Polypropylene PP: Regardless of the increase in inventory, spot Rasp rose 50-100

Sinopec inventory: two-oil polyolefin inventory of 935000 tons, an increase of 150000 tons over the pre-festival (Wednesday).

Mainstream quotation for wire drawing in PP market: yuan / ton

|

Region |

April 3rd |

April 7th |

Rise and fall |

|

North China |

7400-7500 |

7450-7600 |

50/100 |

|

East China |

7500-7600 |

7570-7650 |

70/50 |

|

South China |

7550-7650 |

7600-7700 |

50/50 |

PP China spot market analysis: today, China's PP market continues to rise, the mainstream prices of wire drawing in China range from 7450 to 7700 yuan / ton, with daily increases ranging from 50 to 100 yuan / ton. The international crude oil rose six times in a row, and the cloth oil exceeded 91 US dollars per barrel, which played an obvious role in driving the market. And production enterprises have been actively up-regulated since the beginning of the month. Today, CNOOC Northeast Wire drawing has been raised by 50 yuan / ton, CNPC Southwest has increased by 50-100 yuan / ton in addition to copolymerization, and the two oils are other stable. Coal enterprises across the line to raise ex-factory prices, on-site supply costs to promote a strong role. Add in the upstream parking increment since the end of the month, and the supply side is also good. However, the accumulation of inventory during the holiday is obvious, the inventory of two oil has increased to 935000 tons, and after the rise, the new price to buy into the market is cautious, in addition to some low-price rigid demand to buy or appropriate to fill the early blank order, more choose to wait and wait, trading on the market is relatively general.

PP spot trend forecast: raw materials: crude oil disk further refresh stage new high, oil distribution disk into the 86-95 dollar area. The center of gravity of the raw material moves upward, which drives the production cost of polypropylene higher. Petrochemical policy: at the beginning of the month, the performance of the two cities is good, there are still upward movements in various regions, and the supply cost of goods in the market is strongly supported. On the supply side: since late March, there has been an increase in equipment overhaul in China. In April, there are still many devices parking, including Zhejiang Sinopec, Shenhua Baotou and Datang. At the same time, the possibility of operating parking due to cost is not ruled out, and the market supply is expected to be significantly reduced. On the demand side, the overall downstream demand is relatively stable, driving little in the short term. Under the comprehensive influence, it is expected that the short-term PP market still maintains a strong shock operation.

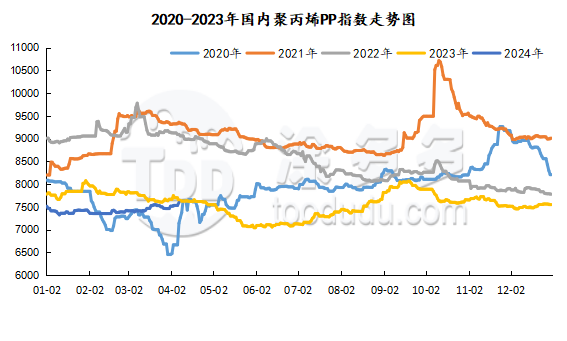

China's PP index: according to Tudor data, China's PP spot index rose 62, or 0.82%, to 7595 on April 7.

China installation parking Summary:

|

Enterprise name |

product line |

Production capacity |

Parking Duration |

departure time |

|

Dalian Petrochemical Corporation |

Third line |

5 |

August 2, 2006 |

To be determined |

|

Wuhan Petrochemical Corporation |

Old equipment |

12 |

November 12, 2021 |

To be determined |

|

Haiguolong oil |

First line |

20 |

February 8, 2022 |

To be determined |

|

Haiguolong oil |

Second line |

35 |

April 3, 2022 |

To be determined |

|

Tianjin Petrochemical Company |

First line |

6 |

August 1, 2022 |

To be determined |

|

Jinxi Petrochemical |

Single line |

15 |

February 16, 2023 |

To be determined |

|

Yanshan Petrochemical |

Second line |

7 |

September 18, 2023 |

To be determined |

|

Shaoxing Sanyuan |

New line |

30 |

September 20, 2023 |

To be determined |

|

Qinghai Salt Lake |

Single line |

16 |

October 27, 2023 |

To be determined |

|

Changzhou Fude |

Single line |

30 |

November 1, 2023 |

To be determined |

|

Jingbo polyolefin |

First line |

20 |

November 1, 2023 |

To be determined |

|

Luoyang Petrochemical |

First line |

8 |

November 3, 2023 |

To be determined |

|

Zhongjing Petrochemical |

The first phase and the first line |

50 |

December 5, 2023 |

To be determined |

|

Hongrun Petrochemical |

Single line |

45 |

December 6, 2023 |

To be determined |

|

Qilu Petrochemical |

Single line |

7 |

December 23, 2023 |

To be determined |

|

Lianhong Xinke |

Second line |

8 |

December 30, 2023 |

To be determined |

|

Fujian Union |

Old line |

12 |

January 3, 2024 |

To be determined |

|

Gold energy chemistry |

First line |

45 |

March 8, 2024 |

To be determined |

|

North China brocade |

Old line |

6 |

March 8, 2024 |

To be determined |

|

Jiutai Group |

Single line |

32 |

March 15, 2024 |

April 15, 2024 |

|

Donghua Energy (Ningbo) |

The first line of Phase II |

40 |

March 19, 2024 |

April 8, 2024 |

|

Donghua Energy (Ningbo) |

Second phase, second line. |

40 |

March 20, 2024 |

April 8, 2024 |

|

Chinese Science Refining and Chemical Industry |

First line |

35 |

March 20, 2024 |

May 20, 2024 |

|

Chinese Science Refining and Chemical Industry |

Second line |

20 |

March 21, 2024 |

May 20, 2024 |

|

Ningbo Fude |

Single line |

40 |

March 24, 2024 |

April 4, 2024 |

|

Jingbo polyolefin |

Second line |

40 |

March 26, 2024 |

April 15, 2024 |

|

Quanzhou, Sinochem |

Second line |

35 |

March 26, 2024 |

March 31, 2024 |

|

Jingmen petrochemical |

Single line |

12 |

March 27, 2024 |

March 31, 2024 |

|

Qinzhou, Guangxi |

Single line |

20 |

March 30, 2024 |

April 1, 2024 |

|

Dalian Petrochemical Corporation |

Second line |

7 |

March 31, 2024 |

May 10, 2024 |

|

Dalian Petrochemical Corporation |

First line |

20 |

March 31, 2024 |

May 10, 2024 |

|

Tianjin Petrochemical Company |

Second line |

20 |

April 1, 2024 |

April 14, 2024 |

|

Zhongyuan Petrochemical Company |

First line |

6 |

April 1, 2024 |

To be determined |

|

Dongguan Juzhengyuan |

The first line of Phase II |

30 |

April 1, 2024 |

April 2, 2024 |

|

Dongguan Juzhengyuan |

Second phase, second line. |

30 |

April 1, 2024 |

April 2, 2024 |

|

Zhejiang Petrochemical Corporation |

First line |

45 |

April 6, 2024 |

April 23, 2024 |

Shenhua auction turnover: Shenhua PP's auction volume today was 2472 tons, an increase of 102.62% over the previous trading day; the trading volume was 1809 tons, an increase of 61.52% over the previous trading day, and the turnover rate was 73.18%, a decrease of 18.62% compared with the previous trading day.