PVC: Futures prices are closed, the spot market is slightly calm, and some have adjusted slightly

PVC futures analysis: closed on Sunday.

List of comprehensive prices by region: yuan / ton

|

Area |

April 3rd |

April 7th |

Rise and fall |

Remarks |

|

North China |

5470-5550 |

5470-5550 |

0/0 |

Send to cash remittance |

|

East China |

5520-5620 |

5540-5630 |

20/10 |

Cash out of the warehouse |

|

South China |

5580-5640 |

5610-5660 |

30/20 |

Cash out of the warehouse |

|

Northeast China |

5520-5640 |

5520-5640 |

0/0 |

Send to cash remittance |

|

Central China |

5500-5540 |

5500-5540 |

0/0 |

Send to cash remittance |

|

Southwest |

5440-5600 |

5440-5600 |

0/0 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction price fluctuation, Sunday spot market turnover is not good. The comparison of valuation shows that North China is stable, East China is up 10-20 yuan / ton, South China is 20-30 yuan / ton, and Northeast, Central China and Southwest China are stable. The factory prices of upstream PVC production enterprises do not bid on Sunday, and there are not many contracts signed in the first generation, and the market is waiting for the opening trend of Monday. Although Sunday is a working day, the futures market is closed, so the spot market performance is relatively calm. On the one hand, the production enterprises wait and see the price, on the other hand, the spot market fluctuation is small, and the market quotation is limited, a small amount of a mouthful price. However, there are still some merchants with poor shipments whose prices are slightly lower than those on Wednesday, and the futures prices are suspended, so there are no base quotations in various regions today. On the whole, there are some low-priced goods in the spot market, and the transaction is mainly concentrated in the low range. Downstream procurement enthusiasm is not high, the transaction in the market is weak.

From a futures perspective: is closed on Sundays.

PVC Future Forecast:

Spot aspect: After the Qingming Festival holiday, the spot market is relatively calm during the period and today, with few bids from production enterprises, and small and flexible adjustments by spot market merchants according to their own shipping rhythms. With the passage of time, on the one hand, changing positions for months is on a daily basis, on the other hand, continuous low horizontal finishing leads to the poor operation of the futures market, thus affecting the operating mentality of the spot market. Even the current highs of the two cities may lose expectations in the low-level negotiations. At present, there is still a certain contradiction between supply and demand, especially the high inventory is still an obvious constraint of the two cities, strong supply and weak demand, so the performance of the two cities is not good. In the outer disk, prices in the international crude oil futures market continued to rise, as geopolitical tensions intensified concerns about supply tensions in the global oil market. At the same time, the market continues to pay attention to the oil supply shortages that may be caused by production cuts in OPEC+ oil-producing countries. On the whole, the spot market price of PVC is still low and narrow in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

April 2nd |

April 3rd |

Rate of change |

|

V2405 collection |

5793 |

5768 |

-25 |

|

|

Average spot price in East China |

5575 |

5570 |

-5 |

|

|

Average spot price in South China |

5620 |

5610 |

-10 |

|

|

PVC2405 basis difference |

-218 |

-198 |

20 |

|

|

V2409 collection |

5933 |

5905 |

-28 |

|

|

V2405-2409 close |

-140 |

-137 |

3 |

|

|

PP2405 collection |

7560 |

7597 |

37 |

|

|

Plastic L2405 collection |

8293 |

8319 |

26 |

|

|

V--PP basis difference |

-1767 |

-1829 |

-62 |

|

|

Vmure-L basis difference of plastics |

-2500 |

-2551 |

-51 |

|

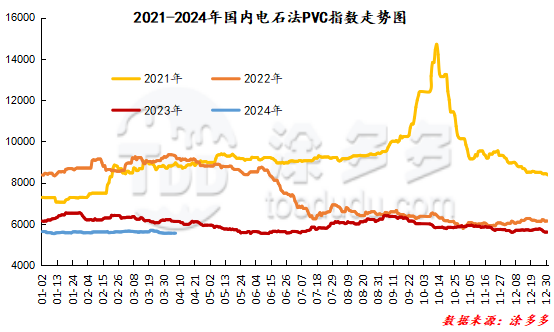

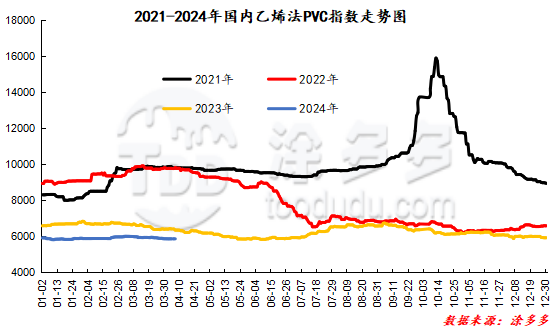

China PVC Index: according to Tudou data, the spot index of China's calcium carbide PVC rose 9.99, or 0.18%, to 5566.38 on April 7. The ethylene method PVC spot index was 5852.16, down 11.45%, with a range of 0.195%. The calcium carbide method index rose, the ethylene method index decreased, and the ethylene-calcium carbide index spread was 285.78.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

4.2 warehouse order volume |

4.3 warehouse order volume |

change |

|

Polyvinyl chloride |

China Reserve shares |

0 |

276 |

276 |

|

|

China Central Reserve Nanjing |

0 |

276 |

276 |

|

Polyvinyl chloride |

Cosco sea logistics |

249 |

490 |

241 |

|

|

Shanghai Zhongyuan Sea |

120 |

190 |

70 |

|

|

Middle and far sea in Jiangyin |

129 |

300 |

171 |

|

Polyvinyl chloride |

Zhejiang International Trade |

0 |

700 |

700 |

|

Polyvinyl chloride |

Peak supply chain |

0 |

280 |

280 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

0 |

2,402 |

2,402 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

944 |

1,505 |

561 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

1,362 |

2,515 |

1,153 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

0 |

84 |

84 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

198 |

198 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

0 |

200 |

200 |

|

PVC subtotal |

|

2,753 |

8,650 |

5,897 |

|

Total |

|

2,753 |

8,650 |

5,897 |

PVC long bears hold the list of bulls:

The market is closed.

The information provided in this report is for reference only.