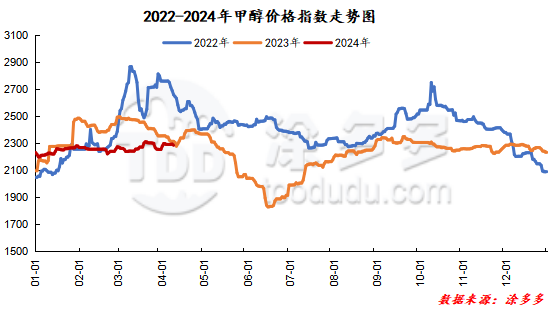

Methanol: Futures market is strong and the spot market is adjusted within a narrow range

On April 17, the methanol market price index was 2371.26, up 15.72 from yesterday and up 0.67 per cent from the previous month.

Outer disk dynamics:

Methanol closed on April 16:

China CFR 304,306 US dollars / ton, up 2 US dollars / ton

Us FOB 99-100cents per gallon, flat

Southeast Asia CFR 341342USD / ton, Ping

European FOB 315.25-316.25 euros / ton, flat.

Summary of today's prices:

Guanzhong: 2280-2290 (0), North Route: 2210-2220 (40), Lunan: 2520 (20), Henan: 2430-2485 (0), Shanxi: 2320-2450 (0), Port: 2645-2655 (35)

Freight:

North Route-Northern Shandong 210-310 (10ax 10), Northern Route-Southern Shandong 340-370 (0max 0), Southern Route-Northern Shandong 240-300 (0max 0), Guanzhong-Southwest Shandong 240-290 (0max 0)

Spot market: today, the price of methanol market is adjusted in a narrow range, the futures market continues to be strong, and the price of the port spot market is adjusted with the market. At present, the overall supply pressure in the Chinese market is not great, coupled with the enthusiasm of some downstream to enter the market to replenish stock. Manufacturers have an obvious mentality of quoting prices. Specifically, the market price in the main producing areas has been raised narrowly, with the quotation on the southern line around 2220 yuan / ton, the price on the northern line around 2210-2220 yuan / ton, the low end up by 40 yuan / ton, and the futures market fluctuating at a high level. In addition, the enthusiasm of some downstream operators to enter the market for replenishment is OK, and under the support of little supply pressure, the market quotation position in the region is high, and we need to pay attention to the maintenance of the equipment in the field in the later stage. The market price in Shandong, the main consumer area, was adjusted in a narrow range, with 2520 yuan / ton in southern Shandong and 2440-2500 yuan / ton in northern Shandong. Yesterday, the enthusiasm of downstream replenishment in the market was not high, the driving force of manufacturers' quotation was insufficient, and the market trading atmosphere cooled slightly. The market quotation in North China has been raised narrowly. Hebei quotation is 2430-2480 yuan / ton today. The futures market trend is strong, which has a certain positive support for the Chinese market. Shanxi quotes 2320-2450 yuan / ton today, maintaining yesterday. With the rapid increase in early prices, downstream operators follow up more cautiously, and the market trading atmosphere has weakened.

Port market: methanol futures were strong in the morning and fell in the afternoon. Spot purchase on demand, sellers are few. In the long term, a small amount of unilateral high selling and low suction, and the current basis is stable. The overall transaction throughout the day is not bad. Taicang main port transaction price:; spot / 4: 2625-2650, base difference 05: 80: 4 transaction: 2605-2630, basis difference 05: 55 pound 62: 5 transaction price: 2570-2590, basis difference 05: 20 shock 250960.

|

Area |

2024/4/17 |

2024/4/16 |

Rise and fall |

|

The whole country |

2371.26 |

2355.54 |

15.72 |

|

Northwest |

2210-2290 |

2170-2290 |

40/0 |

|

North China |

2320-2480 |

2320-2450 |

0/30 |

|

East China |

2645-2730 |

2610-2700 |

35/30 |

|

South China |

2620-2700 |

2630-2700 |

-10/0 |

|

Southwest |

2300-2460 |

2300-2450 |

0/10 |

|

Northeast China |

2440-2540 |

2440-2540 |

0/0 |

|

Shandong |

2440-2520 |

2440-2520 |

0/0 |

|

Central China |

2430-2680 |

2430-2650 |

0/30 |

Future forecast: in the near future, the period price of the main contract of methanol is running firmly, which is good for the mentality of the operators in the market. in addition, the operation of the olefin market downstream of the main force is stable, and the demand for methanol is well supported. Under the support of low inventory pressure, the quoted price of most Chinese manufacturers remains relatively high, but considering that the spot price of methanol has risen faster in the early part of the week. Some downstream operators hold certain resistance to the current high prices, and the market transaction atmosphere has weakened compared with the previous period. At present, some manufacturers in the field are operating at high levels downstream supported by little inventory pressure, while some downstream rigid demand is dominated. It is expected that the methanol market price will be adjusted in a narrow range in the short term, but in the later stage, attention should be paid to coal prices, the landing of spring inspection by various manufacturers and the follow-up of downstream demand.