PVC: Futures prices continue to test the bottom space, the weak pattern continues, and the spot market quotations are chaotic

PVC: futures prices continue to test the bottom space, the weak pattern continues, and the spot market quotation is chaotic.

PVC futures analysis: April 9 V2405 contract opening price: 5813, highest price: 5816, lowest price: 5752, position: 698783, settlement price: 5782, yesterday settlement: 5782, down: 0, daily trading volume: 618622 lots, precipitated capital: 2.839 billion, capital outflow: 72.64 million.

List of comprehensive prices by region: yuan / ton

|

Area |

April 8th |

April 9th |

Rise and fall |

Remarks |

|

North China |

5450-5540 |

5440-5510 |

-10/-30 |

Send to cash remittance |

|

East China |

5520-5620 |

5500-5610 |

-20/-10 |

Cash out of the warehouse |

|

South China |

5590-5650 |

5540-5640 |

-50/-10 |

Cash out of the warehouse |

|

Northeast China |

5470-5620 |

5470-5620 |

0/0 |

Send to cash remittance |

|

Central China |

5500-5540 |

5500-5540 |

0/0 |

Send to cash remittance |

|

Southwest |

5440-5600 |

5440-5600 |

0/0 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction prices continue to adjust mainly in a narrow range, the spot market operation atmosphere is light. Compared with the valuation, it fell by 10-30 yuan / ton in North China, 10-20 yuan / ton in East China, 10-50 yuan / ton in South China, stable in Northeast China, stable in Central China and stable in Southwest China. Upstream PVC manufacturers mostly maintain stable ex-factory prices, and there is no obvious adjustment trend in enterprise quotations, but there are still few contracts signed in today's session. The futures market first fell and then rose, and the quotations of various merchants in the spot market were slightly chaotic. Trade reports in some areas were slightly higher than yesterday's comparison, but the supply of high-priced goods was more difficult to close transactions, mainly concentrated in low areas, and merchants in some areas lowered their quotations slightly, so there were differences in the spot market offer. The basis offer is basically stable, including East China 05 contract-(200-250-280), South China 05 contract-(150-200-230), North 05 contract-(480-500), Southwest 05 contract-(250-370). On the whole, today's spot market transactions are still slightly general, downstream products enterprises to maintain rigid demand for low-cost procurement.

Futures point of view: PVC05 contract night futures prices maintain a volatile trend, the volatility range is relatively narrow. After the beginning of morning trading, the downward trend of futures prices was relatively obvious, followed by low consolidation, and prices rose slightly in late afternoon trading. 2405 contracts range from 5752 to 5816 throughout the day, with a spread of 64 million and reduced positions by 16914 positions to 698783 positions so far. The 2409 contract closed at 5951, with 501450 positions.

PVC Future Forecast:

Futures: & nbsp The PVC05 contract price continued to test the low range in the operating session. During the day, the futures price showed an increase of 18000 hands, the futures price declined obviously, and the increase and downside was still dominated by short positions, but there was a rapid reduction in the afternoon market. In the previous forecast, we mentioned that on the one hand, the 05 contract gradually changed positions and changed months with the passage of time, and the current operation of the futures price continued to fluctuate in the low range. PVC fundamentals and overall commodity sentiment are lack of support and drive. The technical level shows that the three-track openings of the Bolin belt (13, 13, 2) are all downward, and the weakness is obvious, and the fluctuation of the futures price continues to maintain low horizontal trading, and we still maintain the previous point of view. in the short term, the operation of futures prices will continue to observe the performance of the low range of 5750-5850.

spot aspect: At present, the two cities continue to be low, and there is no good improvement in the spot market for the time being. the pace of purchasing rigid demand in the market remains unchanged, and speculative demand cannot be generated for a long time, and the expected spring maintenance and demand recovery from March to April have not been well realized. therefore, from the overall fundamental point of view, the low valuation of PVC and the recent weakening of caustic soda, another major product of chlor-alkali enterprises, are also obvious. Although the chlor-alkali enterprises have signed contracts to maintain the basic quantity, they are not willing to make too many concessions to the ex-factory price, and the price is already at a low level. However, the term of the two cities in the empty situation, it is also difficult to show a better upward trend, 05 contract is likely to end in a weak pattern. Oil prices fell in the outer disk, ending a multi-day rally as Israel reduced its military presence in southern Gaza and began a new round of cease-fire negotiations with Hamas. On the whole, China's PVC spot market still maintains a narrow adjustment model.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

April 8th |

April 9th |

Rate of change |

|

V2405 collection |

5805 |

5797 |

-8 |

|

|

Average spot price in East China |

5570 |

5555 |

-15 |

|

|

Average spot price in South China |

5620 |

5590 |

-30 |

|

|

PVC2405 basis difference |

-235 |

-242 |

-7 |

|

|

V2409 collection |

5950 |

5951 |

1 |

|

|

V2405-2409 close |

-145 |

-154 |

-9 |

|

|

PP2405 collection |

7589 |

7598 |

9 |

|

|

Plastic L2405 collection |

8339 |

8347 |

8 |

|

|

V--PP basis difference |

-1784 |

-1801 |

-17 |

|

|

Vmure-L basis difference of plastics |

-2534 |

-2550 |

-16 |

|

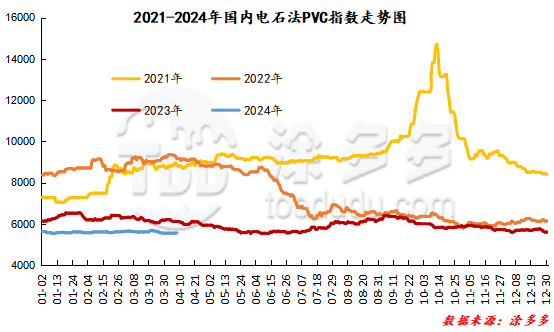

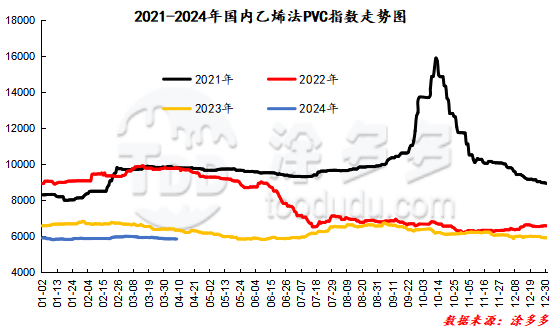

China PVC Index: according to Tuduoduo data, the spot index of China calcium Carbide PVC fell 15.23 or 0.274% to 5538.01 on April 9. The ethylene PVC spot index was 5848.04, down 6.18, or 0.106%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 309.93.

PVC warehouse receipt daily:

|

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.

Original: Pei Zhongxue