Polypropylene PP: Petrochemical accumulated 415,000 tons. After the market opened high, be wary of supply pressure counterattack

During the Spring Festival holiday, China's futures markets were closed, and spot market transactions were also generally quiet. However, external crude oil continued to rise, giving market cost support. Although the stocks of the two oil companies have accumulated to 990,000 tons, it is still difficult to change the market's enthusiasm for overreporting. On the first day of opening, the polypropylene market took the lead in pulling up without futures guidance. Wire drawing prices in three places in China ranged from 7,300 to 7,500 yuan/ton, which was 40 to 150 yuan/ton higher than before the holiday. At present, the main focus is on tentative offers from holders. Procurement from downstream factories has not yet been fully launched. Some tentative inquiries are still scarce, and firm offers are waiting for guidance after the futures market opens.

Petrochemical industry has greatly accumulated reserves

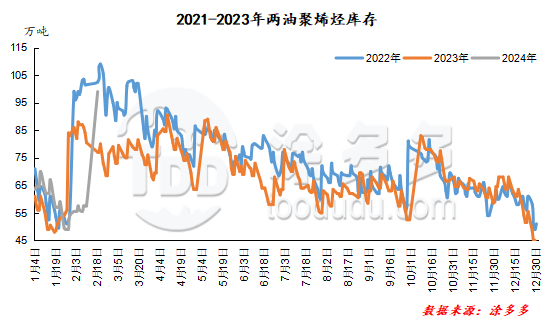

Before the holiday, middlemen actively completed the petrochemical assessment indicators, and downstream just needed to prepare and purchase goods. The inventory of the two oil products dropped to a relatively low level during the year, at 575,000 tons. Returning after the festival, petrochemical inventories accumulated significantly. As of February 18, there were 990,000 tons in the two oil depots, which is equivalent to the level returned after the holiday in 2022, an increase of 415,000 tons compared with the holiday, an increase of 58.1%. There are two reasons for the large accumulation of stocks: most production companies suspended billing during the first and second periods; second, new production capacity continued to increase, the polyolefin production base continued to expand, and market supply increased.

|

2022-2024 Statistics on accumulated petrochemical warehouses before and after the Spring Festival of 2008 (unit: 10,000 tons) |

||||

|

year |

before the Spring Festival |

after the spring Festival |

increase |

increase |

|

the 2022 |

54.5 |

99 |

44.5 |

81.65% |

|

in 2023 |

51 |

82 |

31 |

60.78% |

|

in 2024 |

57.5 |

99 |

41.5 |

72.17% |

Increase in maintenance and restart devices

During the holidays, multiple sets of pre-parking devices resumed operation: Dongguan Juzhengyuan Phase I Line (300,000 tons/year), Jinneng Chemical (450,000 tons/year), Liaoyang Petrochemical (300,000 tons/year), Shaoxing Sanyuan Lao Line (200,000 tons/year), Hongji Petrochemical (200,000 tons/year) PP units restarted. At the same time, Fujian United Old Line (200,000 tons/year) and Yangzi Petrochemical Line 1 B (100,000 tons/year) are about to start, and a new parking device for Maoming Petrochemical Line 2 (300,000 tons/year) will be added. It is planned to start on February 23, 2024.

With the increase in maintenance and restart devices, the polypropylene market supply will increase significantly compared with the pre-holiday period. Moreover, the new capacity expansion of Tianda in Anhui and Guoheng in Quanzhou, which were postponed before the Spring Festival, is still on the way, and the market supply pressure cannot be underestimated.

trend forecast

As far as futures are concerned, with crude oil rising during the holidays and spot prices rising today, a high opening on Monday has become a high probability event. In the spot market, upstream de-warehousing has become the top priority in the current market. On the one hand, petrochemical inventories are high; on the other hand, the restart of equipment maintenance has led to another increase in output. After the holiday, the polypropylene market supply pressure is greater. As a demand side, although downstream factories are expected to need to replenish their warehouses after the Spring Festival, traditional downstream polypropylene such as plastic weaving, BOPP, etc., have relatively weak seasonal demand compared with polyethylene mulch films. In recent years, new downstream orders have fallen short of expectations, and resistance to high-priced raw materials have inhibited the demand side. From the perspective of speculative demand, more attention is paid to futures trends and basis changes.