Daily Review of Urea: Downstream demand follows up, flat market prices continue to bottom out (April 2)

China Urea Price Index:

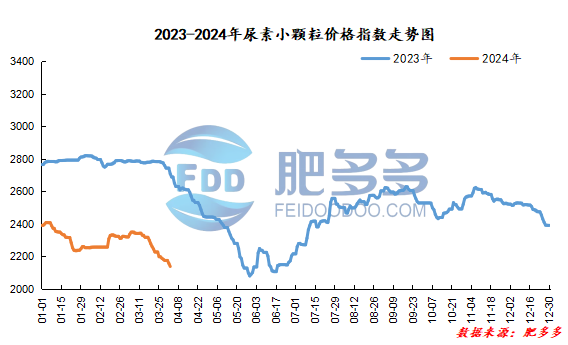

According to Feiduo data, the urea small pellet price index on April 2 was 2,138.00, a decrease of 19.09 from yesterday, a month-on-month decrease of 0.89% and a year-on-year decrease of 21.05%.

Urea futures market:

Today, the opening price of the urea UR409 contract is 1870, the highest price is 1873, the lowest price is 1841, the settlement price is 1856, and the closing price is 1849. The closing price has increased by 5 compared with the settlement price of the previous trading day, up 0.27% month-on-month. The fluctuation range throughout the day is 1841-1873; the basis of the 05 contract in Shandong is 211; the 05 contract has increased its position by 22737 lots today, and so far, the position is 192875 lots.

Spot market analysis:

Today, China's urea market prices continued to be weak and downward. Companies 'orders received fell short of expectations, and quotations continued to be consolidated downward.

Specifically, prices in Northeast China fell to 2,090 - 2,180 yuan/ton. Prices in East China fell to 2,050 - 2,120 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,070 - 2,300 yuan/ton, and the price of large particles fell to 2,080 - 2,200 yuan/ton. Prices in North China fell to 1,930 - 2,120 yuan/ton. Prices in South China fell to 2,200 - 2,280 yuan/ton. Prices in the northwest region are stable at 2,090 - 2,100 yuan/ton. Prices in Southwest China fell to 2,050 - 2,450 yuan/ton.

Market outlook forecast:

In terms of factories, the situation of acquiring new orders by manufacturers is not ideal, and factory quotations continue to be lowered. Current market prices continue to drop, and low market orders may increase. In terms of the market, although prices are currently operating at a low level, there are no obvious signs of improvement in transactions. The trading atmosphere in the market is weak. The cautious mentality of operators is difficult to change, lack confidence, and have a wait-and-see mentality. On the supply side, early parking and maintenance equipment has been restored, the industry's daily output has increased within a narrow range, and sufficient supply continues. On the demand side, agricultural greening fertilizers have basically ended, with a temporary gap, and agricultural demand has weakened; the operating rate of downstream industrial factories has declined, and enthusiasm for purchasing raw materials has been reduced. Most of them have been maintained for bargain-hunting and picking. In a short period of time, demand will face limited market support.

Overall, the current trading of new orders in the urea market is weak. Against the background of high industry supply, downstream procurement demand is mostly cautious and wait-and-see, and the market is weak. It is expected that the urea market price will continue to stabilize and explore in the short term.