Polypropylene PP: Capacity expansion is under pressure and financial sentiment. PP rebounds willfully, chasing after growth or high?

"High capacity expansion" has become the largest label of polypropylene products in recent years, and China's polypropylene production capacity continues to expand significantly in 2024. According to Tuduoduo statistics, China plans to increase polypropylene production capacity by a total of 8.705 million tons, making it the largest year of capacity expansion. Based on this, polypropylene has also become an empty choice.

This weekend, the PP futures market took the lead in a strong rebound, reaching a new high since December 2023, thus breaking the previous consolidation situation of about 150 points. Futures upside break, for the spot market undoubtedly form a strong driving role, although it coincides with Friday, but all over the enthusiasm unabated, consignors have increased shipments, the market situation is good.

For the current rebound, in addition to financial factors, in fact, fundamentals also give a certain drive, specifically:

First, cost assistance

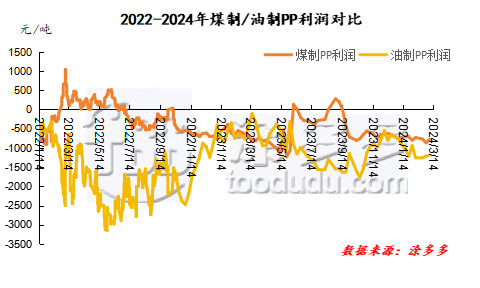

After a long period of horizontal market shock, the overnight oil distribution strongly broke through the key resistance level of US $84. Oil prices continue to rise, resulting in the current polypropylene production costs to comply with the upward, other cost paths such as PDH, methanol and other price shocks have risen, the center of gravity slightly upward. Under the background of strong supply and weak demand of polypropylene in China, the price is difficult to improve and the profit loss continues, of which the loss of oil production cost is more than-1000 yuan / ton. This has also led to the root cause of the relatively strong ex-factory prices of the two oil companies for a period of time.

II. Policy themes

On March 13, the "Action Plan for promoting large-scale equipment Renewal and Consumer goods Trade-in" (hereinafter referred to as "Action Plan") issued by the State Council was officially released, which aroused widespread concern in the society. The third article on the implementation of consumer goods trade-in action mentioned, to carry out cars, home appliances, home decoration consumer goods trade-in, are in the long-term demand for polypropylene to provide bullish drive. On the other hand, in the short term, it gives bullish and bullish subject matter hype.

Third, the overhaul of coal enterprises is coming.

Since late March, the overhaul of China's polypropylene production enterprises has increased, including Jiutai, Zhong'an United and other devices have been stopped one after another. In April, the maintenance equipment of coal chemical industry in Northwest China, except Shenhua Xinjiang 450000 tons / year, other enterprises focus on parking and maintenance. From the maintenance time point of view, the parking time lasts more than 20 days, in addition, the parking device mainly produces wire drawing and low-melting copolymerization, and the supply of goods in the market will shrink.

Overhaul parking Plan of Chinese Polypropylene production Enterprises from March to May 2024

|

Enterprise name |

product line |

Production capacity |

Parking Duration |

|

Gold energy chemistry |

First line |

45 |

March 8, 2024 |

|

North China brocade |

Old line |

6 |

March 8, 2024 |

|

Hongji Petrochemical |

Single line |

20 |

March 13, 2024 |

|

China-Angola alliance |

Single line |

35 |

March 14, 2024 |

|

Haitian petrochemical |

Single line |

20 |

March 15, 2024 |

|

Jiutai Group |

Single line |

32 |

March 15, 2024 |

|

Donghua Energy (Ningbo) |

Phase II |

40 |

March 20, 2024 |

|

Sinopec |

STPP |

20 |

March 17, 2024 |

|

Chinese Science Refining and Chemical Industry |

First line |

35 |

March 20, 2024 |

|

Chinese Science Refining and Chemical Industry |

Second line |

20 |

March 20, 2024 |

|

Ningbo Fude |

Single line |

40 |

March 24, 2024 |

|

Dalian Petrochemical Corporation |

Second line |

7 |

March 31, 2024 |

|

Dalian Petrochemical Corporation |

First line |

20 |

March 31, 2024 |

|

Zhejiang Petrochemical Corporation |

First line |

45 |

End of March 2024 |

|

Zhongyuan Petrochemical Company |

First line |

6 |

April 1, 2024 |

|

Zhongyuan Petrochemical Company |

Second line |

10 |

April 1, 2024 |

|

Tianjin Petrochemical Company |

Second line |

20 |

Early April 2024 |

|

Shenhua Baotou |

Single line |

30 |

Early April 2024 |

|

Datang Duolun |

First line |

23 |

Mid-late April 2024 |

|

Datang Duolun |

Second line |

23 |

Mid-late April 2024 |

|

Dushanzi petrification |

First line |

7 |

May 15, 2024 |

|

Dushanzi petrification |

Second line |

7 |

May 15, 2024 |

|

Dushanzi petrification |

Third line |

30 |

May 15, 2024 |

|

Dushanzi petrification |

Four lines |

25 |

May 15, 2024 |

Under this advantage, the strong rise of funds is also justified. However, for the future market, we still need to pay attention to the game between the cost side and the supply side, as well as the sentiment of capital on the disk.

From the raw material side, geographically, the situation in the Middle East is still unstable, and the situation in Russia and Ukraine is also worthy of attention; fundamentals have positive expectations on both sides of supply and demand, supply-side OPEC+ will continue to control output, and demand-side gasoline demand will pick up seasonally; at the macro level, the risk appetite of financial markets is generally strong. International oil prices remain in a state that is easy to rise and difficult to fall.

From the supply side, according to the current petrochemical maintenance plan, the overall supply contraction is expected to remain unchanged, so the positive effect on the market really exists. But at the same time, the new capacity expansion has gradually become a heavy pressure: on March 7th, the polypropylene plant of Huizhou Lituo New Materials Co., Ltd. (150000 tons / year) has produced qualified products and is currently producing wire drawing. Anhui Tianda PP plant (150000 tons / year PP powder, 150000 tons / year PP granule) has trial produced PP material qualified products, and plans to start up in March. Jinneng Science and Technology Phase II 450000 t / a polypropylene plant is scheduled to be put into trial operation in April.

At the futures level, the current intention to push up funds is obvious, and there is still room for upward growth under the support of fundamentals. However, under the condition that many advantages are fully traded or even there may be over-trading in the future, there is still heavy pressure on capacity expansion and weak rigid demand, so the wave market can be more defined as a rebound than a reversal.