PVC: The futures price is shifting positions to the month, the market has significantly reduced positions and left the market, and the spot has been consolidated in a narrow range

PVC futures analysis: April 11 V2405 contract opening price: 5810, highest price: 5841, lowest price: 5778, position: 569762, settlement price: 5811, yesterday settlement: 5801, up: 10, daily trading volume: 483427 lots, precipitated capital: 2.326 billion, capital outflow: 248 million.

List of comprehensive prices by region: yuan / ton

|

Area |

April 10th |

April eleventh |

Rise and fall |

Remarks |

|

North China |

5440-5510 |

5440-5530 |

0/20 |

Send to cash remittance |

|

East China |

5530-5630 |

5550-5640 |

20/10 |

Cash out of the warehouse |

|

South China |

5560-5640 |

5560-5650 |

0/10 |

Cash out of the warehouse |

|

Northeast China |

5470-5620 |

5470-5620 |

0/0 |

Send to cash remittance |

|

Central China |

5500-5540 |

5500-5540 |

0/0 |

Send to cash remittance |

|

Southwest |

5440-5600 |

5440-5600 |

0/0 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction prices are basically stable, individual prices are adjusted slightly. Compared with the valuation, it rose 20 yuan / ton in North China, 10-20 yuan / ton in East China, 10 yuan / ton in South China, and stable in Northeast, Central China and Southwest China. Upstream PVC production enterprises mostly stable ex-factory prices, individual enterprises tentatively increased 20-30 yuan / ton, the contract is still based on the basic quantity, there is no obvious volume, a generation of merchants feedback orders light. The futures market is still mainly arranged in a narrow range, rising slightly in late trading, and the spot market trader's offer is more stable than most of yesterday, and the supply of high-price goods is difficult to make a deal. at present, there are both point price offer and one-mouthful price in the market, and the basis has not changed much. among them, East China basis offer 05 contract-(250-280), South China 05 contract-(200), North 05 contract-(480-500), Southwest 05 contract-(250-370). Today's inquiry and procurement enthusiasm is not high, transactions are mainly concentrated in the low range, trading in the market is light.

Futures point of view: PVC2405 contract night futures prices opened slightly down after the shock finishing, night trading showed a low of 5778. After the start of morning trading, the futures price continued to operate in a narrow range on the basis of night trading, and the afternoon price rose slightly, while the futures price rose slightly. 2405 contracts range from 5778 to 5841 throughout the day, with a spread of 63. 05. The contract reduced its position by 63340 positions and has held 569762 positions so far. The 2409 contract closed at 5980, with 572037 positions.

PVC Future Forecast:

Spot aspect: & the operation of the nbsp; PVC2405 contract futures disk price showed an obvious market of changing positions and changing months. First of all, there was a reduction of about 63000 positions today, the position decreased rapidly, and the positions left were 28.6% flat compared to 26.2% empty. On the one hand, in the market of reducing positions and leaving the market, there is a demand for reducing positions in the market, but the long positions in the market that remains in the doldrums will increase in consideration of partial stops. With the passage of time, the 05 contract gradually ended, the continuous low horizontal state made the technical level Bollinger belt (13, 13, 2) three-track opening rapidly narrowed, the daily KD line showed a golden fork trend, MACD line two lines shortened. The market for changing positions and changing months is cautiously involved, and it is suggested that we should pay more attention to the upward opportunities in the low range of 09 contracts in the short term.

Futures: the current two cities have been in a narrow range of fluctuations in the adjustment, some upstream production enterprises tentatively raised factory prices 20-30 yuan / ton, but for the overall spot market pull effect is small, the spot market most merchants feedback delivery rhythm is not good. First of all, the futures market shows that the price of changing positions and changing months is not a strong guide to the spot market, and then based on its own PVC fundamentals can not form a better guidance. In the near future, there has been a continuous confirmation of low levels in the two cities, the futures market has been adjusted in a narrow range, and spot market prices have also maintained a small range of fluctuations. from manufacturers to intermediate traders, the current trend of PVC is not as expected in the second quarter as a whole, so it can only be expected in the third quarter, so after the end of the 05 contract to mid-May, the market may show a certain degree of clarity. On the whole, in the short term, the PVC spot market continues to be narrowly arranged.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

April 10th |

April eleventh |

Rate of change |

|

V2405 collection |

5808 |

5832 |

24 |

|

|

Average spot price in East China |

5580 |

5595 |

15 |

|

|

Average spot price in South China |

5600 |

5605 |

5 |

|

|

PVC2405 basis difference |

-228 |

-237 |

-9 |

|

|

V2409 collection |

5963 |

5980 |

17 |

|

|

V2405-2409 close |

-155 |

-148 |

7 |

|

|

PP2405 collection |

7577 |

7608 |

31 |

|

|

Plastic L2405 collection |

8338 |

8383 |

45 |

|

|

V--PP basis difference |

-1769 |

-1776 |

-7 |

|

|

Vmure-L basis difference of plastics |

-2530 |

-2551 |

-21 |

|

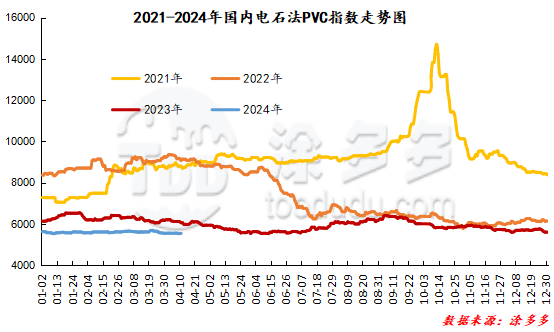

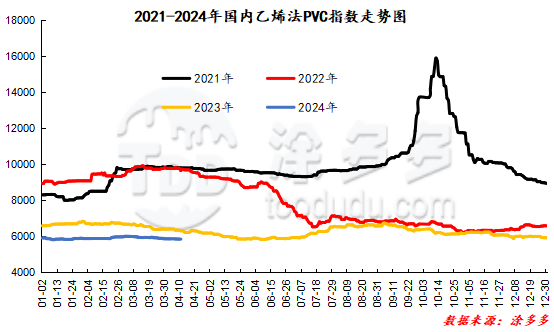

China PVC Index: according to Tudor data, the China calcium Carbide PVC spot Index rose 7.65, or 0.138%, to 5555.42 on April 11. The ethylene method PVC spot index is 5864.78, up 18.05, the range is 0.309%, the calcium carbide method index rises, the ethylene method index rises, the ethylene method-calcium carbide method index price difference is 309.36.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

4.10 warehouse orders |

4.11 warehouse order quantity |

change |

|

Polyvinyl chloride |

China Reserve shares |

572 |

697 |

125 |

|

|

Guangzhou materials |

0 |

60 |

60 |

|

|

China Central Reserve Nanjing |

572 |

637 |

65 |

|

Polyvinyl chloride |

Cosco sea logistics |

1,253 |

1,591 |

338 |

|

|

Zhenjiang Middle and far Sea |

0 |

198 |

198 |

|

|

Shanghai Zhongyuan Sea |

464 |

464 |

0 |

|

|

Middle and far sea in Jiangyin |

789 |

929 |

140 |

|

Polyvinyl chloride |

Zhejiang International Trade |

700 |

940 |

240 |

|

Polyvinyl chloride |

Peak supply chain |

700 |

700 |

0 |

|

Polyvinyl chloride |

Shanghai-Hong Kong logistics |

0 |

127 |

127 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

4,282 |

4,282 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

2,701 |

2,761 |

60 |

|

Polyvinyl chloride |

Pinghu Huarui |

239 |

534 |

295 |

|

Polyvinyl chloride |

Hangzhou port logistics |

64 |

64 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

2,515 |

2,515 |

0 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

84 |

84 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

258 |

258 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

0 |

150 |

150 |

|

Polyvinyl chloride |

Sinotrans East China |

200 |

540 |

340 |

|

PVC subtotal |

|

13,568 |

15,243 |

1,675 |

|

Total |

|

13,568 |

15,243 |

1,675 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.