Daily review of urea: Corporate inventories continue to be low and prices are strong and the momentum still exists (April 29)

China Urea Price Index:

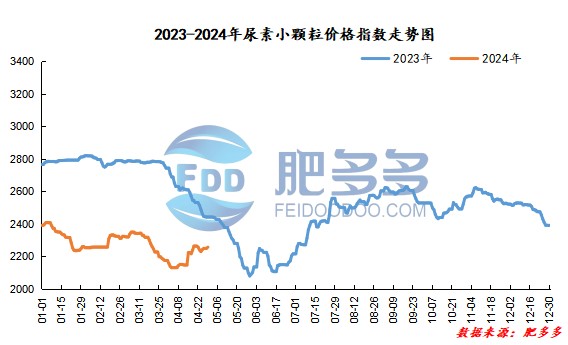

According to Feiduo data, the urea small pellet price index on April 29 was 2,256.95, an increase of 6.82 from yesterday, a month-on-month increase of 0.30% and a year-on-year decrease of 7.59%.

Urea futures market:

Today, the opening price of the urea UR409 contract is 2075, the highest price is 2091, the lowest price is 2053, the settlement price is 2073, and the closing price is 2079. The closing price is 3.3 higher than the settlement price of the previous trading day, up 0.14% month-on-month. The fluctuation range of the whole day is 2053-2091; the basis of the 09 contract in Shandong is 161; the 09 contract has reduced its position by 14 lots today, and so far, the position is 235018 lots.

Spot market analysis:

Today, China's urea market prices continue to increase. Companies received better orders in the previous round, with no pressure on shipments, and current quotations are mostly stable.

Specifically, prices in Northeast China have stabilized at 2,160 - 2,230 yuan/ton. Prices in East China have stabilized at 2,240 - 2,280 yuan/ton. The price of small and medium-sized particles in Central China has stabilized at 2,250 - 2,350 yuan/ton, and the price of large particles has stabilized at 2,260 - 2,290 yuan/ton. Prices in North China rose to 2,120 - 2,230 yuan/ton. Prices in South China rose to 2,300 - 2,410 yuan/ton. Prices in Northwest China rose to 2,170 - 2,180 yuan/ton. Prices in Southwest China are stable at 2,180 - 2,550 yuan/ton.

Market outlook forecast:

In terms of factories, most of the manufacturers 'orders have been fully received during the holidays. Currently, sales pressure has eased, quotations have remained stable and firm, and there is little willingness to adjust prices. Most of the quotations have been stable and consolidated, and some have been consolidated slightly. In terms of the market, after the previous round of large orders acquisitions, the current trading atmosphere has slowed down compared with the previous period, the price increase has stabilized, and the market has become weak and consolidated. In terms of supply, urea companies continue to maintain a high operating rate, and the daily output is also above 180,000 tons. The current company's inventory is still low and is gradually recovering. On the demand side, downstream users just need to buy, and most of the pre-purchase orders have been followed up. Currently, they are mainly cautious about replenishing goods with the high market mentality.

On the whole, the current urea factory continues to implement advance receipts in the early stage, and the downstream just needs to make up a small amount of follow-up. The company's inventories continue to be low, and the market price still has high and strong momentum. It is expected that the urea market price will remain stable and slightly fluctuate in the short term.