Daily Review of Urea: Manufacturers continue to cut prices and collect orders as the May Day holiday approaches (April 24)

China Urea Price Index:

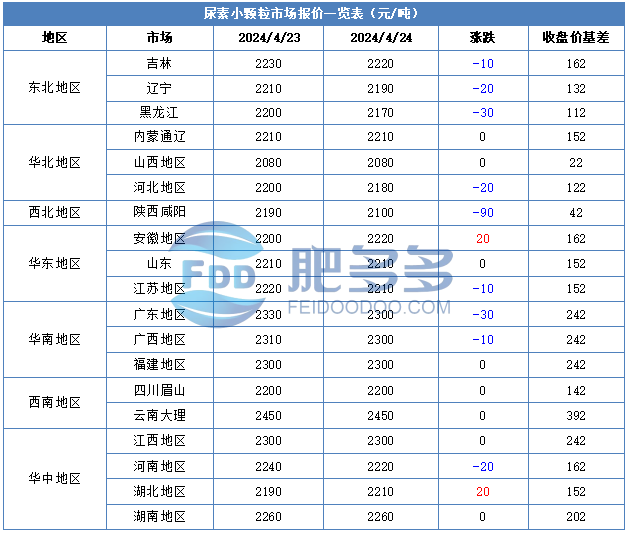

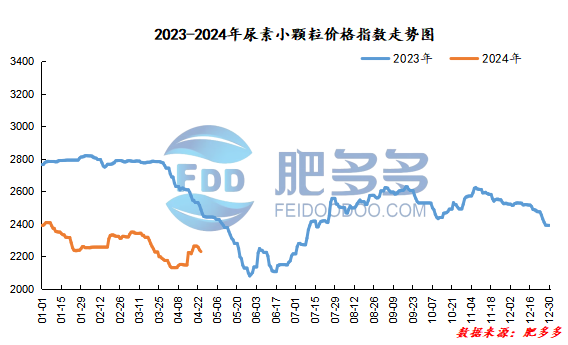

According to Feiduo data, the urea small pellet price index on April 24 was 2,229.68, a decrease of 10.00 from yesterday, a month-on-month decrease of 0.45% and a year-on-year decrease of 10.41%.

Urea futures market:

Today, the opening price of the Urea UR409 contract is 2026, the highest price is 2064, the lowest price is 2023, the settlement price is 2050, and the closing price is 2058. The closing price is 44% higher than the settlement price of the previous trading day, up 2.18% month-on-month. The fluctuation range of the whole day is 2023-2064; the basis of the 09 contract in Shandong is 152; the 09 contract has increased its position by 2322 lots today, and so far, the position is 247202 lots.

Spot market analysis:

Today, China's urea market prices continue to be weak and sorted downwards. Companies are shipping early orders one after another. The May Day holiday is approaching, and many quotations have been lowered.

Specifically, prices in Northeast China fell to 2,160 - 2,230 yuan/ton. Prices in East China fell to 2,200 - 2,220 yuan/ton. The price of small and medium-sized particles in Central China rose to 2,200 - 2,350 yuan/ton, and the price of large particles fell to 2,200 - 2,220 yuan/ton. Prices in North China fell to 2,080 - 2,230 yuan/ton. Prices in South China fell to 2,280 - 2,320 yuan/ton. Prices in Northwest China fell to 2,100 - 2,170 yuan/ton. Prices in Southwest China fell to 2,180 - 2,550 yuan/ton.

Market outlook forecast:

In terms of factories, manufacturers continue to implement advance orders. With the continuous downward adjustment of market prices this week, most companies follow up on price adjustments. In addition, the May Day holiday is approaching, manufacturers 'demand for orders has increased. In order to increase advance receipts, prices have been reduced to collect orders, and short-term quotations are expected to be lowered. In terms of the market, the follow-up of new orders in the market is weak, and the trading atmosphere for new orders is general. The current export news is currently positive and there is no support, which has weakened the impact on the price trend of the Chinese market. On the supply side, some pre-maintenance units have resumed and restarted. The industry's daily output has shown an upward trend for a short time, and the operating rate has rebounded to more than 80%. The current supply and demand fundamentals continue to be loose. On the demand side, China's demand is highly resistant to high market prices. The follow-up pace of downstream purchases has slowed down, and most of the small orders just need to be followed up. As prices continue to be lowered, follow-up and improvement may occur in the later period. Specific changes in price declines.

On the whole, the supply and demand in the urea market have returned to a loose state. The May Day holiday is approaching, and companies have insufficient receipts and over-adjusted prices. There is still room for downward adjustment in current prices. It is expected that urea market prices will continue to be lowered in a short period of time.