PVC: Futures finally broke through the late session and continued to rise. Spot rose slightly.

PVC futures analysis: April 26th V2409 contract opening price: 5918, highest price: 5980, lowest price: 5902, position: 917325, settlement price: 5937, yesterday settlement: 5907, up: 30, daily trading volume: 957913 lots, precipitated capital: 3.839 billion, capital inflow: 29.79 million.

List of comprehensive prices by region: yuan / ton

|

Area |

April twenty _ fifth |

April 26th |

Rise and fall |

Remarks |

|

North China |

5450-5520 |

5450-5540 |

0/20 |

Send to cash remittance |

|

East China |

5550-5660 |

5580-5680 |

30/20 |

Cash out of the warehouse |

|

South China |

5580-5620 |

5610-5660 |

30/40 |

Cash out of the warehouse |

|

Northeast China |

5400-5600 |

5400-5600 |

0/0 |

Send to cash remittance |

|

Central China |

5530-5580 |

5550-5600 |

20/20 |

Send to cash remittance |

|

Southwest |

5420-5640 |

5470-5640 |

50/0 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction prices rose slightly, the spot market prices showed a certain upward performance. Compared with the valuation, North China rose 20 yuan / ton, East China 20-30 yuan / ton, South China 30-40 yuan / ton, Northeast China stable, Central China 20 yuan / ton, Southwest China 50 yuan / ton. The ex-factory prices of upstream PVC production enterprises tentatively increased by 20-50 yuan per ton, including off-site warehouse prices. Some enterprises are still stable prices wait and see. The futures price rose relatively obviously in the late afternoon, and the spot market price rose slightly compared with yesterday, and the spot price advantage decreased after the price went up, but there was still a basis offer, and the point price base did not change much. Among them, East China basis offer 09 contract-(280-330), South China 09 contract-(250-280), North 09 contract-(550-600), Southwest 09 contract-(400). Downstream cautious rigid demand replenishment, the spot market low-price supply is reduced, but the downstream procurement enthusiasm is general, the overall transaction is weak.

From the perspective of futures: & the night price of the nbsp; PVC2409 contract is mainly arranged in a narrow range, and the direction of the futures price is not clear. After the start of morning trading, futures prices rose slightly, the trend was slightly stronger, and prices rose further in late afternoon trading. 2409 contracts range from 5902 to 5980 throughout the day, with a difference of 78. 09 contracts reducing 2108 positions, so far 917325 positions, 05 contracts closing 5797, positions 85318.

PVC Future Forecast:

Futures: & the intraday price of nbsp; PVC2409 contract futures showed a significant rise, especially the peak of the late trading price once reached 5980, which is no different from the high point in our previous forecast. First of all, the futures price did not stop rising in late trading, and in terms of transactions, it opened 23.9% more than the empty open 23.2%. Secondly, the fluctuation of the futures price finally put an end to the trend of low horizontal trading, and there was a rise that broke through the middle track. The daily KD line and MACD line showed a golden fork trend. The overall commodity index performed better, the cultural goods index rose, and the main Chinese futures contract rose more and fell less in the afternoon close. As a whole, the operation of futures prices in the short term may enter a new shock stage, and observe the stability of the high range of 5950-6020.

Spot aspect: futures and cash markets perform relatively well today. On the one hand, the horizontal market has ended, and the spot market has also seen a certain tentative rise. Both production enterprises and traders have adjusted behavior, but the downstream feedback is relatively insipid. In the face of the rising market price acceptance is not high. At present, there are not many variables in the supply and demand level, and the rise in futures prices tends to follow the overall commodity index, so the support from fundamentals is relatively limited. In the outer disk, international oil prices rose as Israel stepped up its air strikes on Rafah in Gaza and the market worried that supplies in the Middle East would be affected. In addition, the sharp decline in US crude oil inventories is better than the oil market. With Israel likely to start attacking Rafah in southern Gaza, fighting between Israel and Hamas in the Gaza Strip is expected to expand, which could increase the likelihood of a broader war that could disrupt oil supplies in the Middle East. On the whole, the operation of the spot market may follow into a new adjustment band in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

April twenty _ fifth |

April 26th |

Rate of change |

|

V2409 collection |

5918 |

5978 |

60 |

|

|

Average spot price in East China |

5605 |

5630 |

25 |

|

|

Average spot price in South China |

5600 |

5635 |

35 |

|

|

PVC2409 basis difference |

-313 |

-348 |

-35 |

|

|

V2501 collection |

6067 |

6128 |

61 |

|

|

V2409-2501 close |

-149 |

-150 |

-1 |

|

|

PP2409 collection |

7568 |

7626 |

58 |

|

|

Plastic L2409 |

8364 |

8454 |

90 |

|

|

V--PP basis difference |

-1650 |

-1648 |

2 |

|

|

Vmure-L basis difference of plastics |

-2446 |

-2476 |

-30 |

|

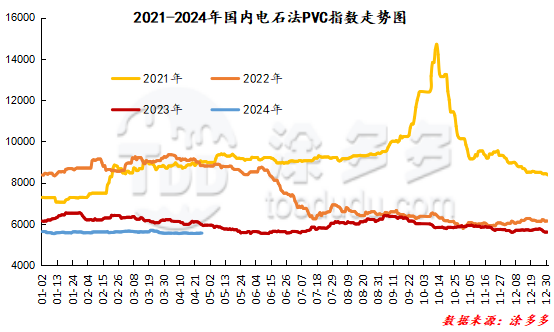

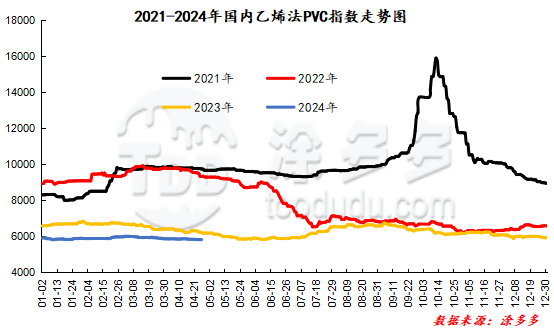

China PVC Index: according to Tuduoduo data, China calcium Carbide PVC spot index rose 21.95% to 5581.69 on April 26th, a range of 0.395%. The ethylene method PVC spot index is 5822.19, down 0, the range is 0%, the calcium carbide method index rises, the ethylene method index is stable, and the ethylene method-calcium carbide method index spread is 240.5.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

4.25 warehouse orders |

4.26 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,159 |

2,159 |

0 |

|

|

Large-scale reserve |

240 |

240 |

0 |

|

|

Guangzhou materials |

1,090 |

1,090 |

0 |

|

|

The central reserve is near the port |

118 |

118 |

0 |

|

|

China Central Reserve Nanjing |

711 |

711 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

1,796 |

1,859 |

63 |

|

|

Zhenjiang Middle and far Sea |

396 |

396 |

0 |

|

|

Shanghai Zhongyuan Sea |

471 |

471 |

0 |

|

|

Middle and far sea in Jiangyin |

929 |

992 |

63 |

|

Polyvinyl chloride |

Zhejiang 837 |

60 |

60 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

1,496 |

1,496 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

784 |

784 |

0 |

|

Polyvinyl chloride |

Shanghai-Hong Kong logistics |

415 |

415 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

4,905 |

4,905 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

6,094 |

6,094 |

0 |

|

Polyvinyl chloride |

Pinghu Huarui |

1,228 |

1,228 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

184 |

184 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

4,001 |

4,001 |

0 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

518 |

518 |

0 |

|

Polyvinyl chloride |

Chuanhua mandarin |

379 |

379 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

150 |

150 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

1,560 |

1,560 |

0 |

|

PVC subtotal |

|

26,863 |

26,926 |

63 |

|

Total |

|

26,863 |

26,926 |

63 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.