Daily Review of Urea: Tight spot supply of enterprises boosts market trading atmosphere (April 25)

China Urea Price Index:

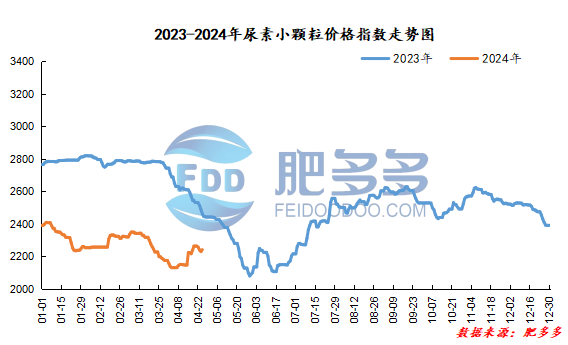

According to Feiduo data, the urea small pellet price index on April 25 was 2,241.50, an increase of 11.82 from yesterday, a month-on-month increase of 0.53% and a year-on-year decrease of 8.97%.

Urea futures market:

Today, the opening price of the Urea UR409 contract is 2074, the highest price is 2098, the lowest price is 2059, the settlement price is 2079, and the closing price is 2082. The closing price has increased by 32 compared with the settlement price of the previous trading day, up 1.56% month-on-month. The fluctuation range of the whole day is 2059-2098; the basis of the 09 contract in Shandong is 148; the 09 contract has reduced its position by 832 lots today, and so far, it has held 246370 lots.

Spot market analysis:

Today, China's urea market prices rose again. After low-price transactions increased, companies 'inventories decreased. Under the tight spot supply situation, today's ex-factory quotations increased.

Specifically, prices in Northeast China have stabilized at 2,160 - 2,230 yuan/ton. Prices in East China rose to 2,220 - 2,260 yuan/ton. The price of small and medium-sized particles in Central China rose to 2,200 - 2,350 yuan/ton, and the price of large particles rose to 2,200 - 2,230 yuan/ton. Prices in North China rose to 2,100 - 2,230 yuan/ton. Prices in South China rose to 2,320 - 2,370 yuan/ton. Prices in the northwest region are stable at 2,100 - 2,170 yuan/ton. Prices in Southwest China are stable at 2,180 - 2,550 yuan/ton.

Market outlook forecast:

In terms of factories, after market prices began to loosen and lower this week, some factories have increased their number of new orders, and the pressure to collect orders on May Day has eased. Currently, they have a good mentality and are mainly holding prices. Coupled with the current low inventory of enterprises, some manufacturers have shown a reluctance to sell. Today's quotations are adjusted upwards. In terms of the market, driven by the improvement in orders received by factories in the main production and marketing area, the market trading atmosphere has improved. Low-priced supplies have decreased and inventories have been low. Some factories have increased their quotations, and some have stopped collecting, which has boosted the atmosphere in the market. On the supply side, early equipment maintenance has been resumed one after another, and production has rebounded. However, the company's inventory has decreased slightly. In addition, there is not a small number of planned equipment maintenance in the later period, which has provided a positive impact on the supply side to a certain extent. On the demand side, downstream storage companies are just in need of stock, and driven by the on-site trading atmosphere, downstream compound fertilizer factories and traders follow up in a timely and appropriate manner.

Overall, the current urea market is rising again driven by low inventories and equipment maintenance plans. It is expected that the urea market price will increase more in the short term with changes in inventories.