Polyethylene PE: Futures pulled back after rushing higher, spot prices adjusted up and down, and short-term focus on the trend of crude oil

Sinopec Inventories: The polyolefin stocks of the two oils were 805,000 tons, a decrease of 5,000 tons from yesterday.

Shenhua auction statistics: The online auction volume today was 909 tons, and today's transaction volume was 850 tons. High-pressure auction volume today was 33.45 tons, and today's transaction volume was 33.45 tons. Low-pressure today's auction volume is 0 tons, and today's transaction volume is 0 tons.

PE spot market analysis: The price of PE market in China continues to rise today, with the increase of various varieties ranging from 30 to 120 yuan/ton. In terms of price: China's linear mainstream prices range from 8,350 to 8,700 yuan/ton, high-pressure prices range from 9,350 to 9,700 yuan/ton, low-pressure film materials range from 8,350 to 8,750 yuan/ton, and low-pressure wire drawing range from 8,450 to 8,800 yuan/ton. Explosions came from Isfahan in central Iran, Suweida province in southern Syria, and Baghdad and Babil provinces in Iraq. During the Asian session, the increase in WTI crude oil futures once widened to 2%, while the futures market quickly returned, stimulating industry companies to overstate to a certain extent. As Iranian military officers said the overnight attack did not cause any damage, futures highs fell back and the high prices of the spot portion also eased. The prices of petrochemicals and coal companies are still partially increased, and on-site cost drivers have once again strengthened. Traders pushed up tentatively, and the downstream just needed to enter the market, but the transaction was acceptable at a slightly lower price.

PE spot trend forecast: In terms of raw materials: Crude oil continues to operate at a high level, paying attention to geographical trends. Petrochemical policy: After several trading days of silence, petrochemical and coal companies once again moved to increase prices, and the boost to on-site costs increased. Supply: Lianyungang Petrochemical, Jiutai, Zhongke Refining and Chemical, Hainan Refining and Chemical, and Zhejiang Petrochemical have been suspended until April and May. Recently, new units such as Zhongyuan Petrochemical and Maoming Petrochemical have continued to be suspended for maintenance, and the market supply continues to shrink. In terms of demand, the overall downstream demand is relatively stable, with small overall variables. Under the comprehensive influence, it is expected that the PE market will still operate at a high level, focusing on the market trend and spot transactions.

Mainstream quotation in PE market: yuan/ton

|

varieties |

regional |

April 18 |

April 19 |

rise and fall |

|

linear |

North China |

8350-8400 |

8420-8450 |

70/50 |

|

East China |

8350-8450 |

8350-8500 |

0/50 |

|

|

South China |

8380-8600 |

8470-8700 |

90/100 |

|

|

high-pressure membrane |

North China |

9300-9380 |

9350-9450 |

50/70 |

|

East China |

9350-9600 |

9380-9650 |

30/50 |

|

|

South China |

9450-9600 |

9550-9700 |

100/100 |

|

|

low-pressure membrane |

North China |

8300-8550 |

8350-8550 |

50/0 |

|

East China |

8500-8750 |

8500-8750 |

0/0 |

|

|

South China |

8400-8580 |

8400-8700 |

0/120 |

|

|

low pressure wire drawing |

North China |

8350-8600 |

8450-8600 |

50/0 |

|

East China |

8450-8700 |

8500-8700 |

50/0 |

|

|

South China |

8550-8800 |

8550-8800 |

0/0 |

Analysis of PE futures: On April 19, the opening price of L2409 was 8424, the highest price was 8581, the lowest price was 8391, the position was 463744 lots, the settlement price was 8478, yesterday's settlement: 8424, the increase: 54, and the daily trading volume was 638508 lots.

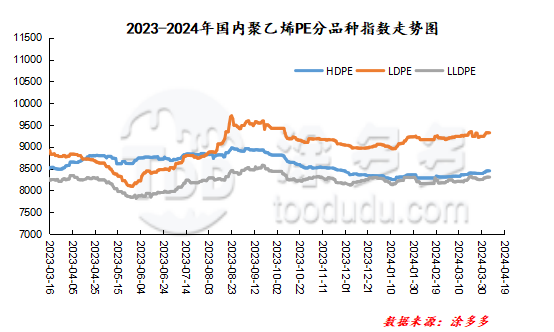

China's PE Index: According to Tuduo's data, China's LLDPE spot index on April 19 was 8482, up 60, or 0.71%;LDPE film spot index was 9513, up 66, or 0.70%;HDPE spot index was 8571, up 35, or 0.41%.