Daily review of urea: Manufacturers 'inventory pressure continues to be consolidated downward (April 3)

China Urea Price Index:

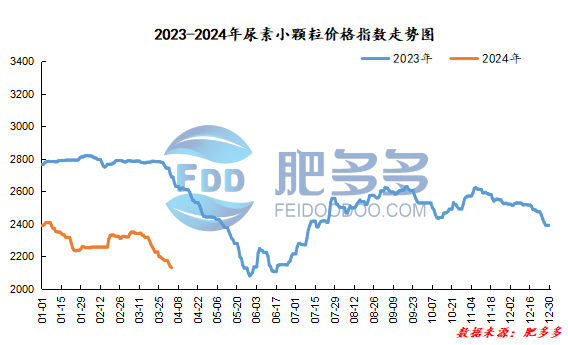

According to Feiduo data, the urea small pellet price index on April 3 was 2,130.59, a decrease of 7.41 from yesterday, a month-on-month decrease of 0.35% and a year-on-year decrease of 20.75%.

Urea futures market:

Today, the opening price of the urea UR409 contract is 1856, the highest price is 1893, the lowest price is 1855, the settlement price is 1880, and the closing price is 1876. The closing price has increased by 20 compared with the settlement price of the previous trading day, up 1.08% month-on-month. The fluctuation range of the whole day is 1855-1893; the basis of the 05 contract in Shandong region is 174; the 05 contract has reduced its position by 3514 lots today, and so far, it has held 190361 lots.

Spot market analysis:

Today, China's urea market prices continued to be weak and downward. Factory quotations continued to test downward. The market follow-up showed no improvement. The price has dropped to a low level, and the current decline has slowed down.

Specifically, prices in Northeast China fell to 2,080 - 2,160 yuan/ton. Prices in East China fell to 2,050 - 2,110 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,050 - 2,300 yuan/ton, and the price of large particles fell to 2,060 - 2,120 yuan/ton. Prices in North China fell to 1,930 - 2,100 yuan/ton. Prices in South China fell to 2,200 - 2,260 yuan/ton. Prices in the northwest region are stable at 2,090 - 2,100 yuan/ton. Prices in Southwest China are stable at 2,050 - 2,450 yuan/ton.

Market outlook forecast:

In terms of factories, manufacturers are gradually decreasing, and offers continue to fall under pressure on shipments. Currently, prices are gradually lowered to a lower level, and the decline has slowed down slightly. However, the transaction of new orders has not improved, and shipments are still under pressure. In terms of the market, the market transaction atmosphere is average, the trading atmosphere is still deadlocked and light, the mood is weak and downward, and the market continues to fall. On the supply side, industry start-ups continue to be high and supply continues to be sufficient. Current market demand is weak and prices have dropped to a lower level. In the later period, under pressure on corporate shipments, start-ups may fall. On the demand side, demand-side support is still weak, and prices continue to fall. Downstream purchases often wait for low-price purchases in the market and wait and see.

On the whole, the current urea market continues to be weak, downstream purchasing sentiment is wait-and-see, corporate inventories are under pressure, and urea market prices are expected to continue to be stable and slightly tentative in the short term.