Daily review of urea: Industry Nissan maintains high market prices are weak (April 1)

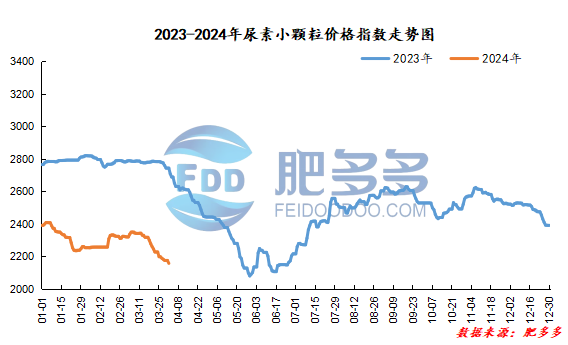

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on April 1 was 2,157.09, a decrease of 18.05 from last Friday, a month-on-month decrease of 0.83% and a year-on-year decrease of 21.37%.

Urea futures market:

Today, the opening price of the urea UR409 contract is 1851, the highest price is 1876, the lowest price is 1818, the settlement price is 1844, and the closing price is 1873. The closing price is 7% higher than the settlement price of the previous trading day, up 0.38% month-on-month. The fluctuation range throughout the day is 1818-1876; the basis of the 05 contract in Shandong is 227; the 05 contract has increased its position by 19699 lots today, and so far, it has held 17.11 lots.

Spot market analysis:

Today, China's urea market prices continue to decline, industry supply continues to be high, downstream follow-up mentality is more cautious, and the market is operating in a weak position.

Specifically, prices in Northeast China fell to 2,100 - 2,210 yuan/ton. Prices in East China fell to 2,070 - 2,140 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,090 - 2,320 yuan/ton, and the price of large particles fell to 2,100 - 2,250 yuan/ton. Prices in North China fell to 1,930 - 2,130 yuan/ton. Prices in South China fell to 2,210 - 2,290 yuan/ton. Prices in Northwest China fell to 2,090 - 2,100 yuan/ton. Prices in Southwest China are stable at 2,100 - 2,450 yuan/ton.

Market outlook forecast:

In terms of factories, after factories cut prices in the early stage and collect orders, inventories dropped slightly. Currently, most manufacturers implement advance receipts in the early stage, and some continue to reduce prices and collect orders. Company shipments are still under pressure. In terms of the market, market trading activity has dropped compared with the previous period. Transactions have not improved significantly. Many low-end goods have been sold. The current market lacks substantial benefits to support the upward trend of prices. The mood of operators is more cautious and pessimistic. In terms of supply, early maintenance equipment has been restored one after another. The current industry's daily output continues to be high, and supply is still in a loose state. On the demand side, agriculture has entered a small gap, and demand has weakened in stages; downstream industrial factories have mostly maintained a small amount of on-demand replenishment, which is pessimistic and demand has limited support for prices.

On the whole, the current supply-demand relationship in the urea market is weak. Under high daily production, the market is easy to fall but not to rise. It is expected that the urea market price will continue to consolidate downward in a short period of time.