Polyethylene PE: Brent broke through 88, three major coal companies made linear increases in factory delivery, and cost drivers were strong at the beginning of the month.

Intra-day focus: Brent crude oil broke through 88 US dollars per barrel, the highest level since October 2023. Intra-day rise of 0.54% WTI crude oil hit 84 US dollars per barrel, up 0.54%. (Asian session on April 2)

Sinopec inventory: two-oil polyolefin inventory of 800000 tons, down 40, 000 tons from yesterday.

Shenhua auction statistics: the linear auction volume today is 1150 tons, today's turnover is 965 tons, the auction turnover rate is 83.91%, down 7% from yesterday's 90.91%.

|

Brand number |

Library point |

Bidding quantity |

Trading volume |

Starting unit price |

Transaction interval |

Transaction rate |

|

7042 |

Baotou Coal Chemical Warehouse |

100 |

100 |

8150 |

8280-8300 |

100.00% |

|

7042 |

Access source |

300 |

300 |

8200 |

8260-8270 |

100.00% |

|

7042 |

Wuhan Wuhan Iron Depot of Ningxia Coal Mine |

300 |

173 |

8150 |

8150 |

57.67% |

|

7042 |

Ningming Coal Zhejiang Jianfeng Reservoir |

50 |

0 |

8290 |

- |

0.00% |

|

7042 |

Ningxia Coal Qingzhou domestic and Foreign Transportation Depot |

300 |

300 |

8180 |

8180-8190 |

100.00% |

|

7050-Baotou |

Access to the source library |

100 |

92 |

8200 |

8200 |

92.00% |

|

Total linetype |

1150 |

965 |

|

|

83.91% |

|

PE spot market analysis: today, China's PE market is strong and rising, with various varieties rising from 30 to 100 yuan / ton, which is slower than yesterday. Price: China's linear mainstream prices range from 8160 yuan to 8500 yuan per ton, high pressure prices range from 9150 yuan to 9500 yuan per ton, low pressure membrane prices range from 8150 yuan to 8500 yuan per ton, and low pressure wire drawing ranges from 8150 yuan to 8700 yuan per ton. Although today's futures market once exceeded 8300, but the bulls did not push up enough, the intraday interval was consolidated, and the daily trading was once down, suppressing the atmosphere in the market. Petrochemical, there are still some adjustments, coal companies linear coal Baofeng Pucheng raised 10-40 yuan / ton, the cost support is strong. Traders wait and see mainly shipments, linear more to maintain yesterday's offer, some make up, high and low pressure due to some petrochemical adjustments at the beginning of the month, the offer followed higher. Downstream rigid demand to enter the market, although close to the Qingming Festival holiday, but the market does not see obvious stock preparation behavior, the terminal enters the market according to its own rhythm to purchase mainly, slightly higher prices take goods cautiously, intraday trading performance is general.

PE spot trend forecast: raw materials: crude oil disk further refresh stage new high, oil distribution disk into the 86-90 dollar area. The center of gravity of the raw material moves upward, which drives the production cost of polypropylene higher. Petrochemical policy: the current petrochemical continues to go to the warehouse, at the beginning of the month, the performance of the two cities is still good, the major regions are still up-regulated, and the supply cost is strongly supported. On the supply side: Lianyungang Petrochemical, Jiutai, Zhongke Refining and Chemical Co., Hainan Refining and Chemical Co., Ltd., Zhejiang Petrochemical Co., Ltd. stopped one after another until April and May, recently continued to add Zhongyuan Petrochemical, Maoming Petrochemical and other equipment parking maintenance, the market supply continues to shrink. In terms of demand, the overall downstream demand is relatively stable, and the overall variable is small. Under the comprehensive influence, the PE market is expected to remain volatile at the beginning of the month, paying attention to the trend of the market and spot transactions.

Mainstream quotation in PE market: yuan / ton

|

Variety |

Region |

April 1st |

April 2nd |

Rise and fall |

|

Linear |

North China |

8230-8300 |

8230-8300 |

0/0 |

|

East China |

8160-8250 |

8160-8300 |

0/50 |

|

|

South China |

8250-8500 |

8250-8500 |

0/0 |

|

|

High pressure film |

North China |

9120-9130 |

9150-9170 |

30/40 |

|

East China |

9100-9350 |

9150-9450 |

50/100 |

|

|

South China |

9280-9500 |

9280-9500 |

0/0 |

|

|

Low pressure film |

North China |

8120-8430 |

8150-8430 |

30/0 |

|

East China |

8250-8500 |

8350-8550 |

100/50 |

|

|

South China |

8250-8450 |

8250-8450 |

0/0 |

|

|

Low pressure wire drawing |

North China |

8120-8550 |

8150-8550 |

30/0 |

|

East China |

8400-8650 |

8400-8650 |

0/0 |

|

|

South China |

8500-8700 |

8500-8700 |

0/0 |

PE futures analysis: April 2 L2405 opening price: 8275, highest price: 8301, lowest price: 8255, position: 228414 hands, settlement price: 8278, yesterday settlement: 8262, up: 16, daily trading volume: 209016 lots.

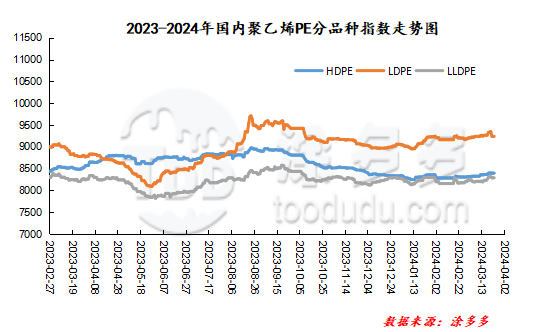

China PE Index: according to Tudor data, on April 2, China's LLDPE spot index rose 8, or 0.10%, to 9283, up 36, or 0.39%. The LLDPE spot index rose 18, or 0.21%, to 8428.