PVC: Futures prices have reduced positions and left the market more flat, some have stopped losses, and the spot continues to adjust within a narrow range

PVC futures analysis: April 3 V2405 contract opening price: 5793, highest price: 5816, lowest price: 5766, position: 735903, settlement price: 5798, yesterday settlement: 5804, down: 6, daily trading volume: 580536 lots, precipitated capital: 2.971 billion, capital outflow: 105 million.

List of comprehensive prices by region: yuan / ton

|

Area |

April 2nd |

April 3rd |

Rise and fall |

Remarks |

|

North China |

5480-5550 |

5470-5550 |

-10/0 |

Send to cash remittance |

|

East China |

5530-5620 |

5520-5620 |

-10/0 |

Cash out of the warehouse |

|

South China |

5590-5650 |

5580-5640 |

-10/-10 |

Cash out of the warehouse |

|

Northeast China |

5520-5640 |

5520-5640 |

0/0 |

Send to cash remittance |

|

Central China |

5500-5540 |

5500-5540 |

0/0 |

Send to cash remittance |

|

Southwest |

5440-5600 |

5440-5600 |

0/0 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction price fluctuation is small, each region continues to operate in a narrow range. Compared with the valuation, it fell by 10 yuan / ton in North China, 10 yuan / ton in East China, 10 yuan / ton in South China, and stable in Northeast, Central and Southwest China. There is no obvious adjustment in the ex-factory price of upstream PVC production enterprises, most of them are stable quotations, and the first-generation contracts are mainly based on basic quantity. Futures prices continue to be low and narrow, traders offer little change than yesterday, but there are some low-price sources in the market, transactions are mainly concentrated in the low range. The basis has a tendency to expand, including East China basis offer 05 contract-(220-250-270), South China 05 contract-(150-200-230), North 05 contract-(480-500-530), Southwest 05 contract-(220-250). Downstream procurement enthusiasm is not high, although the point price supply and a price offer are available, but the transaction in the market is weak.

From the perspective of futures: & the night price of nbsp; PVC2405 contract is mainly arranged in a narrow range, and the fluctuation range of futures price is small. After the beginning of early trading, the volatility of the futures price still did not change significantly, still dominated by a narrow adjustment, and the late afternoon weakening was relatively obvious, and the late decline did not stop. 2405 contracts range from 5766 to 5816 throughout the day, with a spread of 50,05.05 and a reduction of 22660 positions, with 735903 positions so far. The 2409 contract closed at 5905, with 416874 positions.

PVC Future Forecast:

Futures: The operation of the PVC2405 contract futures price continues to be low and narrow, but the difference compared with the previous period lies in the decline of the late trading price. There is no night trading on Wednesday, April 3, when the Qingming Festival comes. Therefore, the market shows the market of reducing positions and leaving the market, and the trading is 23.1% flat compared with 25.7% more flat. In the trend of low futures price operation, the increase of Duoping is more inclined to consider more single stop losses. The technical level shows that the three-track openings of the Bolin belt (13, 13, 2) have all turned downward, and a short trend has been formed at present. Although the operation of the futures price is still dominated by low and narrow finishing, the weak pattern continues. In the short term, continue to observe the operating range of the low range between 5750 and 5850.

Spot aspect: before the Qingming Festival holiday, the turnover in the spot market is light, the state of low and narrow arrangement continues, and the supply of low-priced goods in the spot market has increased, and production enterprises and middlemen are still facing greater sales pressure. At present, the start-up load of PVC plant is stable, but the production pressure of chlor-alkali enterprises is large, the loss of single product PVC is obvious, and the trend of caustic soda in the two major chlor-alkali products is the same in recent weeks, which is mainly 50-100yuan / ton, which shows that the chlor-alkali market continues to be weak. In the outer disk, the price of international crude oil futures market continued to rise as Russia and Ukraine launched more attacks on each other's energy infrastructure, leading to a rise in geopolitical risks. Israel's attack on the Iranian consulate in Syria also raised concerns about the conflict in the Middle East. On the whole, the spot market price of PVC is still low and narrow in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

April 2nd |

April 3rd |

Rate of change |

|

V2405 collection |

5793 |

5768 |

-25 |

|

|

Average spot price in East China |

5575 |

5570 |

-5 |

|

|

Average spot price in South China |

5620 |

5610 |

-10 |

|

|

PVC2405 basis difference |

-218 |

-198 |

20 |

|

|

V2409 collection |

5933 |

5905 |

-28 |

|

|

V2405-2409 close |

-140 |

-137 |

3 |

|

|

PP2405 collection |

7560 |

7597 |

37 |

|

|

Plastic L2405 collection |

8293 |

8319 |

26 |

|

|

V--PP basis difference |

-1767 |

-1829 |

-62 |

|

|

Vmure-L basis difference of plastics |

-2500 |

-2551 |

-51 |

|

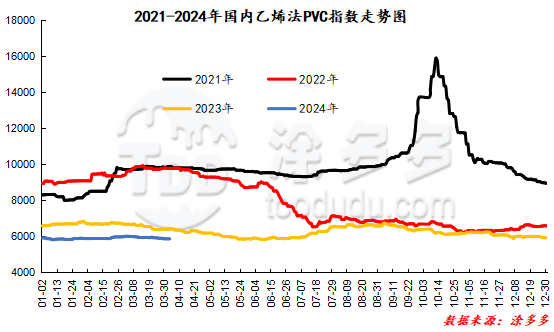

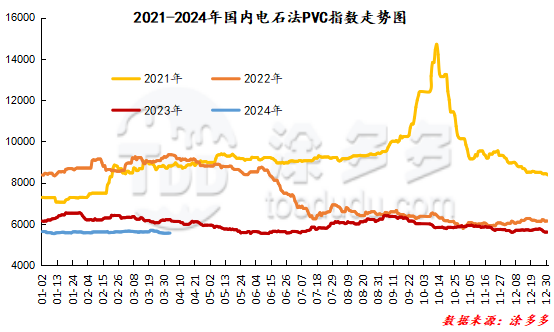

China PVC Index: according to Tuduoduo data, the China calcium Carbide PVC spot Index fell 4.73, or 0.085%, to 5556.39 on April 3. The PVC spot index of ethylene method is 5863.61, up 0%, the range of 0%, the index of calcium carbide method is down, the index of ethylene method is stable, and the price difference between ethylene method and calcium carbide method is 307.22.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

4.2 warehouse order volume |

4.3 warehouse order volume |

change |

|

Polyvinyl chloride |

China Reserve shares |

0 |

276 |

276 |

|

|

China Central Reserve Nanjing |

0 |

276 |

276 |

|

Polyvinyl chloride |

Cosco sea logistics |

249 |

490 |

241 |

|

|

Shanghai Zhongyuan Sea |

120 |

190 |

70 |

|

|

Middle and far sea in Jiangyin |

129 |

300 |

171 |

|

Polyvinyl chloride |

Zhejiang International Trade |

0 |

700 |

700 |

|

Polyvinyl chloride |

Peak supply chain |

0 |

280 |

280 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

0 |

2,402 |

2,402 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

944 |

1,505 |

561 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

1,362 |

2,515 |

1,153 |

|

Polyvinyl chloride |

Quick biography of Xiangyu in Shanghai |

0 |

84 |

84 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

198 |

198 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

0 |

200 |

200 |

|

PVC subtotal |

|

2,753 |

8,650 |

5,897 |

|

Total |

|

2,753 |

8,650 |

5,897 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.