Polypropylene PP: Annual exports are back to positive value again, and a discussion on the cross-border sea route for polypropylene

In recent years, the supply capacity of the polypropylene industry has been increasing, and its production capacity has increased year by year, from 23 million tons in 2018 to 34.71 million tons in 2022. China's polypropylene production capacity has grown at an average annual rate of 9.6% in the past five years. Due to the failure to launch more than one planned plant in 2022, it was postponed to 2023 to further increase the capacity expansion during the year and superimpose the original capacity expansion plan. China's polypropylene will usher in the largest wave of capacity expansion in history in 2023. By the end of 2023, China's polypropylene production capacity broke through the 40 million-ton mark to 40.06 million tons, with a new production capacity of 5.05 million tons, an increase of 14.55 percent, an eight-year high.

Figure 1

China's industry has greatly expanded its capacity, but the growth of domestic demand is limited, and the contradiction between supply and demand in the market has become increasingly prominent. In order to alleviate the supply pressure, resource export has become an important engine of the industry. Based on this, major petrochemical, PetroChina and large traders have been actively opening up export channels and achieved certain results. in addition, in order to improve international competitiveness and encourage exports, the country has formulated an export tax rebate system, coupled with the fact that Chinese market prices have been injected into the world for a long time. More competitive in terms of price, export arbitrage window opens from time to time, export volume to maintain a certain volume.

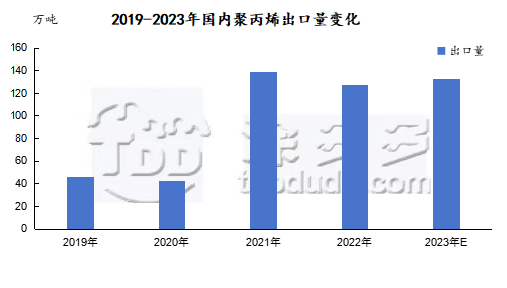

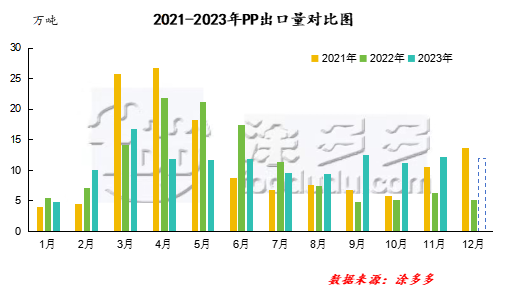

Judging from the changing trend of China's polypropylene export volume in the past five years, China's polypropylene export is divided into several stages. Before 2021, the spread window will be opened less often and for a shorter time, so there will be fewer export opportunities. From 2019 to 2020, China's annual polypropylene export volume continued to grow steadily, but the growth rate was slow. China's annual polypropylene export volume basically maintained at the level of more than 400000 tons. In 2021, due to the cold wave in the United States, many local polypropylene plants stopped, the global flow of polypropylene goods changed, goods from the Middle East and the far East were absorbed to high-priced areas such as the United States and South America, and China's export window opened. Resources continue to flow to Southeast Asia. China's polypropylene export has seen a huge increase, with an increase of 227.21%. From 2022 to 2023, with the continuous expansion of domestic polypropylene production capacity, the pressure of market supply and demand is becoming more and more prominent. the opening of the export market can better balance the relationship between supply and demand. China's polypropylene export is maintained at the level of 12-1.4 million tons / year, and the growth rate is relatively slow.

Figure 2

According to customs statistics, China's cumulative polypropylene exports from January to November 2023 were 1.2198 million tons, down 0.05% from the same period last year. According to Tuduoduo data, it is estimated that China's polypropylene exports will be about 1.3296 million tons in 2023, an increase of 4.27% over the previous year, and the export growth rate will return to the correct range.

Figure 3

The main reasons for the increase of China's polypropylene export in 2023 are as follows: first, China's capacity expansion. Production capacity has expanded significantly in 2023, and most of the new capacity is located in coastal areas, which is conducive to exports. Second, the phased devaluation of the RMB is good for exports. In 2023, the onshore and offshore RMB exchange rates depreciated by 5.4% and 5.7% respectively from April to June. On May 19, the central parity rate of the RMB against the US dollar broke 7 for the first time this year. On Sept. 8, the onshore renminbi hit 7.3510 against the dollar, its lowest level since the end of December 2007. Third, demand from major export receiving countries rebounded. The main destination of China's polypropylene export is in Southeast Asia, and the overall scale accounts for more than 30% of the annual polypropylene export. Among them, Vietnam is the largest exporter of polypropylene in China, accounting for 15% of the total export volume of polypropylene. According to figures released by Vietnam's General Administration of Statistics on December 29th, Vietnam's GDP rose 5.05 per cent year-on-year in 2023, higher than the expected 4.7 per cent. With the economic recovery, the demand for polypropylene, which is closely related to people's lives, has also rebounded, especially for membranes and wiredrawing.

Since 2024, the capacity expansion of polypropylene in China has continued, and the Chinese polypropylene market is subject to the supply pressure brought about by the rapid capacity expansion. While the international market has gradually entered the database-building cycle, India, South America and other markets may undertake some Chinese resources during the export window opening cycle. It is expected that China's polypropylene exports will still have a good performance in 2024.