PVC: Futures rose significantly in early trading, with positions on the market being lightened, and spot prices tentatively increased slightly

PVC futures analysis: April 22nd V2409 contract opening price: 5869, highest price: 5940, lowest price: 5866, position: 834552, settlement price: 5912, yesterday settlement: 5902, up: 10, daily trading volume: 796684 lots, precipitated capital: 3.455 billion, capital outflow: 66.77 million.

List of comprehensive prices by region: yuan / ton

|

Area |

April nineteenth |

April 22nd |

Rise and fall |

Remarks |

|

North China |

5450-5520 |

5470-5540 |

20/20 |

Send to cash remittance |

|

East China |

5510-5600 |

5550-5630 |

40/30 |

Cash out of the warehouse |

|

South China |

5580-5630 |

5580-5630 |

0/0 |

Cash out of the warehouse |

|

Northeast China |

5400-5600 |

5400-5600 |

0/0 |

Send to cash remittance |

|

Central China |

5530-5580 |

5550-5590 |

20/10 |

Send to cash remittance |

|

Southwest |

5420-5610 |

5420-5640 |

0/30 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction prices are mainly sorted out slightly, and prices in some areas are trying to rise slightly. Compared with the valuation, North China rose 20 yuan / ton, East China increased 30-40 yuan / ton, South China and Northeast China were stable, Central China rose 10-20 yuan / ton, and Southwest China increased 30 yuan / ton. The ex-factory price of upstream PVC production enterprises happened to be not significantly adjusted on Monday, although the futures futures price was strong, but most of the production enterprises were wait-and-see and there were few contracts signed on Monday. The price of traders in each region changed little, but the high price was blocked, some of the transactions were negotiated slightly, and the advantage of the basis offer declined after the price went up, and most merchants turned to 09 contracts. Among them, East China basis offer 09 contract-(330), South China 09 contract-(280), North 09 contract-(600), Southwest 09 contract-(400). On the whole, the purchasing enthusiasm of the downstream is not high, most of them give priority to the consumption of raw material inventory, and the spot purchasing enthusiasm is low.

Futures point of view: PVC2409 contract on Friday night trading prices rose slightly after the shock, the overall night trading did not see an obvious trend of change. Futures prices rose significantly after the start of morning trading on Monday, hitting a high of 5940, mainly in the afternoon. 2409 contracts fluctuated in the range of 5866-5940 throughout the day, with a shortfall of 20463 positions in 74 and 09 contracts. So far, 834552 positions were held, 05 contracts closed at 5775, and positions were 220776 positions.

PVC Future Forecast:

Futures: PVC2409 contract futures showed an obvious upward trend in early trading on Monday, and the market showed a reduced position, in which the trading was 25.5% flat compared with 23.6% flat, and the increase in short level made the futures price show a certain upward performance. The technical level shows that the opening of the three tracks of the Bollinger belt (13, 13, 2) is still downward, although the disk has gone up, but only in view of the small rise from low to upward, the overall fluctuation range has not changed much compared with the previous week. The candle chart shows a positive pillar with a long shadow line, and as a whole, the two markets cannot be guided by fundamentals in the short term, so the fluctuation of futures prices or continue to test the scope of the early stage. Continue to observe the performance in the range of 5850-5980.

Spot: the spot market at the beginning of the week did not show obvious price changes, although some areas tentatively rose slightly, but there is a certain amount of room for profit. PVC fundamentals, calcium carbide prices slightly down 50 yuan / ton, and Taixing Xinpu VCM unit weekly pricing reduced to factory 4900-5000 acceptance, cost port support has been weakened. PVC supply and demand level is still not good, enterprises and middlemen have a certain shipping pressure, the spot market began to actively apply for warehouse receipts transactions, in order to transfer sales difficulties. At present, there is no guiding policy news at the macro level, so the overall performance of the Chinese market is poor. In the outer disk, international oil prices closed higher, but fell on the weekly line as Israel's retaliatory strike against Iran appeared to be limited, reducing concerns about the broader regional conflict. On the whole, the trend of narrow consolidation of the PVC spot market continues in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

April nineteenth |

April 22nd |

Rate of change |

|

V2409 collection |

5885 |

5915 |

30 |

|

|

Average spot price in East China |

5555 |

5590 |

35 |

|

|

Average spot price in South China |

5605 |

5605 |

0 |

|

|

PVC2409 basis difference |

-330 |

-325 |

5 |

|

|

V2501 collection |

6030 |

6058 |

28 |

|

|

V2409-2501 close |

-145 |

-143 |

2 |

|

|

PP2409 collection |

7650 |

7626 |

-24 |

|

|

Plastic L2409 |

8464 |

8462 |

-2 |

|

|

V--PP basis difference |

-1765 |

-1711 |

54 |

|

|

Vmure-L basis difference of plastics |

-2579 |

-2547 |

32 |

|

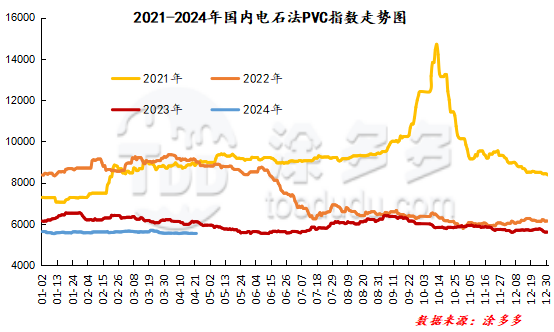

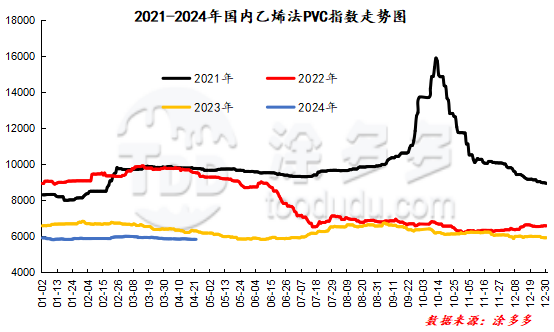

China PVC Index: according to Tuduoduo data, the spot index of China calcium Carbide PVC rose 17.78% to 5562.35 on April 22, up 0.321%. The ethylene PVC spot index was 5824.37, down 10.36, with a range of 0.178%. The calcium carbide index rose, the ethylene index decreased, and the ethylene-calcium carbide index spread was 262.02.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

4.19 warehouse orders |

4.22 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,159 |

2,159 |

0 |

|

|

Large-scale reserve |

240 |

240 |

0 |

|

|

Guangzhou materials |

1,090 |

1,090 |

0 |

|

|

The central reserve is near the port |

118 |

118 |

0 |

|

|

China Central Reserve Nanjing |

711 |

711 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

1,796 |

1,796 |

0 |

|

|

Zhenjiang Middle and far Sea |

396 |

396 |

0 |

|

|

Shanghai Zhongyuan Sea |

471 |

471 |

0 |

|

|

Middle and far sea in Jiangyin |

929 |

929 |

0 |

|

Polyvinyl chloride |

Zhejiang 837 |

60 |

60 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

1,496 |

1,496 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

784 |

784 |

0 |

|

Polyvinyl chloride |

Shanghai-Hong Kong logistics |

382 |

382 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

4,682 |

4,773 |

91 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

4,686 |

5,774 |

1,088 |

|

Polyvinyl chloride |

Pinghu Huarui |

1,053 |

1,053 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

184 |

184 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

4,001 |

4,001 |

0 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

518 |

518 |

0 |

|

Polyvinyl chloride |

Chuanhua mandarin |

379 |

379 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

150 |

150 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

1,560 |

1,560 |

0 |

|

PVC subtotal |

|

24,724 |

25,903 |

1,179 |

|

Total |

|

24,724 |

25,903 |

1,179 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.