PVC: Futures positions continue to increase sharply, but futures prices weaken and downward, and the spot market adjusts flexibly

PVC futures analysis: April 16 V2409 contract opening price: 5950, highest price: 5951, lowest price: 5885, position: 780033, settlement price: 5919, yesterday settlement: 5964, down: 45, daily trading volume: 978261 lots, precipitated capital: 3.216 billion, capital inflow: 229 million.

List of comprehensive prices by region: yuan / ton

|

Area |

April fifteenth |

April sixteenth |

Rise and fall |

Remarks |

|

North China |

5450-5530 |

5450-5510 |

0/-20 |

Send to cash remittance |

|

East China |

5550-5640 |

5520-5620 |

-30/-20 |

Cash out of the warehouse |

|

South China |

5580-5650 |

5540-5650 |

-40/0 |

Cash out of the warehouse |

|

Northeast China |

5420-5620 |

5420-5620 |

0/0 |

Send to cash remittance |

|

Central China |

5550-5600 |

5550-5600 |

0/0 |

Send to cash remittance |

|

Southwest |

5440-5600 |

5420-5580 |

-20/-20 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction prices are mainly arranged in a narrow range, and some spot market prices are adjusted slightly. Compared with the valuation, it fell 20 yuan / ton in North China, 20-30 yuan / ton in East China, 40 yuan / ton in South China, stable in Northeast China, stable in Central China, and 20 yuan / ton in Southwest China. Upstream PVC production enterprise factory price has not been significantly adjusted, more stable wait-and-see, factory price to maintain the previous quotation. Futures 09 contract weakens narrowly throughout the day, the trader's offer price is little different from that of yesterday, and the supply of high-priced goods is still difficult to close the transaction. Although the main contract has changed, the spot market basis offer is still dominated by 05 contract, not reporting 09 contract. Among them, East China basis offer 05 contract-(250-270), South China 05 contract-(200), North 05 contract-(480-500) Southwest 05 contract-(250-270). At present, no matter the spot market is a point price or a basis offer, please negotiate the light and actual transaction part of the transaction. The downstream purchasing enthusiasm is not good.

From a futures point of view: PVC2409 contract night futures prices high and low, futures prices slightly lower, late trading slightly higher, early trading prices further slightly upward, but the upward range is very small, and then weakened again, afternoon prices continued to fall in late afternoon. 2409 contracts fluctuate in the range of 5885-5951 throughout the day, with a spread of 66. 09 contracts with an increase of 63026 positions and 780033 positions so far. The 2405 contract closed at 5765, with 326966 positions.

PVC Future Forecast:

Spot aspect: The operation of the futures market of the PVC2409 contract showed a certain pressure performance, and the futures price broke through the lower track from the middle track, but due to the obvious narrowing of the Bollinger belt, after falling from the high point for two consecutive days, the fluctuation range was not large, but the narrowed track led to a change in the technical closing line, in which the opening of the third rail opening of the Bollinger belt (13,13,2) was obvious, and the KD line at the daily level quickly changed from the golden fork trend to the two-line crossing. The MACD line at the daily level continues to show a dead-fork trend. The current PVC fundamentals still do not see guiding variables after the main change, and the current weak market is still facing hedging pressure, in the short term, we think that the operation of futures prices or continue to test the low range of 09 contracts, observe the performance of the range of 5850-5980.

Futures: the performance of the two cities continues to be weak, in yesterday's forecast we mentioned that the two cities still face certain tests, did not expect to cash so quickly, the futures market significantly increased positions and prices fell, trading short opened mostly, on the one hand, insurance policies, on the other hand, there are short-term short positions. In terms of PVC fundamentals, Taiwan Formosa Plastics PVC exports fell by US $30 in May, CIF India lowered by US $30 to US $800 / ton, CFR China's main port by US $30 to US $775 / ton, CIF Southeast Asia by US $30 to US $760 / ton, and there is no quantity discount, the downward price of Formosa Plastics is bad for the Chinese market to a certain extent, suppressing export orders. On the outer disk, international oil prices closed lower as Iran's attack on Israel over the weekend caused little damage, helping to allay fears that the rapid escalation of the conflict could reduce crude oil supplies. On the whole, the spot market still faces a narrow adjustment in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

April fifteenth |

April sixteenth |

Rate of change |

|

V2409 collection |

5951 |

5890 |

-61 |

|

|

Average spot price in East China |

5595 |

5570 |

-25 |

|

|

Average spot price in South China |

5615 |

5595 |

-20 |

|

|

PVC2409 basis difference |

-356 |

-320 |

36 |

|

|

V2501 collection |

6155 |

6032 |

-123 |

|

|

V2409-2501 close |

-204 |

-142 |

62 |

|

|

PP2409 collection |

7602 |

7580 |

-22 |

|

|

Plastic L2409 |

8410 |

8394 |

-16 |

|

|

V--PP basis difference |

-1651 |

-1690 |

-39 |

|

|

Vmure-L basis difference of plastics |

-2459 |

-2504 |

-45 |

|

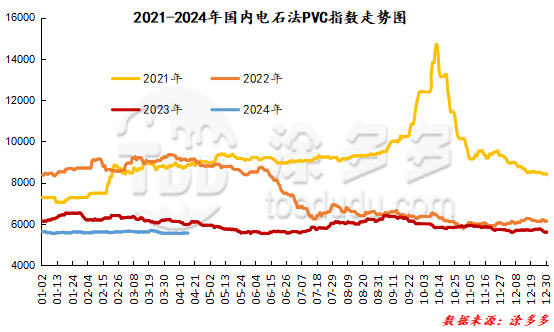

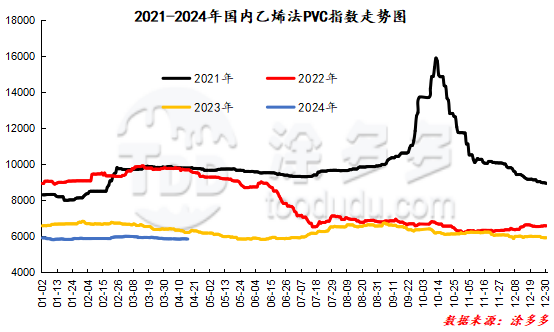

China PVC Index: according to Tuduoduo data, the spot index of China's calcium carbide PVC fell 15.73 or 0.283% to 5548.16 on April 16. The ethylene PVC spot index was 5845.02, down 6.24, or 0.107%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 296.86.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

4.15 warehouse orders |

4.16 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

2,041 |

2,141 |

100 |

|

|

Large-scale reserve |

240 |

240 |

0 |

|

|

Guangzhou materials |

1,090 |

1,090 |

0 |

|

|

The central reserve is near the port |

0 |

100 |

100 |

|

|

China Central Reserve Nanjing |

711 |

711 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

1,591 |

1,598 |

7 |

|

|

Zhenjiang Middle and far Sea |

198 |

198 |

0 |

|

|

Shanghai Zhongyuan Sea |

464 |

471 |

7 |

|

|

Middle and far sea in Jiangyin |

929 |

929 |

0 |

|

Polyvinyl chloride |

Zhejiang 837 |

0 |

60 |

60 |

|

Polyvinyl chloride |

Zhejiang International Trade |

1,496 |

1,496 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

784 |

784 |

0 |

|

Polyvinyl chloride |

Shanghai-Hong Kong logistics |

311 |

311 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

4,542 |

4,542 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

3,907 |

4,191 |

284 |

|

Polyvinyl chloride |

Pinghu Huarui |

1,053 |

1,053 |

0 |

|

Polyvinyl chloride |

Hangzhou port logistics |

64 |

184 |

120 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

3,379 |

3,379 |

0 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

518 |

518 |

0 |

|

Polyvinyl chloride |

Chuanhua mandarin |

120 |

379 |

259 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

150 |

150 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

450 |

450 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

540 |

1,560 |

1,020 |

|

PVC subtotal |

|

21,330 |

23,180 |

1,850 |

|

Total |

|

21,330 |

23,180 |

1,850 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.