PVC: Futures prices were arranged in a narrow range, and the low range was tested twice. The spot market was slightly flat at the beginning of the week

PVC futures analysis: April 1st V2405 contract opening price: 5792, highest price: 5824, lowest price: 5773, position: 761255, settlement price: 5798, yesterday settlement: 5792, up: 6, daily trading volume: 535201 lots, precipitated capital: 3.099 billion, capital outflow: 23.61 million.

List of comprehensive prices by region: yuan / ton

|

Area |

March twenty _ ninth |

April 1st |

Rise and fall |

Remarks |

|

North China |

5500-5550 |

5500-5550 |

0/0 |

Send to cash remittance |

|

East China |

5510-5620 |

5520-5620 |

10/0 |

Cash out of the warehouse |

|

South China |

5560-5620 |

5590-5640 |

30/20 |

Cash out of the warehouse |

|

Northeast China |

5550-5640 |

5520-5640 |

-30/0 |

Send to cash remittance |

|

Central China |

5500-5540 |

5500-5540 |

0/0 |

Send to cash remittance |

|

Southwest |

5440-5600 |

5440-5600 |

0/0 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction price range collation, the spot market transaction is not good. The comparison of valuation shows that North China is stable, East China is up 10 yuan / ton, South China is up 20-30 yuan / ton, Northeast China is down 30 yuan / ton, and Central China and Southwest China are stable. Most of the ex-factory prices of upstream PVC production enterprises remained stable, which coincided with little price adjustment on Monday. The futures market was arranged in a low and narrow range, the quotations of merchants in the spot market were chaotic, and the quotations of some traders were slightly higher than last Friday, while some merchants remained basically unchanged. Spot price and one-bite price are available, but point price has advantages, including East China basis offer 05 contract-(180-200), South China 05 contract-(220-250), North 05 contract-(500-530), Southwest 05 contract-(250). On Monday, there are some low-priced goods in the spot market, the downstream purchasing enthusiasm is general, the early replenishment is appropriate, the terminal order enthusiasm is not good, the transaction is weak.

Futures point of view: PVC2405 contract night trading price opened slightly volatile, futures prices weakened intraday fell below 5800 again. Prices fluctuated upwards after the start of morning trading on Monday, and late afternoon prices were sorted out at relatively small and high levels, but the overall increase throughout the day was insufficient. 2405 contracts range from 5773 to 5824 throughout the day, with a spread of 51. 055.The contract reduced its position by 9110 hands and has held 761255 positions so far. The 2409 contract closed at 5963, with 374387 positions.

PVC Future Forecast:

Futures: PVC2405 contract futures after running to the low range last week, continue to test the low range today Monday, but what is different from the previous period is that the operation of Monday futures price rose slightly from the low level, showing a small reduction in the market, but there was a slight increase in trading, with 22.6% more opening than 20.7% short opening. The technical level shows that the opening of the Bollinger belt (13, 13, 2) expands, and the middle rail continues to turn down. although the KD line at the daily level still shows a dead-fork trend, the distance between the two lines is shortened, and the operating range of the price is relatively narrow. As a whole, the operation of futures prices in the short term or continue to test the low range, still observe the performance of the range of 5770-5850.

Spot: cash prices in the two cities continue to be mainly arranged in a narrow range, but merchants with more early downgrades in some parts of the spot market began to repair slightly on Monday, but the spot market feedback on price fluctuations was mediocre, especially downstream enterprises in the early downside in the process of low-point replenishment, so the spot market is light at the beginning of the week, and trading has not heard of a better performance. From the point of view of early April, the futures market began to face the market of changing positions and changing months gradually. On the one hand, the market of changing positions and changing months is dominated by short positions. Although there can not be a better upward trend, or the departure of short positions can curb the further decline of futures prices. On the other hand, the arrival of the change of positions for the month may make the price high of the two cities destined to be at the high point in late March, and the 05 contract and the market before May are not as expected. On the whole, in the short term, the PVC spot market may continue to narrow the low-level test.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

March twenty _ ninth |

April 1st |

Rate of change |

|

V2405 collection |

5791 |

5816 |

25 |

|

|

Average spot price in East China |

5565 |

5570 |

5 |

|

|

Average spot price in South China |

5590 |

5615 |

25 |

|

|

PVC2405 basis difference |

-226 |

-246 |

-20 |

|

|

V2409 collection |

5935 |

5963 |

28 |

|

|

V2405-2409 close |

-144 |

-147 |

-3 |

|

|

PP2405 collection |

7483 |

7539 |

56 |

|

|

Plastic L2405 collection |

8225 |

8275 |

50 |

|

|

V--PP basis difference |

-1692 |

-1723 |

-31 |

|

|

Vmure-L basis difference of plastics |

-2434 |

-2459 |

-25 |

|

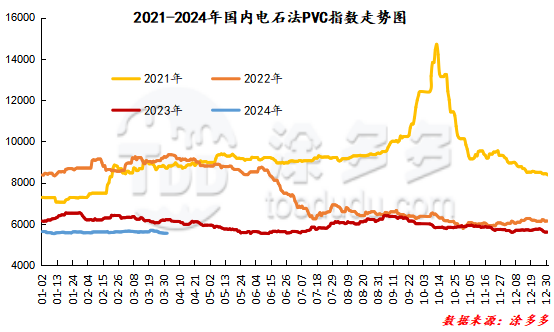

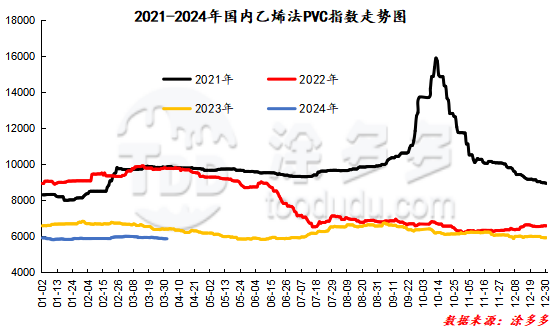

China PVC Index: according to Tudou data, China calcium Carbide PVC spot index rose 6.08, or 0.109%, to 5560.6 on April 1. The PVC spot index of ethylene method was 5860.91, down 6.31%, with a range of 0.108%. The calcium carbide index rose, the ethylene index decreased, and the ethylene-calcium carbide index spread was 300.31.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

3.29 warehouse orders |

4.1 warehouse receipt volume |

change |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

0 |

762 |

762 |

|

PVC subtotal |

|

0 |

762 |

762 |

|

Total |

|

0 |

762 |

762 |

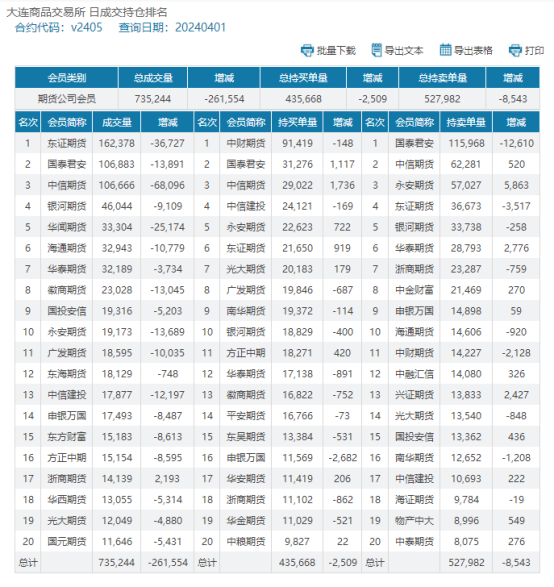

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.