Polyethylene PE: The two oils continue to go to the warehouse, and the spot has partially made up for the increase, and high-priced transactions are relatively slow

Sinopec Inventories: The polyolefin inventory of the two oils was 865,000 tons, a decrease of 20,000 tons from yesterday.

Shenhua auction statistics: Today's auction volume is 1050 tons, and today's transaction volume is 700 tons. The auction transaction rate is 66.67%, down 0.95% from yesterday's 67.62%. High-pressure auction volume today was 65 tons, and today's transaction volume was 34 tons.

|

plate number |

storage points |

auction volume |

trading volume |

starting price |

trading range |

transaction rate |

|

7042 |

Baotou Coal Chemical Industry Warehouse |

100 |

100 |

8250 |

8280-8290 |

100.00% |

|

7042 |

Tongdayuan |

300 |

300 |

8300 |

8380-8390 |

100.00% |

|

7042 |

Ningmei Wuhan Wutieku |

300 |

0 |

8270 |

- |

0.00% |

|

7042 |

Ningmei Zhejiang Jianfengku |

50 |

0 |

8410 |

- |

0.00% |

|

7042 |

Ningmei Qingzhou Sinotrans Warehouse |

300 |

300 |

8300 |

8300 |

100.00% |

|

line total |

1050 |

700 |

|

|

66.67% |

|

|

2420 starting materials |

Yulin Chemical Industry Warehouse |

65 |

34 |

8800 |

8800 |

52.31% |

|

High Pressure Total |

65 |

34 |

|

|

52.31% |

|

PE spot market analysis: Today, China's PE market fluctuated and rose, with some increases ranging from 20 to 70 yuan/ton. In terms of price: China's linear mainstream prices range from 8,230 to 8,620 yuan/ton, high-pressure prices range from 9,250 to 9,550 yuan/ton, low-pressure film materials range from 8,300 to 8,700 yuan/ton, and low-pressure wire drawing range from 8,350 to 8,800 yuan/ton. Futures 'gains slowed down, but some petrochemicals were still raised, mainly by PetroChina Resources. The linear majority of coal companies rose by 20-50 yuan/ton, and the cost boost was still obvious. Traders wait and see shipments, but after the rise, transactions at new prices have been slow to follow up. The overall trading performance is average, and transactions at high prices are relatively slow.

PE spot trend forecast: In terms of raw materials: crude oil will further set a new high, and the oil distribution market will enter the US$86 -95 region. The shift in the focus of raw materials has driven up the cost of polyethylene production. Petrochemical policy: Currently, petrochemicals continue to go to the warehouse. Although the performance of the two cities is still acceptable, major regions are still moving upward, and the cost of on-site supply is strongly supported. Supply: Lianyungang Petrochemical, Jiutai, Zhongke Refining and Chemical, Hainan Refining and Chemical, and Zhejiang Petrochemical have been suspended until April and May. Recently, new units such as Zhongyuan Petrochemical and Maoming Petrochemical have continued to be suspended for maintenance, and the market supply continues to shrink. In terms of demand, the overall downstream demand is relatively stable, with small overall variables. Under the comprehensive influence, it is expected that the PE market will remain a volatile and strong market, but there is relatively limited room for continued upward. Focus on the market trend and spot transactions.

Mainstream quotation in PE market: yuan/ton

|

varieties |

regional |

April 8 |

April 9 |

rise and fall |

|

linear |

North China |

8330-8350 |

8330-8350 |

0/0 |

|

East China |

8200-8350 |

8230-8380 |

30/30 |

|

|

South China |

8330-8580 |

8350-8620 |

20/40 |

|

|

high-pressure membrane |

North China |

9250-9280 |

9250-9300 |

0/20 |

|

East China |

9250-9500 |

9250-9550 |

0/50 |

|

|

South China |

9350-9500 |

9350-9500 |

0/0 |

|

|

low-pressure membrane |

North China |

8300-8450 |

8300-8450 |

0/0 |

|

East China |

8400-8700 |

8400-8700 |

0/0 |

|

|

South China |

8400-8580 |

8400-8580 |

0/0 |

|

|

low pressure wire drawing |

North China |

8280-8550 |

8350-8550 |

70/0 |

|

East China |

8450-8700 |

8450-8700 |

0/0 |

|

|

South China |

8500-8800 |

8500-8800 |

0/0 |

Analysis of PE futures: On April 9, the opening price of L2409 was 8370, the highest price was 8406, the lowest price was 8356, the position was 308355 lots, the settlement price was 8381, yesterday's settlement: 8352, the increase: 29, and the daily trading volume: 176686 lots.

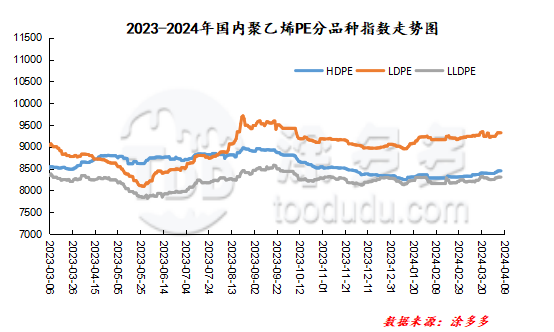

China's PE Index: According to Tu Duoduo's data, on April 9, China's LLDPE spot index was 8377, up 20, or 0.24%; the LDPE film spot index was 9367, up 12, or 0.13%; the HDPE spot index was 8515, up 6, or 0.07%.