PVC: Short futures prices were strongly suppressed, falling below the barrier and approaching the previous low, and the number of transactions in the spot market increased slightly

PVC futures analysis: March 29th V2405 contract opening price: 5830, highest price: 5836, lowest price: 5765, position: 770365, settlement price: 5792, yesterday settlement: 5822, down: 30, daily trading volume: 746677 lots, precipitated capital: 3.123 billion, capital inflow: 1.41 million.

List of comprehensive prices by region: yuan / ton

|

Area |

March 28th |

March twenty _ ninth |

Rise and fall |

Remarks |

|

North China |

5500-5550 |

5500-5550 |

0/0 |

Send to cash remittance |

|

East China |

5510-5650 |

5510-5620 |

0/-30 |

Cash out of the warehouse |

|

South China |

5600-5650 |

5560-5620 |

-40/-30 |

Cash out of the warehouse |

|

Northeast China |

5550-5640 |

5550-5640 |

0/0 |

Send to cash remittance |

|

Central China |

5520-5560 |

5500-5540 |

-20/-20 |

Send to cash remittance |

|

Southwest |

5460-5600 |

5440-5600 |

-20/0 |

Kuti / send to |

PVC spot market: mainstream transaction prices in China's PVC market continue to weaken, and the focus of transactions in the spot market moves downward. The comparison of valuation shows that North China is stable, East China is down 30 yuan / ton, South China is 30-40 yuan / ton, Northeast China is stable, Central China is down 20 yuan / ton, Southwest China is down 20 yuan / ton. Upstream PVC production enterprise factory price continues to reduce 20-50 yuan / ton, although the production enterprise quotation is positive, but the contract signing is not much and mainly based on the basic quantity. Futures continued to fall on the weak side, with prices offered by traders generally lower than yesterday, and the supply of goods at low prices in the spot market increased. After the weakening of futures prices, the basis offer advantage is obvious, compared with yesterday's basis adjustment is not big, including East China basis offer 05 contract-(180-280), South China 05 contract-(150-250), North 05 contract-(500-520), Southwest 05 contract-(250-300). Downstream mentality is relatively cautious, most bargain hanging order replenishment, and there are differences in transactions in the spot market, some traders said that the transaction slightly improved, some said that the transaction is general, hedgers replenish the goods.

Futures point of view: PVC2405 contract night futures prices fell at the beginning of trading, the overall night market weakness is difficult to change. Futures prices weakened further after the start of morning trading, and continued to weaken in early trading after falling below the 5800 mark at night, then rebounded slightly, mainly in the afternoon. 2405 contracts range from 5765 to 5836 throughout the day, with a price difference of 71. 05. the position of the contract has been reduced by 5500 hands, and the position has been held so far by 770365 lots. The 2409 contract closed at 5935, with 364717 positions.

PVC Future Forecast:

Futures: PVC2405 contract futures continued to decline, falling below the 5800 mark showed a further downward situation, of which the low of 5765 approached the previous low of 5740. At one point, there was an increase of 40,000 positions in intraday trading, and the participation of short-term hot money in most positions in late afternoon trading was obvious, with 26.0% vs. 20.5% in terms of transaction. The return of bears makes the operation of the stock price continue to be weak, the technical level shows that the opening of the lower rail in the Bollinger belt (13,13,2) is obvious downward, and the opening of the third rail is enlarged. The continuous decline of futures prices from the high level has led to the expansion of the deadlock trend of the KD line and MACD line at the daily level. With the passage of time, the 05 contract began to move positions and change months into April, and continue to observe the operation of the low range and the performance of the previous low position in the short term.

Spot aspect: & the downward price of nbsp; futures on the one hand increases the supply of low-priced goods in the spot market, on the other hand, the spot price transaction is slightly active after the downward price, and some hedgers take the goods. After the current price decline in the two markets, the pressure on PVC production enterprises in the spot market increases, while the cost port price is high, but the price of PVC continues to fall. although we mentioned in our forecast that the valuation of PVC is on the low side, the role of air distribution leads to the continuation of weakness in the two cities. At the close of midday, the main contract of Chinese futures rose more and fell less, but the two major products of chlor-alkali caustic soda and PVC fell on the list, the weak role is undoubtedly very obvious. In the outer disk, international oil prices rebounded after falling for two consecutive days as OPEC+ maintained the prospect of production cuts, continued attacks on Russia's energy infrastructure and falling drilling rigs in the United States tightened crude oil supplies. On the whole, the PVC spot market may still be low in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

March 28th |

March twenty _ ninth |

Rate of change |

|

V2405 collection |

5830 |

5791 |

-39 |

|

|

Average spot price in East China |

5580 |

5565 |

-15 |

|

|

Average spot price in South China |

5625 |

5590 |

-35 |

|

|

PVC2405 basis difference |

-250 |

-226 |

24 |

|

|

V2409 collection |

5962 |

5935 |

-27 |

|

|

V2405-2409 close |

-132 |

-144 |

-12 |

|

|

PP2405 collection |

7472 |

7483 |

11 |

|

|

Plastic L2405 collection |

8220 |

8225 |

5 |

|

|

V--PP basis difference |

-1642 |

-1692 |

-50 |

|

|

Vmure-L basis difference of plastics |

-2390 |

-2434 |

-44 |

|

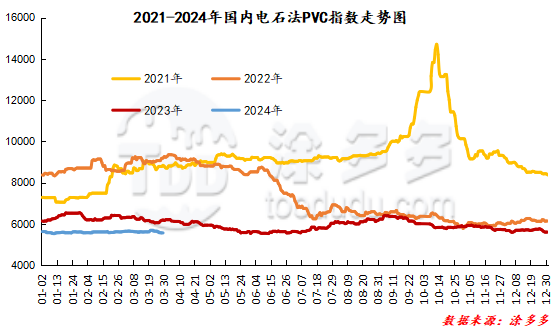

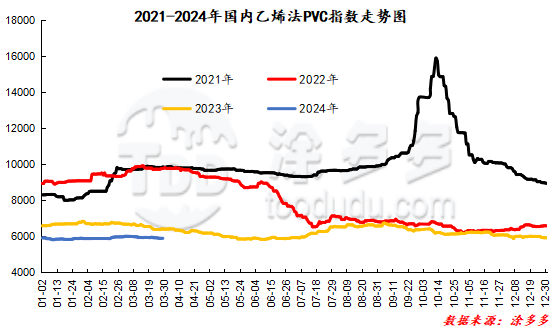

China PVC Index: according to Tuduoduo data, the Chinese calcium carbide PVC spot index fell 15.55, or 0.279%, to 5554.52 on March 29th. The ethylene PVC spot index was 5867.22, down 23.81, or 0.404%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 312.7.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

3.28 warehouse orders |

3.29 warehouse orders |

change |

|

Polyvinyl chloride |

Cosco sea logistics |

150 |

0 |

-150 |

|

|

Zhenjiang Middle and far Sea |

150 |

0 |

-150 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,500 |

0 |

-1,500 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

11 |

0 |

-11 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

40 |

0 |

-40 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

236 |

0 |

-236 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

8 |

0 |

-8 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,149 |

0 |

-1,149 |

|

PVC subtotal |

|

3,094 |

0 |

-3,094 |

|

Total |

|

3,094 |

0 |

-3,094 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.