Methanol: Futures returned to the 2500 mark and spot prices fluctuated within a narrow range

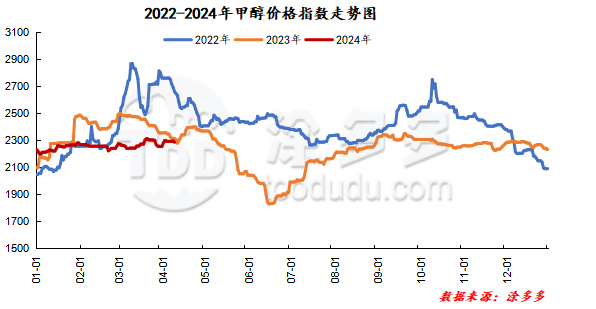

On April 10, the methanol market price index was 2288.98, up 4.87 from yesterday and 0.21 from a month earlier.

Outer disk dynamics:

Methanol closed on April 9:

China CFR 292-300USD / ton, down US $2 / tonne

Us FOB 99-100cents per gallon, up 2 cents per gallon

Southeast Asian CFR 339-340 US dollars / ton, down 2 US dollars / ton

European FOB 302.75-303.75 euros / ton, up 0.25 euros / ton.

Summary of today's prices:

Guanzhong: 2230-2250 (0), North Route: 2080-2110 (10), Lunan: 2400 (0), Henan: 2310-2340 (10), Shanxi: 2210-2280 (0), Port: 2540-2570 (10)

Freight:

North Route-North Shandong 220-280 (0ax 0), North Line-Southern Shandong 290-310 (0max 0), South Line-Northern Shandong 230-270 (0max 0), Guanzhong-Southwest Shandong 170-230 (0max 0)

Spot market: today, the methanol market price is weak and volatile, the futures market is fluctuating upward, closing at 2520 yuan, and the port spot quotation is raised along with the market, but the overall performance of the Chinese market is general, and the terminal market demand has not significantly improved. Downstream users buy and buy more price reduction operations, trading is still dominated by rigid demand, specifically, the market prices in the main producing areas have fallen in a narrow range, and the quotation on the southern line revolves around 2120 yuan / ton. The quotation of the north line revolves around 2080-2110 yuan / ton, the low end is raised by 10 yuan / ton, and the market transaction atmosphere in the region is good. During the restart of the Jiutai olefin plant, there is some support on the demand side, and attention should be paid to the maintenance of the plant in the field in the later stage. The market price in Shandong, the main consumer area, is adjusted in a narrow range, with 2400 yuan / ton in southern Shandong and 2350-2360 yuan / ton in northern Shandong. At present, the enthusiasm of picking up goods downstream is not high, and the transaction only maintains rigid demand. The market quotation in North China is mainly arranged. Hebei quotes 2300-2350 yuan / ton today, enterprise inventory remains low, and the supply side has a little support for the mentality of operators. Shanxi quotes 2210-2280 yuan / ton today, and the low end is stable. Methanol enterprise inventory to maintain low non-depot pressure, and methanol futures trend is strong, boost operators' price mentality, manufacturers are not strong will to adjust prices.

Port market: methanol futures rebounded today. Spot on-demand procurement, price delivery, the basis rebounded. Forward part of the high shipments, a small number of buyers to follow up, the basis rebounded slightly. The overall transaction is active throughout the day. Taicang main port transaction price: spot transaction: 2535-2570, base difference 05-53 Universe 60 position 4-deal: 2540-2575, base spread 05-45 prime 55 position-4 transaction: 2525-2565, base difference 05-43 prime 50 position 5 transaction: 2490-2520, base difference 05-7 pound 10.

|

Area |

2024/4/9 |

2024/4/8 |

Rise and fall |

|

The whole country |

2284.11 |

2294.28 |

-10.17 |

|

Northwest |

2070-2250 |

2080-2280 |

-10/-30 |

|

North China |

2210-2350 |

2230-2350 |

-20/0 |

|

East China |

2525-2620 |

2565-2670 |

-10/-50 |

|

South China |

2560-2650 |

2590-2660 |

-30/-10 |

|

Southwest |

2310-2450 |

2330-2450 |

-20/0 |

|

Northeast China |

2350-2480 |

2350-2480 |

0/0 |

|

Shandong |

2350-2420 |

2360-2420 |

-10/0 |

|

Central China |

2300-2620 |

2310-2650 |

-10/-30 |

& nbsp In the future, it is predicted that the futures market will rise instead of falling, supporting the mentality of the operators to a certain extent, coupled with the recovery of demand in the main downstream market, the market support on the demand side has improved slightly, and some regional operators have quoted prices to maintain high levels under the support of low inventory pressure. Jiutai 600000 ton olefin plant operates normally, and methanol production of some olefin units increases narrowly in the later stage, and the inventory pressure of most Chinese manufacturers is not great at present. There is a little support for the mentality of the industry. At present, there are both good and bad in the Chinese market, and it is expected that the short-term methanol market price will be adjusted in a narrow range and the port spot will be arranged at a high level, but in the later stage, attention should be paid to the arrival of imported goods and the operation of the plant in the field.