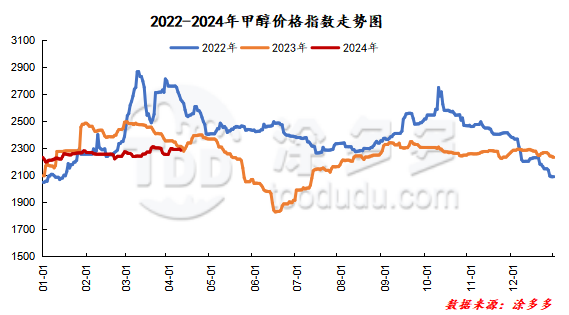

Methanol: Futures market continues to be weak, spot prices fluctuate and fall back

On April 9, the methanol market price index was 2284.11, down 10.17 from yesterday and 0.44% from the previous month.

Outer disk dynamics:

Methanol closed on April 8:

China CFR 294-301 US dollars / ton, down 4 US dollars / ton

Us FOB 97-98 cents per gallon, down 3 cents per gallon

Southeast Asia CFR 341342USD / ton, Ping

European FOB 302.5-303.5 euros / ton, up 8 euros / ton.

Summary of today's prices:

Guanzhong: 2230-2280 (0), North Route: 2070-2120 (- 10), Lunan: 2400 (0), Henan: 2300-2320 (- 10), Shanxi: 2210-2280 (- 20), Port: 2525-2550 (- 40)

Freight:

North Route-North Shandong 220-280 (0Uniqure 10), Northern Route-Southern Shandong 290-310 (0amp 0), Southern Route-Northern Shandong 230-270 (- 10 Universe Mueller 10), Guanzhong-Southwest Shandong 170-230 (0max 0)

Spot market: today, the methanol market adjusts narrowly, the futures market continues to be weak, the port spot quotation adjusts with the market, coupled with the slow recovery of downstream market demand, the mindset of market operators is average, and the market transaction only maintains rigid demand. specifically, the market price in the main producing areas fell narrowly, with the price on the south line around 2120 yuan / ton, the price on the north line around 2070-2120 yuan / ton, and the low end down by 10 yuan / ton. The market transaction atmosphere in the region is good. During the restart of the Jiutai olefin plant, there is some support on the demand side, and some bidding enterprises sell at a premium. In the later stage, we need to pay attention to the maintenance of the equipment in the field. The market price in Shandong, the main consumer area, is adjusted in a narrow range, with 2400 yuan / ton in southern Shandong. The demand side in the region does not fluctuate obviously for the time being, and the market atmosphere is still cautious. Northern Shandong is 2350-2360 yuan / ton. The market is weak, and the attitude of operators is more wait-and-see. The market quotation in North China is mainly arranged. Hebei quotation is 2300-2350 yuan / ton today. Some downstream operators still have a certain wait-and-see mood towards the future, and the enthusiasm of entering the market is general. Shanxi quotes 2210-2280 yuan / ton today, the low end is stable, and the terminal demand is flat. Downstream manufacturers mostly maintain rigid demand to pick up goods, and the market transaction is limited.

Port market: methanol futures are weak and volatile. Spot negotiations are rare. Shipments were positive in April, and the basis continued to weaken. (5) the basis difference is stable. The overall transaction throughout the day is not bad. Taicang main port transaction price: 4 transaction price: 2520-2550, basis + 62Universe price 50, transaction 4: 2515-2530, basis + 55pm 40, transaction 4: 2515-2530, basis + 45pm 40, transaction 5: 2475-2485, basis + 5max. 7.

|

Area |

2024/4/9 |

2024/4/8 |

Rise and fall |

|

The whole country |

2284.11 |

2294.28 |

-10.17 |

|

Northwest |

2070-2250 |

2080-2280 |

-10/-30 |

|

North China |

2210-2350 |

2230-2350 |

-20/0 |

|

East China |

2525-2620 |

2565-2670 |

-10/-50 |

|

South China |

2560-2650 |

2590-2660 |

-30/-10 |

|

Southwest |

2310-2450 |

2330-2450 |

-20/0 |

|

Northeast China |

2350-2480 |

2350-2480 |

0/0 |

|

Shandong |

2350-2420 |

2360-2420 |

-10/0 |

|

Central China |

2300-2620 |

2310-2650 |

-10/-30 |

future forecast: at present, the inventory pressure of manufacturers in China's main production areas is not great, coupled with the fact that Jiutai 600000 tons / year MTO device resumed full load operation today, the market demand side in the region has slightly improved, which has a certain support for the mentality of operators, but the recent weak operation of the futures market, the port spot quotation fell with the market, coupled with the gradual increase in the arrival of imported goods, downstream and traders entered the market mainly at a low price. At present, the short-term methanol market price is expected to adjust in a narrow range, but in the later stage, we should pay attention to the coal price, the release of the spring inspection of various manufacturers and the follow-up of downstream demand.