PVC: Futures significantly increased positions by more than 126,000 lots, on-site trading was active, and spot prices were slightly adjusted

PVC futures analysis: April 15 V2409 contract opening price: 5980, highest price: 5992, lowest price: 5934, position: 717007, settlement price: 5964, yesterday settlement: 5972, down: 8, daily trading volume: 970792 lots, precipitated capital: 2.987 billion, capital inflow: 521 million.

List of comprehensive prices by region: yuan / ton

|

Area |

April 12th |

April fifteenth |

Rise and fall |

Remarks |

|

North China |

5440-5530 |

5450-5530 |

10/0 |

Send to cash remittance |

|

East China |

5550-5650 |

5550-5640 |

0/-10 |

Cash out of the warehouse |

|

South China |

5580-5670 |

5580-5650 |

0/-20 |

Cash out of the warehouse |

|

Northeast China |

5470-5620 |

5420-5620 |

-50/0 |

Send to cash remittance |

|

Central China |

5550-5600 |

5550-5600 |

0/0 |

Send to cash remittance |

|

Southwest |

5440-5600 |

5440-5600 |

0/0 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction prices continue to sort out mainly, the overall fluctuation is not big on Monday. Compared with the valuation, North China rose 10 yuan / ton, East China fell 10 yuan / ton, South China fell 20 yuan / ton, Northeast China fell 50 yuan / ton, and Central China and Southwest China were stable. The ex-factory prices of upstream PVC production enterprises mostly remained stable, with no obvious adjustment, and there were few contracts signed on Monday. The futures market continued to fluctuate in a narrow range, and the change of positions was completed. The spot market price adjustment was small, and the merchants adjusted flexibly according to their own conditions. The price quoted by some traders was slightly lower than that of last Friday, with both the point price and the mouthful price. The change in the basis offer is small, including 05 contract in East China-(250-270), 05 contract in South China-(200), 05 contract in North China-(480-500). Southwest 05 contract-(250-270). On the whole, the supply of high-priced goods is difficult to close the deal, the basis offer has no advantage for the time being, and the actual transaction part is negotiated slightly.

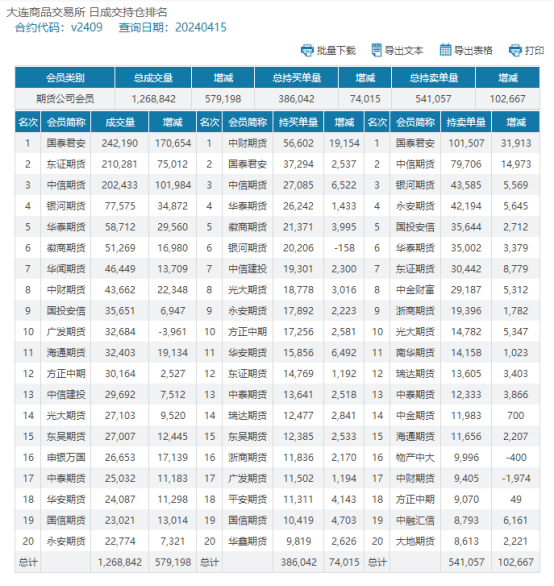

From a futures point of view: & the price of the nbsp; PVC2409 contract opened volatile on Friday night, followed by a slight decline. Prices rebounded after the start of morning trading on Monday, and prices weakened slightly again in the afternoon. 2409 contracts range from 5934 to 5992 throughout the day, with a spread of 58. 05 and an increase of 126634 positions in contracts, with 717007 positions so far. The 2405 contract closed at 5920, with 376778 positions.

PVC Future Forecast:

Spot aspect: PVC2409 contract futures showed a substantial increase of more than 126000 positions. First, the position change 09 contract officially took office, and both sides entered the market. In terms of transaction, there was an increase of 29.4% compared with 26.8%. Retail investors participated in a large number of positions, including an increase of 102667 positions in the top 20 positions and an increase of 74015 in short positions. The trace of changing the position and changing the moon is relatively obvious. The technical level shows that the operation of the futures price is approaching the track, the opening of the three tracks of the Bollinger belt (13,13,2) narrows rapidly, and the MACD line at the daily level shows a dead-forked trend. From the short-term operation point of view, the changed 09 contract will still be in a relatively narrow state of shock. Continue to observe the running range between the upper tracks, and look at the prefix 6 above.

Futures: After the change of positions, the performance of the spot market is still relatively lacklustre, and the spot market offer is still more inclined to the 05 contract, but the sharp decrease in 05 contract positions and the obvious entry of both parties with long and short positions in 09 contract, the replacement of the expected point price still takes some time, so the two cities are still facing certain tests, on the one hand, from the pressure of hedging policies, on the other hand, when the contract month difference is large. It is expected that 09 contract will still bear some pressure in the short term after the end of the contract. There are not many recent variables in the fundamentals of PVC, but it is still difficult for manufacturers or middlemen to feedback shipments. On the outer disk, oil prices rose, supported by tensions in the Middle East. But the International Energy Agency (IEA) bearish global oil demand growth forecast curbs the rise in oil prices. On the whole, the spot market may face some turbulent adjustment in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

April 12th |

April fifteenth |

Rate of change |

|

V2409 collection |

5967 |

5951 |

-16 |

|

|

Average spot price in East China |

5600 |

5595 |

-5 |

|

|

Average spot price in South China |

5625 |

5615 |

-10 |

|

|

PVC2409 basis difference |

-367 |

-356 |

11 |

|

|

V2501 collection |

6090 |

6155 |

65 |

|

|

V2409-2501 close |

-123 |

-204 |

-81 |

|

|

PP2409 collection |

7597 |

7602 |

5 |

|

|

Plastic L2409 |

8369 |

8410 |

41 |

|

|

V--PP basis difference |

-1630 |

-1651 |

-21 |

|

|

Vmure-L basis difference of plastics |

-2402 |

-2459 |

-57 |

|

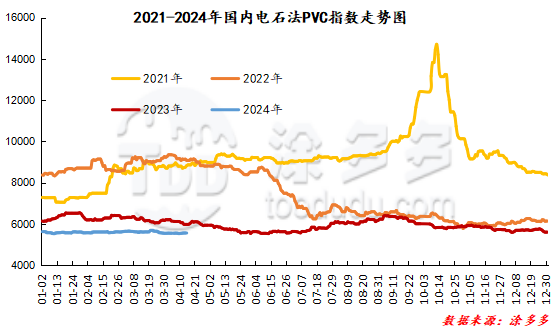

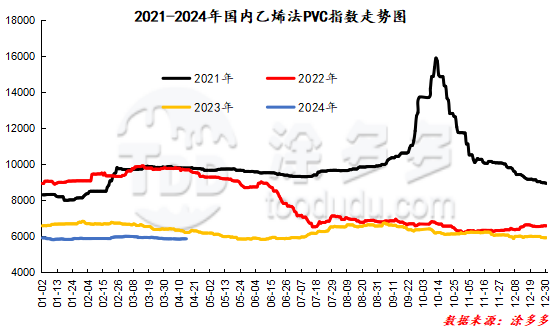

China PVC Index: according to Tuduoduo data, the China calcium Carbide PVC spot Index fell 4.2, or 0.075%, to 5563.89 on April 15. The ethylene method PVC spot index was 5851.26, down 13.52, or 0.211%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 287.37.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

4.12 warehouse orders |

4.15 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

1,011 |

2,041 |

1,030 |

|

|

Large-scale reserve |

0 |

240 |

240 |

|

|

Guangzhou materials |

300 |

1,090 |

790 |

|

|

China Central Reserve Nanjing |

711 |

711 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

1,591 |

1,591 |

0 |

|

|

Zhenjiang Middle and far Sea |

198 |

198 |

0 |

|

|

Shanghai Zhongyuan Sea |

464 |

464 |

0 |

|

|

Middle and far sea in Jiangyin |

929 |

929 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

1,496 |

1,496 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

784 |

784 |

0 |

|

Polyvinyl chloride |

Shanghai-Hong Kong logistics |

311 |

311 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

4,542 |

4,542 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

3,787 |

3,907 |

120 |

|

Polyvinyl chloride |

Pinghu Huarui |

642 |

1,053 |

411 |

|

Polyvinyl chloride |

Hangzhou port logistics |

64 |

64 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

2,515 |

3,379 |

864 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

318 |

518 |

200 |

|

Polyvinyl chloride |

Chuanhua mandarin |

0 |

120 |

120 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

0 |

300 |

300 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

150 |

150 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

0 |

450 |

450 |

|

Polyvinyl chloride |

Sinotrans East China |

540 |

540 |

0 |

|

PVC subtotal |

|

17,835 |

21,330 |

3,495 |

|

Total |

|

17,835 |

21,330 |

3,495 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.