Polyethylene PE: 8300 is in sight, spot offers are generally rising, and factory prices are still expected to increase.

Core point of view: today, China's plastic spot market changed the previous decline, both rebounded. More aspects of futures come from the improvement of the macro and commodity atmosphere. The National Bureau of Statistics released the manufacturing PMI (purchasing managers' index) in March, which was 50.8. This is the data for five consecutive months in the contraction range below 50, back to the expansion range above 50, the stock market and Mandarin commodities performed strongly. From the spot market point of view, the daily increase of each variety is less than 100 yuan / ton, and the linearity is generally as high as 20-60 yuan / ton. However, after the rise, the new price market is mainly wait-and-see, chasing the rise to take the goods is relatively cautious.

Sinopec inventory: two-oil polyolefin inventory of 840000 tons, an increase of 80, 000 tons over last week.

Shenhua auction statistics: the linear auction volume today is 550 tons, today's turnover is 500 tons, and the auction turnover rate is 90.91%.

|

Brand number |

Library point |

Bidding quantity |

Trading volume |

Starting unit price |

Transaction interval |

Transaction rate |

|

7042 |

Access source |

200 |

200 |

8100 |

8260-8270 |

100.00% |

|

7042 |

Wuhan Wuhan Iron Depot of Ningxia Coal Mine |

300 |

300 |

8100 |

8100-8110 |

100.00% |

|

7042 |

Ningming Coal Zhejiang Jianfeng Reservoir |

50 |

0 |

8240 |

- |

0.00% |

|

Total linetype |

550 |

500 |

|

|

90.91% |

|

Mainstream quotation in PE market: yuan / ton

|

Variety |

Region |

March twenty _ ninth |

April 1st |

Rise and fall |

|

Linear |

North China |

8170-8250 |

8230-8300 |

60/50 |

|

East China |

8140-8230 |

8160-8250 |

20/20 |

|

|

South China |

8200-8500 |

8250-8500 |

50/0 |

|

|

High pressure film |

North China |

9100-9130 |

9120-9130 |

20/0 |

|

East China |

9080-9350 |

9100-9350 |

20/0 |

|

|

South China |

9270-9500 |

9280-9500 |

10/0 |

|

|

Low pressure film |

North China |

8100-8430 |

8120-8430 |

20/0 |

|

East China |

8200-8500 |

8250-8500 |

50/0 |

|

|

South China |

8200-8450 |

8250-8450 |

50/0 |

|

|

Low pressure wire drawing |

North China |

8070-8550 |

8120-8550 |

50/0 |

|

East China |

8380-8600 |

8400-8650 |

20/50 |

|

|

South China |

8450-8700 |

8500-8700 |

50/0 |

PE spot market analysis: China's PE market is generally higher today, with various varieties rising from 20 to 60 yuan / ton. Price: China's linear mainstream prices range from 8160 yuan to 8500 yuan per ton, high pressure prices range from 9100 yuan to 9500 yuan per ton, low pressure membrane prices range from 8120 yuan to 8500 yuan per ton, and low pressure wire drawing ranges from 8120 yuan to 8700 yuan per ton. At the end of the month, two oil stocks accumulated again to more than 800000 tons at the end of the month. At the same time, petrochemical crescent prices, the Northeast, East China, South China region raised factory prices ranging from 50-100 yuan / ton. The linear ex-factory price of coal enterprises has been raised by 20-60 yuan per ton, and the cost of supply in the field is strongly supported. The plastic surface increases the position upward, boosts the confidence of the industry. The traders raised the price and shipped the goods, pushing up continuously within the day. Downstream rigid demand to enter the market, slightly lower price rigid demand to follow up, catch up to take the goods is relatively limited.

PE spot trend Forecast: raw materials: the current focus of the crude oil market is still on the geographical situation, the Gaza ceasefire negotiations have reached an impasse, the Palestinian-Israeli conflict has not been effectively resolved, but the cease-fire negotiations are still continuing. Geographical factors are still the main positive support source of crude oil disk, the trend of geographical situation determines the degree of short-term pricing of crude oil, and the upgrading or cooling of the geopolitical situation will determine the rising and falling trend of crude oil; as for coal, most coal mines in the region maintain normal production, individual coal mines stop production and maintenance in the current month, and the overall coal supply level is slightly reduced. With the end of central heating in northern regions, the actual demand performance is not good, the rise in coal prices still lacks strong support, and it is expected that the market coal price stalemate is weak in the later stage. On the supply side: Lianyungang Petrochemical, Jiutai, Zhongke Refining and Chemical Co., Hainan Refining and Chemical Co., Ltd., Zhejiang Petrochemical Co., Ltd. stopped one after another until April and May, and continued to add parking maintenance in April, such as Zhongyuan Petrochemical, Pucheng, China and South Korea Sinopec, and did not rule out the possibility of operating parking due to cost reasons, and the market supply was expected to be significantly reduced. In terms of demand, the overall downstream demand is relatively stable, and the overall variable is small. Under the comprehensive influence, the PE market is expected to remain volatile at the beginning of the month, with a small rebound expected in the short term.

PE futures analysis: April 1st L2405 opening price: 8212, highest price: 8292, lowest price: 8210, position: 247838 hands, settlement price: 8262, yesterday settlement: 8226, up: 36, daily trading volume: 237115 lots.

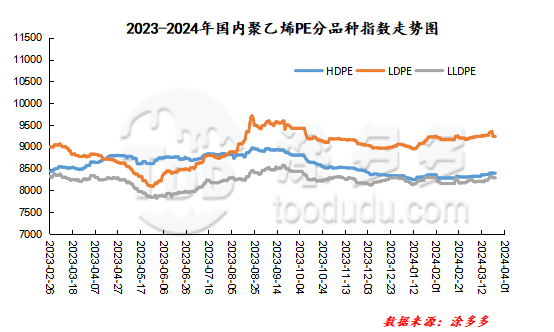

China PE Index: according to Tudor data, on April 1, China's LLDPE spot index was 8282, up 34, or 0.41%. The LLDPE film spot index was 9247, up 9, or 0.10%. The LLDPE spot index was 8410, up 24, or 0.29.