PVC: The futures price plunged sharply in the end of the session, reduced positions and opened slightly higher, and the spot market was performing poorly.

PVC futures analysis: March 26th V2405 contract opening price: 5882, highest price: 5908, lowest price: 5810, position: 813024, settlement price: 5877, yesterday settlement: 5908, down: 31, daily trading volume: 680748 lots, precipitated capital: 3.311 billion, capital outflow: 83.69 million.

List of comprehensive prices by region: yuan / ton

|

Area |

March twenty _ fifth |

March 26th |

Rise and fall |

Remarks |

|

North China |

5530-5600 |

5500-5550 |

-30/-50 |

Send to cash remittance |

|

East China |

5580-5690 |

5520-5660 |

-60/-30 |

Cash out of the warehouse |

|

South China |

5650-5700 |

5620-5670 |

-30/-30 |

Cash out of the warehouse |

|

Northeast China |

5550-5690 |

5550-5690 |

0/0 |

Send to cash remittance |

|

Central China |

5610-5640 |

5550-5590 |

-60/-50 |

Send to cash remittance |

|

Southwest |

5490-5650 |

5460-5600 |

-30/-50 |

Kuti / send to |

PVC spot market: China PVC market mainstream transaction prices continue to decline slightly, the spot market is not good. Compared with the valuation, it fell by 30-50 yuan / ton in North China, 30-60 yuan / ton in East China, 30 yuan / ton in South China, stable in Northeast China, 50-60 yuan / ton in Central China and 30-50 yuan / ton in Southwest China. Upstream PVC production enterprises factory price reduction of 20-30-50 yuan / ton, some enterprises stable price wait and see. The volatility of the futures price is weaker, especially in the afternoon, the spot market point price supply and a mouthful offer coexist, but a high offer has no reference significance. After the futures price goes down, the spot price advantage is highlighted, and the basis offer is expanded and adjusted. Among them, East China basis offer 05 contract-(240-290), South China 05 contract-(200-240), North 05 contract-(500-570) Southwest 05 contract-(240-300). On the whole, after the futures price fell, the spot market turnover improved slightly, the downstream mentality was cautious to meet the rigid demand for bargain, and the hanging orders were mostly concentrated below 5850 points.

Futures point of view: PVC2405 contract night futures prices continue to fluctuate mainly in a narrow range, and the range of volatility is relatively small. After the start of morning trading, the shock gradually weakened, positions were reduced one after another, and the price dived obviously in the afternoon close a few minutes after the close. 2405 contracts range from 5810 to 5908 throughout the day, with a spread of 98. 05. The contract reduced its position by 11482 hands and has held 813024 positions so far. The 2409 contract closed at 5954, with 327819 positions.

PVC Future Forecast:

Futures: & the operation of nbsp; PVC2405 contract futures continued its downtrend, showing a four-point decline from the high, down 238 points from the high of 6048 to the current low of 5810. Today's trading continued to show a reduced position, in terms of transactions, which opened 21.5% compared with 20.8% more. But duo ping increased, of which duo ping 27.4% vs. air level 22.2%. The technical level shows that the opening of the three tracks of the Bollinger belt (13, 13, 2) opens, the low point of the futures price approaches the position of the lower track, and shows a fast diving pattern in late trading. The KD line and MACD line at the daily level show a dead cross trend, and the low point of the futures price even begins to approach the post-holiday low range. Overall, the operation of futures prices in the short term continues to test the low range of 5800-5850.

Spot: futures late-day diving caught the spot market off guard. First of all, the rigid demand of downstream products enterprises is mostly concentrated in the spot price below 5850, and the diving at the end of the day makes most of the spot price become a deal, so although the transaction has improved, the diving in the late market suddenly weakens the spot market atmosphere. Considering the current time point, the 05 contract and the market in May are expected to be discouraged by the downward price, and as the mood fades, even if there is a reduction in maintenance supply, it is not expected to make a better reversal of the market. At present, the fundamentals of PVC are still weak, so the futures market lacks sufficient support, which also makes the spot market always face sales pressure. In the outer disk, international oil prices closed higher because of production restrictions ordered by the Russian government and attacks on energy infrastructure in Russia and Ukraine, but the UN request for a cease-fire in Gaza helped limit the increase to some extent. Overall, the PVC spot market operation or low-level consolidation in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

March twenty _ fifth |

March 26th |

Rate of change |

|

V2405 collection |

5881 |

5817 |

-64 |

|

|

Average spot price in East China |

5635 |

5590 |

-45 |

|

|

Average spot price in South China |

5675 |

5645 |

-30 |

|

|

PVC2405 basis difference |

-246 |

-227 |

19 |

|

|

V2409 collection |

6031 |

5954 |

-77 |

|

|

V2405-2409 close |

-150 |

-137 |

13 |

|

|

PP2405 collection |

7506 |

7497 |

-9 |

|

|

Plastic L2405 collection |

8219 |

8213 |

-6 |

|

|

V--PP basis difference |

-1625 |

-1680 |

-55 |

|

|

Vmure-L basis difference of plastics |

-2338 |

-2396 |

-58 |

|

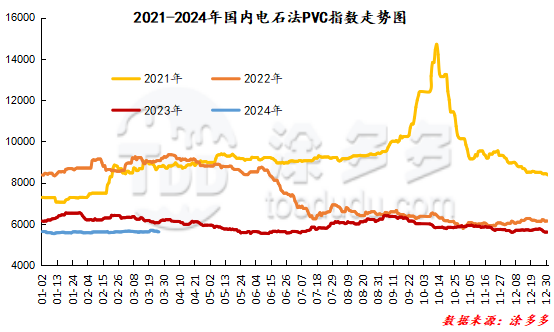

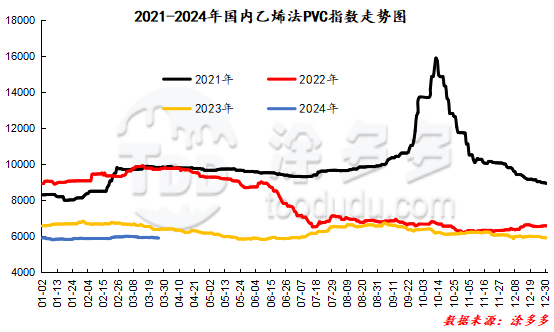

China PVC Index: according to Tuduoduo data, the spot index of China's calcium carbide PVC fell 38.67, or 0.688%, to 5582.69 on March 26. The PVC spot index of ethylene method was 5891.03, down 13.62%, with a range of 0.211%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 308.34.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

3.25 warehouse orders |

3.26 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

1,254 |

1,254 |

0 |

|

|

China Central Reserve Nanjing |

1,254 |

1,254 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

522 |

184 |

-338 |

|

|

Zhenjiang Middle and far Sea |

522 |

184 |

-338 |

|

Polyvinyl chloride |

Peak supply chain |

1,988 |

1,988 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,632 |

1,632 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

512 |

311 |

-201 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

1,070 |

1,070 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

220 |

220 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

44 |

44 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Benniu Port) |

41 |

0 |

-41 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

1 |

0 |

-1 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

114 |

113 |

-1 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

241 |

241 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

249 |

249 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

80 |

80 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Sinotrans East China |

1,388 |

1,388 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

10 |

10 |

0 |

|

PVC subtotal |

|

10,604 |

10,022 |

-582 |

|

Total |

|

10,604 |

10,022 |

-582 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.