Daily Review of Urea: Positive demand supports the continuous increase in corporate quotations (May 8)

China Urea Price Index:

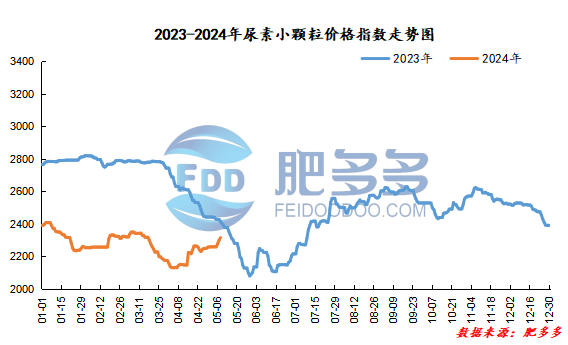

According to calculations from Feiduo data, the urea small pellet price index on May 8 was 2,315.27, an increase of 16.05 from yesterday, a month-on-month increase of 0.70% and a year-on-year decrease of 4.11%.

Urea futures market:

Today, the opening price of the Urea UR409 contract is 2120, the highest price is 2125, the lowest price is 2095, the settlement price is 2112, and the closing price is 40% lower than the settlement price of the previous trading day, down 1.85% month-on-month. The fluctuation range of the whole day is 2095-2125; the basis of the 09 contract in Shandong is 191; the 09 contract has increased its position by 2158 lots today, and so far, it has held 240623 lots.

Urea futures prices have fallen sharply, more due to the cooling of emotions affected by upper-level control. There has been no significant shift in fundamentals. Short-term urea futures prices are expected to remain high and mainly volatile.

Spot market analysis:

Today, China's urea market prices continued to increase steadily and moderately. Due to its strong fundamentals, corporate quotations continued to increase.

Specifically, prices in Northeast China rose to 2,190 - 2,250 yuan/ton. Prices in East China rose to 2,290 - 2,340 yuan/ton. The price of small and medium-sized particles in Central China rose to 2,300 - 2,420 yuan/ton, and the price of large particles fell to 2,260 - 2,310 yuan/ton. Prices in North China rose to 2,170 - 2,320 yuan/ton. Prices in South China rose to 2,350 - 2,480 yuan/ton. Prices in Northwest China rose to 2,280 - 2,290 yuan/ton. Prices in Southwest China rose to 2,260 - 2,650 yuan/ton.

Market outlook forecast:

In terms of factories, manufacturers continue to ship goods in advance. Recently, corporate inventories have continued to be removed from the warehouse, which is at a low level during the same period. A small number of new orders have been followed up, and the actual transaction focus continues to rise. In terms of the market, the market trading atmosphere is relatively active, and low-priced supplies have been gradually decreasing. Under the influence of the policy of ensuring supply and stabilizing prices, the trading sentiment on the floor has been slightly cautious. The news affects the mentality, and the market waits and waits to organize. In terms of supply, the industry's average daily output has increased month-on-month recently, remaining above 180,000 tons. However, some units have plans to enter the maintenance period recently, and the industry may start to start a decline. In terms of demand, farming has entered the peak season, and the agricultural market has strong demand, and fertilizer preparation has been followed up one after another; industrial compound fertilizers are in the peak season of high nitrogen fertilizer production, and factory start-ups have increased month-on-month. The demand for raw material procurement is high, and demand support still exists.

On the whole, the downstream of the urea market continues to need to follow up, causing the focus of market transactions to continue to move upward. However, the industry is cautious and the main focus is on prudent operations. It is expected that the urea market price will be stable and small in a short period of time, and there is limited room for price growth.