PVC: Futures rose slightly in the late afternoon, but transactions were still mostly open, and the spot trend was not good

PVC futures analysis: April 17 V2409 contract opening price: 5881, highest price: 5928, lowest price: 5874, position: 796227, settlement price: 5898, yesterday settlement: 5919, down: 21, daily trading volume: 693700 lots, precipitated capital: 3.3 billion, capital inflow: 84.05 million.

List of comprehensive prices by region: yuan / ton

|

Area |

April sixteenth |

April seventeenth |

Rise and fall |

Remarks |

|

North China |

5450-5510 |

5460-5520 |

10/10 |

Send to cash remittance |

|

East China |

5520-5620 |

5520-5610 |

0/-10 |

Cash out of the warehouse |

|

South China |

5540-5650 |

5550-5640 |

10/-10 |

Cash out of the warehouse |

|

Northeast China |

5420-5620 |

5400-5600 |

-20/-20 |

Send to cash remittance |

|

Central China |

5550-5600 |

5530-5580 |

-20/-20 |

Send to cash remittance |

|

Southwest |

5420-5580 |

5420-5580 |

0/0 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction price range collation mainly, some areas slightly weaker. Compared with the valuation, North China rose 10 yuan / ton, East China fell 10 yuan / ton, low-end prices in South China rose within 10 months, high-end prices fell 10 yuan / ton, and Northeast China fell 20 yuan / ton. central China fell 20 yuan / ton, and southwest China was stable. Upstream PVC production enterprise factory price at the beginning of a partial reduction of 20-50 yuan / ton, and downstream wait-and-see, resulting in fewer contracts, enterprises still have a certain pressure to go to the warehouse. The trend of the spot market in various regions is not good, the spot market quotations in some areas have dropped slightly, and the price offers of traders in some areas have changed little compared with yesterday afternoon, but the supply of high-priced goods is difficult to close, and the basis offer has a slight price advantage. among them, East China basis offer 05 contract-(250-270), South China 05 contract-(200), North 05 contract-(480-500), Southwest 05 contract-(250-270). Downstream bargain replenishment, but some hang single point on the low side, the whole day whether it is a mouthful price or point price transaction lukewarm.

Futures point of view: PVC2409 contract night trading price opened slightly higher, followed by a narrow range of shock finishing. After the beginning of morning trading, the trend of futures prices did not change significantly, mainly by a small adjustment, and there was a small rise in afternoon prices. 2409 contracts fluctuate in the range of 5874-5928 throughout the day, with a spread of 54. 09 contracts with an increase of 16194 positions and 796227 positions so far. The 2405 contract closed at 5790, with 293641 positions.

PVC Future Forecast:

Futures: The operation of the futures market of the PVC2409 contract was slightly repaired from the low point at the end of the day. Compared with the substantial increase in positions a few days ago, the position changed little today, with only an increase of more than 16000 positions. In terms of transaction, the short opening was 25.3% compared with 22.9% more, and it was still dominated by short opening. At present, the weakness of the 09 contract has not been significantly improved, and the trend of the previous main contract continues, but because the monthly difference of the contract belongs to the rising water structure. Therefore, after the change of the main force of 09 contract, the price operation of the spot market is more awkward. The technical level shows that the Bollinger belt (13, 13, 2) three tracks turn down, the low of the price continues to break through the lower track position. Overall, the operation of 09 contracts will continue to test the low range of 5850-5980 in the short term.

Spot aspect: After the change of the main force, there is no obvious improvement in the two cities, and the spot market has maintained a low level of continuous testing. On the one hand, the upstream PVC production enterprises maintain the shipping rhythm in the early stage, and there is no obvious guidance for the price to rise or fall slightly. Secondly, middlemen are faced with low profits and inactive downstream pick-up, both upstream enterprises and middlemen are faced with the problem of poor supply digestion. And most of the current basis spot market is still quoting 05 contracts, the main change after hedging did not have time to change, so the current point price transaction is also lukewarm. In the outer disk, international oil prices closed slightly lower as economic resistance put pressure on investor sentiment and curbed the rise in oil prices caused by geopolitical tensions, and the market focused on Israel and its reaction to Iran's attack on Israeli territory over the weekend. Overall, the spot market will continue to adjust slightly in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

April sixteenth |

April seventeenth |

Rate of change |

|

V2409 collection |

5890 |

5921 |

31 |

|

|

Average spot price in East China |

5570 |

5565 |

-5 |

|

|

Average spot price in South China |

5595 |

5595 |

0 |

|

|

PVC2409 basis difference |

-320 |

-356 |

-36 |

|

|

V2501 collection |

6032 |

6065 |

33 |

|

|

V2409-2501 close |

-142 |

-144 |

-2 |

|

|

PP2409 collection |

7580 |

7618 |

38 |

|

|

Plastic L2409 |

8394 |

8430 |

36 |

|

|

V--PP basis difference |

-1690 |

-1697 |

-7 |

|

|

Vmure-L basis difference of plastics |

-2504 |

-2509 |

-5 |

|

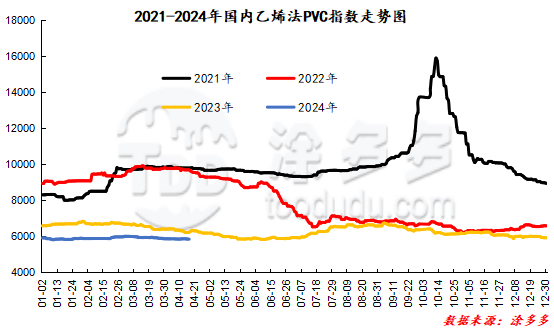

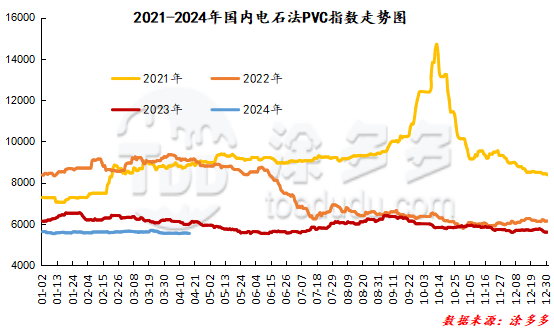

China PVC Index: according to Tuduoduo data, China calcium Carbide PVC spot index fell 3.11, or 0.056%, to 5545.05 on April 17. The ethylene PVC spot index was 5843.99, down 1.03, with a range of 0.018%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 298.94.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

4.16 warehouse orders |

4.17 warehouse order quantity |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,141 |

2,159 |

18 |

|

|

Large-scale reserve |

240 |

240 |

0 |

|

|

Guangzhou materials |

1,090 |

1,090 |

0 |

|

|

The central reserve is near the port |

100 |

118 |

18 |

|

|

China Central Reserve Nanjing |

711 |

711 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

1,598 |

1,598 |

0 |

|

|

Zhenjiang Middle and far Sea |

198 |

198 |

0 |

|

|

Shanghai Zhongyuan Sea |

471 |

471 |

0 |

|

|

Middle and far sea in Jiangyin |

929 |

929 |

0 |

|

Polyvinyl chloride |

Zhejiang 837 |

60 |

60 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

1,496 |

1,496 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

784 |

784 |

0 |

|

Polyvinyl chloride |

Shanghai-Hong Kong logistics |

311 |

311 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

4,542 |

4,542 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

4,191 |

4,586 |

395 |

|

Polyvinyl chloride |

Pinghu Huarui |

1,053 |

1,053 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

184 |

184 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,379 |

3,743 |

364 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

518 |

518 |

0 |

|

Polyvinyl chloride |

Chuanhua mandarin |

379 |

379 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

150 |

150 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

1,560 |

1,560 |

0 |

|

PVC subtotal |

|

23,180 |

23,957 |

777 |

|

Total |

|

23,180 |

23,957 |

777 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.