Polyolefins: After continuous declines, how strong is the market rebound?

Since the first half of January, the polyolefin market has not got off to a good start, and the two markets continue to fall. Since last Thursday, with the recovery of macro sentiment, the spot market has gradually gone under the treasury, and the market has gradually shown signs of rebound. As of January 15, the mainstream linear price in China was 8070-8400 yuan / ton, up 20-90 yuan / ton from last Thursday, while the mainstream price of PP wire drawing in China was 7270-7450 yuan / ton, up about 30 yuan / ton from last Thursday. After the market has stopped falling, how strong is the rebound and how far is the road to rebound?

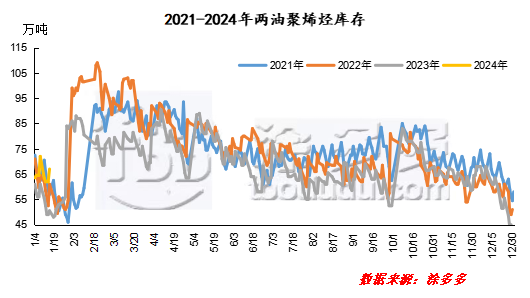

Supply side: two oil stocks move down, output increases in the second half of the month

Entering the two oil depots this month, there are New Year's Day holiday depots and slow shipments caused by the falling market, polyolefin stocks once rose to 700000 tons, a high in nearly four years. The continuous decline in the market and signs of rising, driving part of the market to buy, since last week, two oil accelerated to the warehouse. Last Friday, two oil inventories fell to 620000 tons. On Monday morning, although there are tired stocks, the overall inventory level has dropped to the middle of the year. And with the continuous improvement of on-site shipments, it is expected that the upstream inventory will accelerate downward.

Figure 1

In terms of yield, whether polyethylene or polypropylene 1 In March, minor repairs of maintenance facilities were mainly carried out in China, and polypropylene was once again facing the supply increment brought by capacity expansion, and polyolefin production and start-up in the second half of January are still expected to increase further. From the perspective of polyethylene, only Sinochem Quanzhou low-voltage parking in the second half of the month, but the previous overhaul of Lanhua Qumi, Maoming and Hainan low-voltage devices will gradually start up, the supply of goods in the field will increase significantly. In terms of polypropylene, Maoming, China and South Korea and Zhejiang Petrochemical have parking plans, but at the same time, Jingmen, Maoming third line and Juzhengyuan all have parking plans. And new capacity expansion, Guangdong (Jieyang) petrochemical second line 200000 tons / year smoothly put into production, Anhui Tianda 150000 tons / year polypropylene plant has been trial production, is about to operate normally, in the new capacity put into operation, the supply pressure is still not to be underestimated.

|

Maintenance plan of polyolefin production enterprises in the second half of January 2024 |

||||||

|

Product |

Enterprise name |

Device name |

Production line |

Production capacity |

Parking Duration |

departure time |

|

PE |

Quanzhou, Sinochem |

HDPE |

|

40 |

January 16, 2024 |

January 30, 2024 |

|

PP |

Maoming Petrochemical |

|

First line |

17 |

January 17, 2024 |

January 25, 2024 |

|

Sinopec |

|

Third line |

30 |

January 18, 2024 |

January 28, 2024 |

|

|

Zhejiang Petrochemical Corporation |

|

Third line |

45 |

January 25, 2024 |

To be determined |

|

Table 1

Demand side: short-term trading stabilizes, midline rigid demand weakens

From a current point of view, but with the improvement of the two markets, some of the early wait-and-see buying market bargain into the market, the trading atmosphere has stabilized. However, from the midline point of view, the weakening rigid demand for polyolefin has become an indisputable fact. The downstream categories mainly maintain year-end orders, while new orders continue to weaken, and the return of enterprise funds at the end of the year restricts the circulation of raw materials.

Raw material side: pay attention to the spillover risk of armed conflict between the United States and Britain and Houthi

Oil prices are slightly higher as airstrikes by the United States and its allies against Houthi militants could trigger broader conflicts and disrupt crude oil supplies in the Middle East. But the rebound in oil prices is still constrained by the prospect of increased supply and slowing demand growth in non-OPEC countries. In the short term, the crude oil market continues to pay attention to the geopolitical situation, and after the mutual attack between the United States and Britain and the Houthi forces, pay attention to whether there is a risk of spillover from the scope of the conflict. For coal, most coal mines in Ordos region of Inner Mongolia maintain normal production and sales, mainly to implement long-term association shipping, the price of superimposed ports is continuously slightly reduced, the terminal is still dominated by rigid demand, and there is no large demand for replenishment for the time being. it is expected that coal prices at Kengkou will maintain a weak operation situation in the short term. On the whole, the upward drive that the feedstock end brings to the polyolefin market is relatively limited under the influence of the geopolitical situation.

Commodity sentiment: China is concerned about whether PPI can become a regular employee.

Overall commodity sentiment in China was poor in the first half of January, partly due to the revision of expectations of US interest rate cuts and, on the other hand, weak macro data on China. However, after the market is fully bearish, short-term attention will be paid to whether China's PPI can become positive and whether the number of interest rate cuts by the Federal Reserve in 24 years will continue to be lowered. With China's social finance and credit data still unable to cut interest rates, there is still caution about whether commodity sentiment can continue to pick up in the short term.

Overall, the current polyolefin market has rebounded after a continuous decline in repair demand, but the midline in the fundamental constraints, the rebound is relatively limited, market variables focus on raw materials and commodity sentiment changes.