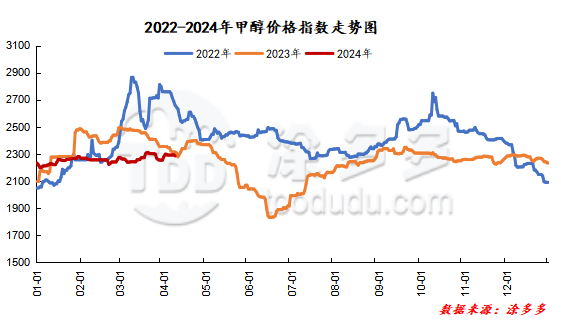

Methanol: The methanol period is now rising simultaneously and the transaction atmosphere in China is improving

On April 15, the methanol market price index was 2332.23, up 32.87 from the previous working day and 1.43% higher than the previous working day.

Outer disk dynamics:

Methanol closed on April 12:

China CFR 295-301USD / ton, Ping

Us FOB 99-100cents per gallon, flat

Southeast Asia CFR 341342USD / ton, Ping

European FOB 315.25-316.25 euros / ton, up 2.25 euros / ton.

Summary of today's prices:

Guanzhong: 2230-2250 (0), North Route: 2100-2120 (20), Lunan: 2400-2440 (0), Henan: 2360-2370 (10), Shanxi: 2210-2290 (0), Port: 25602585 (- 5)

Freight:

Northern route-200-310 (- 10amp 10), northern route-southern Shandong 320-370 (30amp 60), southern route-northern Shandong 230-290 (0amp 10), Guanzhong-southwest Shandong 180-250 (0max 30)

Spot market: today, the methanol market price is strong and volatile, and the futures market is higher, which drives the mood of the operators in the market to be better. In addition, the current negotiable supply of goods in the port area is limited, and the support basis remains strong. And manufacturers in some parts of China have quoted higher new prices under the support of little inventory pressure, and the bidding situation of enterprises is better. Specifically, the market price in the main producing areas has been raised narrowly, with the quotation on the south line around 2220 yuan / ton, the price on the north line around 2170-2200 yuan / ton, and the low end up by 70 yuan / ton. at present, the inventory pressure of manufacturers in the region is not great, and the new price of manufacturers has been raised. Changqing quotation has been raised 30 yuan / ton 2280 yuan / ton factory cash exchange, small single price 2290 yuan / ton factory cash exchange, at present, the plant 600000 tons / year plant normal operation In the later stage, we also need to pay attention to the maintenance of the equipment in the field. Market prices in Shandong, the main consumer, went higher, with southern Shandong 2500-2520 yuan / ton and northern Shandong 2450 yuan / ton, with a low-end increase of 70 yuan / ton. recently, the overall inventory pressure of manufacturers in the region is not great, and the price-up sentiment of some operators is more obvious. but the downstream market demand performance is general, pay attention to tomorrow's market bidding situation. The market quotation in North China is mainly arranged. Hebei quotes 2300-2350 yuan / ton today, maintaining the previous working day, the futures market trend is strong, and there is a certain positive support for the Chinese market. Shanxi quotes 2210-2290 yuan / ton today, and the low end is stable. Methanol enterprise inventory to maintain low non-draining warehouse pressure, and methanol futures trend is strong, boost operators' price mentality, manufacturers are not willing to adjust prices, pay attention to tomorrow's market auction situation.

Port market: methanol futures rose today. There are few goods out of stock, and there is a rigid demand for buying. The paper part of the goods are shipped at a high price, the buying price is followed up, the basis is strong, and the focus of the transaction moves up with the futures; the afternoon talks are deadlocked. The overall deal is OK. Taicang main port transaction price: 4, transaction price: 2610-2635, basis difference 05: 75, base difference: 78, transaction price: 2580-2620, basis difference: 05: 63, margin: 65, transaction price: 2550-2580, basis difference: 05: 20: 25.

|

Area |

2024/4/15 |

2024/4/12 |

Rise and fall |

|

The whole country |

2332.23 |

2299.36 |

32.87 |

|

Northwest |

2170-2250 |

2100-2250 |

60/0 |

|

North China |

2210-2370 |

2210-2350 |

0/20 |

|

East China |

2610-2690 |

2560-2640 |

50/50 |

|

South China |

2620-2690 |

2585-2660 |

35/30 |

|

Southwest |

2310-2450 |

2310-2450 |

0/0 |

|

Northeast China |

2350-2540 |

2350-2500 |

0/40 |

|

Shandong |

2450-2520 |

2380-2440 |

70/80 |

|

Central China |

2400-2620 |

2360-2620 |

40/0 |

Future forecast: recently, the Chinese market equipment maintenance, restart, Jiutai, Donghua and other devices have maintenance plans, but considering the recent weak volatility of the coal market, the profitability of coal-to-methanol enterprises is OK. Under the support of high profits, we do not rule out the possibility of subsequent manufacturers delaying maintenance plans, and the current futures market remains high, which forms a certain support for the mindset of the market operators. Most Chinese manufacturers have raised their quotations under the support of low inventory pressure, but with the continuous increase in methanol prices, the profitability of downstream industries is poor, and the demand for methanol in some industries is mediocre. At present, under the mixture of good and bad, the short-term methanol market price is expected to adjust in a narrow range, but in the later stage, we need to pay attention to the coal price, the landing of the spring inspection of various manufacturers and the follow-up of downstream demand.