |

-6 |

|

|

V2409-2501 close |

-153 |

-158 |

-5 |

|

|

PP2409 collection |

7593 |

7567 |

-26 |

|

|

Plastic L2409 |

8503 |

8490 |

-13 |

|

|

V--PP basis difference |

-1561 |

-1546 |

15 |

|

|

Vmure-L basis difference of plastics |

-2471 |

-2469 |

2 |

|

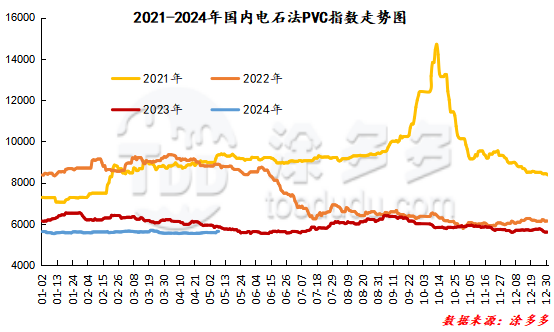

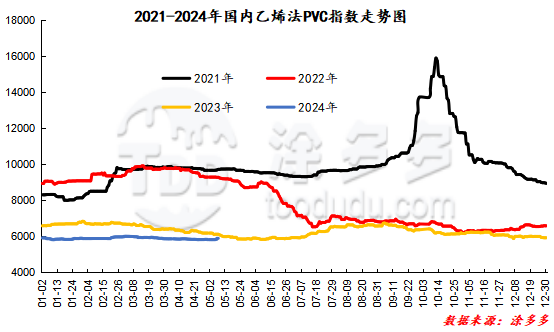

China PVC Index: according to Tudor data, the spot index of China's calcium carbide PVC rose 21.47, or 0.38%, to 5666.10 on May 8. The ethylene PVC spot index was 5942.82, up 50.53, or 0.858%, the calcium carbide index rose, the ethylene index rose, and the ethylene-calcium carbide index spread was 276.72.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

5.7 warehouse order volume |

5.8 warehouse order volume |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,335 |

2,513 |

178 |

|

|

Large-scale reserve |

240 |

240 |

0 |

|

|

Guangzhou materials |

1,090 |

1,203 |

113 |

|

|

The central reserve is near the port |

190 |

255 |

65 |

|

|

China Central Reserve Nanjing |

815 |

815 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

2,154 |

2,571 |

417 |

|

|

Zhenjiang Middle and far Sea |

561 |

919 |

358 |

|

|

Shanghai Zhongyuan Sea |

601 |

601 |

0 |

|

|

Middle and far sea in Jiangyin |

992 |

1,051 |

59 |

|

Polyvinyl chloride |

Zhejiang 837 |

60 |

60 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

1,640 |

1,640 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

904 |

904 |

0 |

|

Polyvinyl chloride |

Shanghai-Hong Kong logistics |

415 |

615 |

200 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

5,257 |

5,257 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

8,004 |

9,332 |

1,328 |

|

Polyvinyl chloride |

Pinghu Huarui |

1,515 |

1,515 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

304 |

544 |

240 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

5,035 |

5,035 |

0 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

618 |

850 |

232 |

|

Polyvinyl chloride |

Chuanhua mandarin |

379 |

379 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

600 |

600 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

1,560 |

1,560 |

0 |

|

Polyvinyl chloride |

Zhejiang Jiahua |

0 |

300 |

300 |

|

PVC subtotal |

|

31,914 |

34,809 |

2,895 |

|

Total |

|

31,914 |

34,809 |

2,895 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.