Polyethylene PE: The bulls left the market in the late session and the market was green. Is it to regroup or pull back from here?

Sinopec Inventories: The polyolefin stocks of the two oils were 855,000 tons, a decrease of 25,000 tons from yesterday.

Shenhua auction statistics: Today's auction volume is 950 tons, and today's transaction volume is 900 tons. High-pressure auction volume today was 96 tons, and today's transaction volume was 33 tons. Low-pressure today's auction volume is 0 tons, and today's transaction volume is 0 tons.

PE spot market analysis: Today, China's PE market prices are operating strongly, and spot prices generally increase by 20-50 yuan/ton. In terms of price: China's linear mainstream prices range from 8,300 to 8,600 yuan/ton, high-pressure prices range from 9,270 to 9,600 yuan/ton, low-pressure film materials range from 8,300 to 8,750 yuan/ton, and low-pressure wire drawing range from 8,350 to 8,800 yuan/ton. Futures continued to rise in daily trading, and the intraday trading once again set a new stage high, supporting the mentality of the industry to a certain extent. Petrochemical and coal companies both raised their prices, and on-site cost-driving forces strengthened again. The downstream just needed to enter the market, and the transaction was still acceptable at a slightly lower price.

PE spot trend forecast: In terms of raw materials: Crude oil continues to operate at a high level, paying attention to geographical trends. Petrochemical policy: After several trading days of silence, petrochemical and coal companies once again moved to increase prices, and the boost to on-site costs increased. Supply: Lianyungang Petrochemical, Jiutai, Zhongke Refining and Chemical, Hainan Refining and Chemical, and Zhejiang Petrochemical have been suspended until April and May. Recently, new units such as Zhongyuan Petrochemical and Maoming Petrochemical have continued to be suspended for maintenance, and the market supply continues to shrink. In terms of demand, the overall downstream demand is relatively stable, with small overall variables. Under the comprehensive influence, it is expected that the PE market will still operate at a high level, focusing on the market trend and spot transactions.

Mainstream quotation in PE market: yuan/ton

|

varieties |

regional |

April 15 |

April 16 |

rise and fall |

|

linear |

North China |

8330-8350 |

8350-8400 |

20/50 |

|

East China |

8250-8380 |

8300-8430 |

50/50 |

|

|

South China |

8350-8600 |

8380-8600 |

30/0 |

|

|

high-pressure membrane |

North China |

9270-9330 |

9270-9350 |

0/20 |

|

East China |

9300-9550 |

9300-9550 |

0/0 |

|

|

South China |

9400-9550 |

9450-9600 |

50/50 |

|

|

low-pressure membrane |

North China |

8250-8500 |

8300-8500 |

50/0 |

|

East China |

8450-8700 |

8450-8750 |

0/50 |

|

|

South China |

8400-8580 |

8400-8580 |

0/0 |

|

|

low pressure wire drawing |

North China |

8300-8550 |

8350-8600 |

50/50 |

|

East China |

8450-8700 |

8450-8700 |

0/0 |

|

|

South China |

8500-8800 |

8550-8800 |

50/0 |

Analysis of PE futures: On April 16, the opening price of L2409 was 8405, the highest price was 8470, the lowest price was 8356, the position was 419627 lots, the settlement price was 8416, yesterday's settlement: 8400, the increase: 16, and the daily trading volume was 459527 lots.

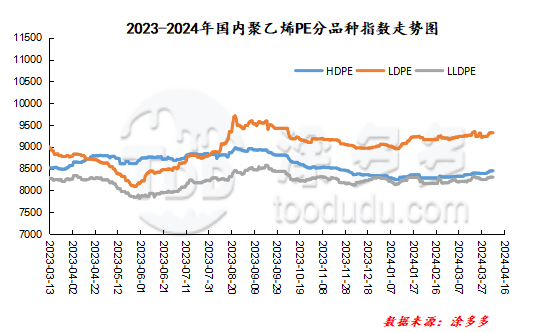

China's PE Index: According to Tuduo's data, China's LLDPE spot index on April 16 was 8410, up 33, or 0.39%;LDPE film spot index was 9420, up 20, or 0.21%;HDPE spot index was 8536, up 21, or 0.25%.